Cash Flow Report Statement is a financial report to provide relevant information about the cash receipts and disbursements the company has in particular accounting period. Information from cash flow is important to know liquidity, financial flexibility and overall performance of company. This statement is used to complement other financial report. Since, there are often an analysis on Balance Sheet and Income Statement does not indicate actual condition of the company’s performance. By seeing this statement, any companies can measure the ability to generate cash and cash equivalents from the operational activities. And it should indicate that company has enough resources and ability to survive.

There are three categories that you usually find in this type of report:

1. Operating Activities

The amount of cash flows generate from operating activities is a key indicator to determine whether the operations of entity can generate sufficient cash flows to repay the loan, maintain the operating ability of entity, pay dividends, and make new investments without relying on external sources of funding.

Operating activities are principal revenue-producing activities and other activities that are not investment and also financing activities. Hence, Cash flows from operating activities are primarily derived from the principal income generating activities of the entity. Therefore, the cash flows generally come from transactions and other events that affect the determination of net profit/loss.

Some examples of cash flows from operating activities are (in cash) :

- receipts from sale of goods and services, royalties, fees, commissions, and other income;

- payments to and for the benefit of employees

- receipts and payments by an insurer in respect of premiums, claims, annuities and other policy benefits;

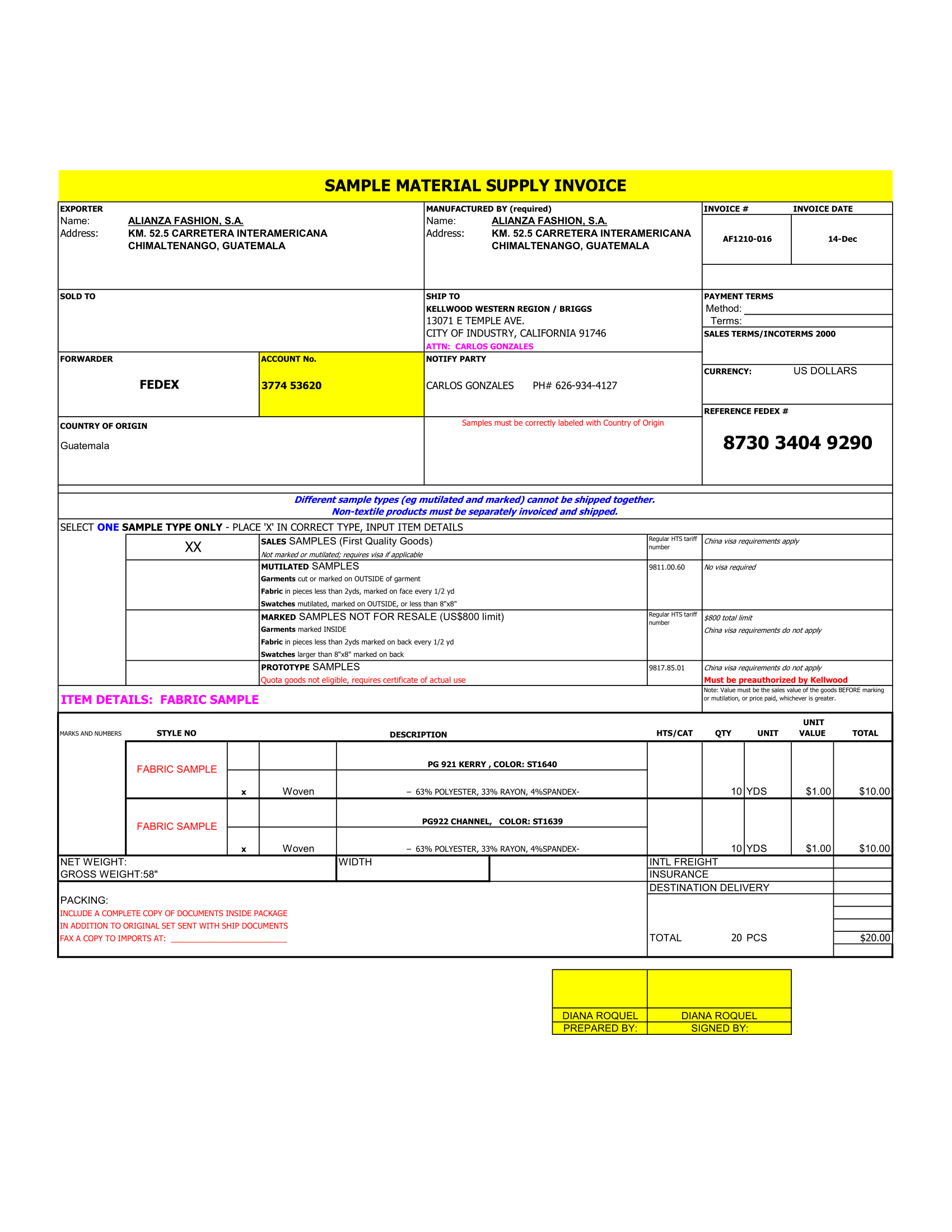

2. Investment Activities

It is the acquisition and disposal of long-term assets and other investments that does not include cash equivalents. The separate disclosure of cash flows arising from investment activity needs to be done because cash flow reflects expenditure incurred for resources intended to generate future earnings and cash flows. Including obtaining loans or lending, buying or disposing of investment and property, factories, and equipment.

Some examples of cash flows from investing activities are:

- payments to purchase fixed assets, intangible assets and other long-term assets

- receipts from sale of land, buildings, and equipment, as well as intangible assets and other long-term assets;

- advances and loans granted to other parties

- receipts from repayment of advances and loans made to other parties that provided to other parties

- payments in connection with futures, forward, option and swap contract except when contracts are held for trading purposes or contracted, or when payments are classified as financing activities; and

3. Financial Activities

Financial activities or funding are activities that result in changes in amount and composition of contributed capital and borrowings of the entity. Hence, The separate disclosure of cash flows arising from financing activities is important because it is very useful in predicting claims of future cash flows by providers of capital entities.

- receipts from issuance of shares or other equity instruments, issuance of bonds, loans, notes, mortgages, and short-term borrowings and other long-term.

- payments to owners to withdraw or redeem shares of entity;

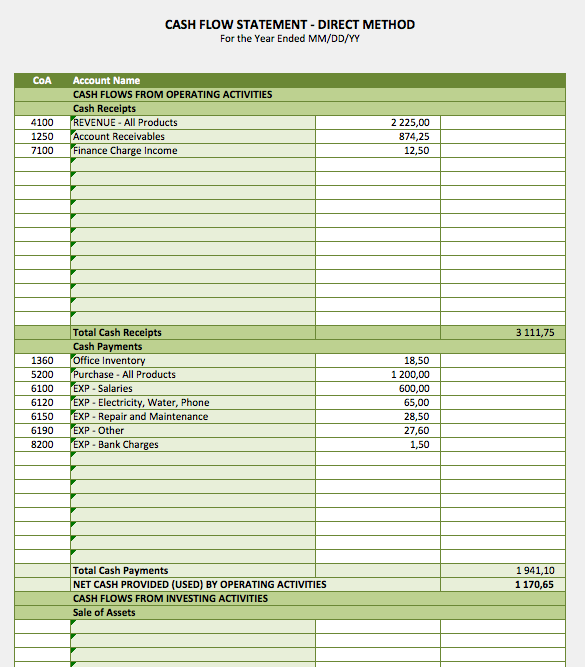

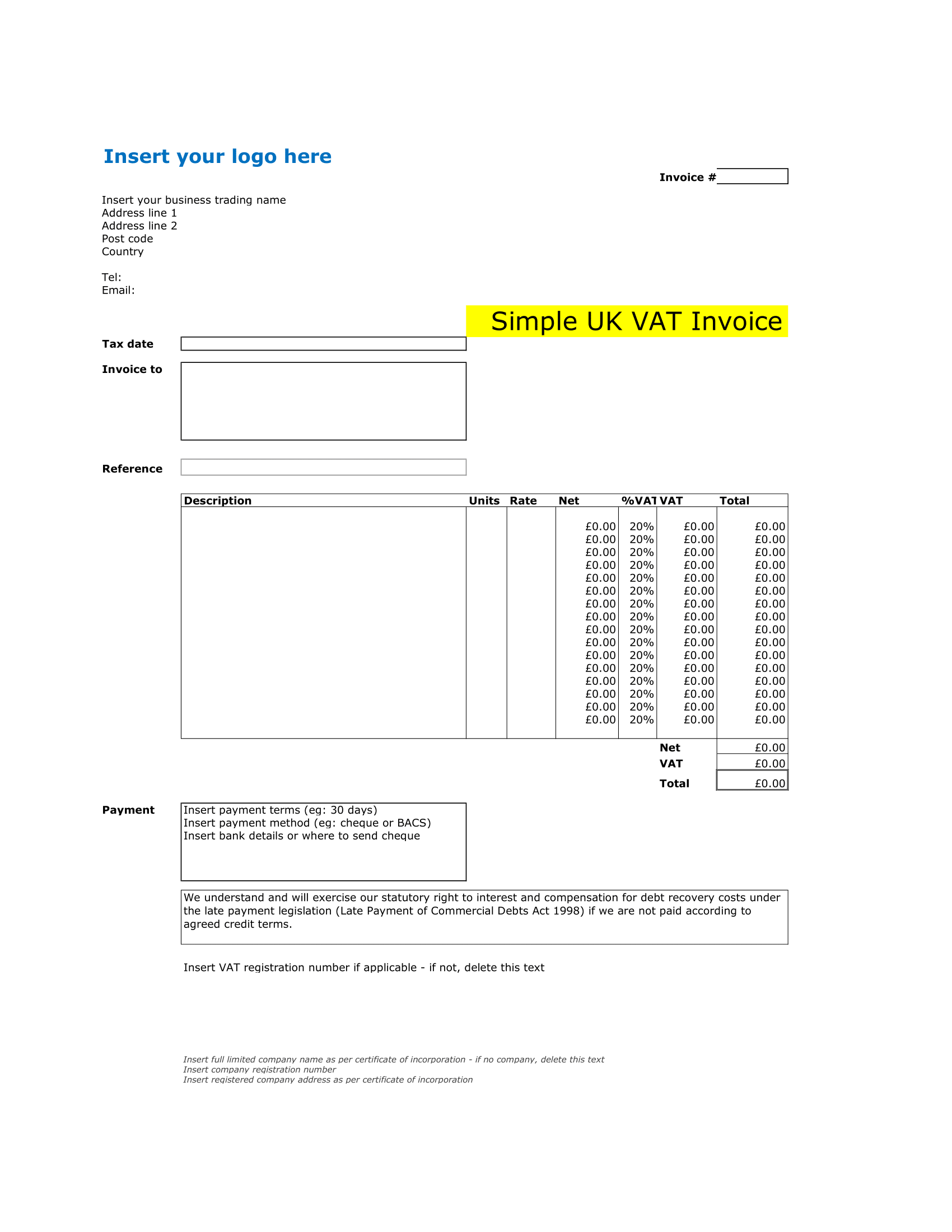

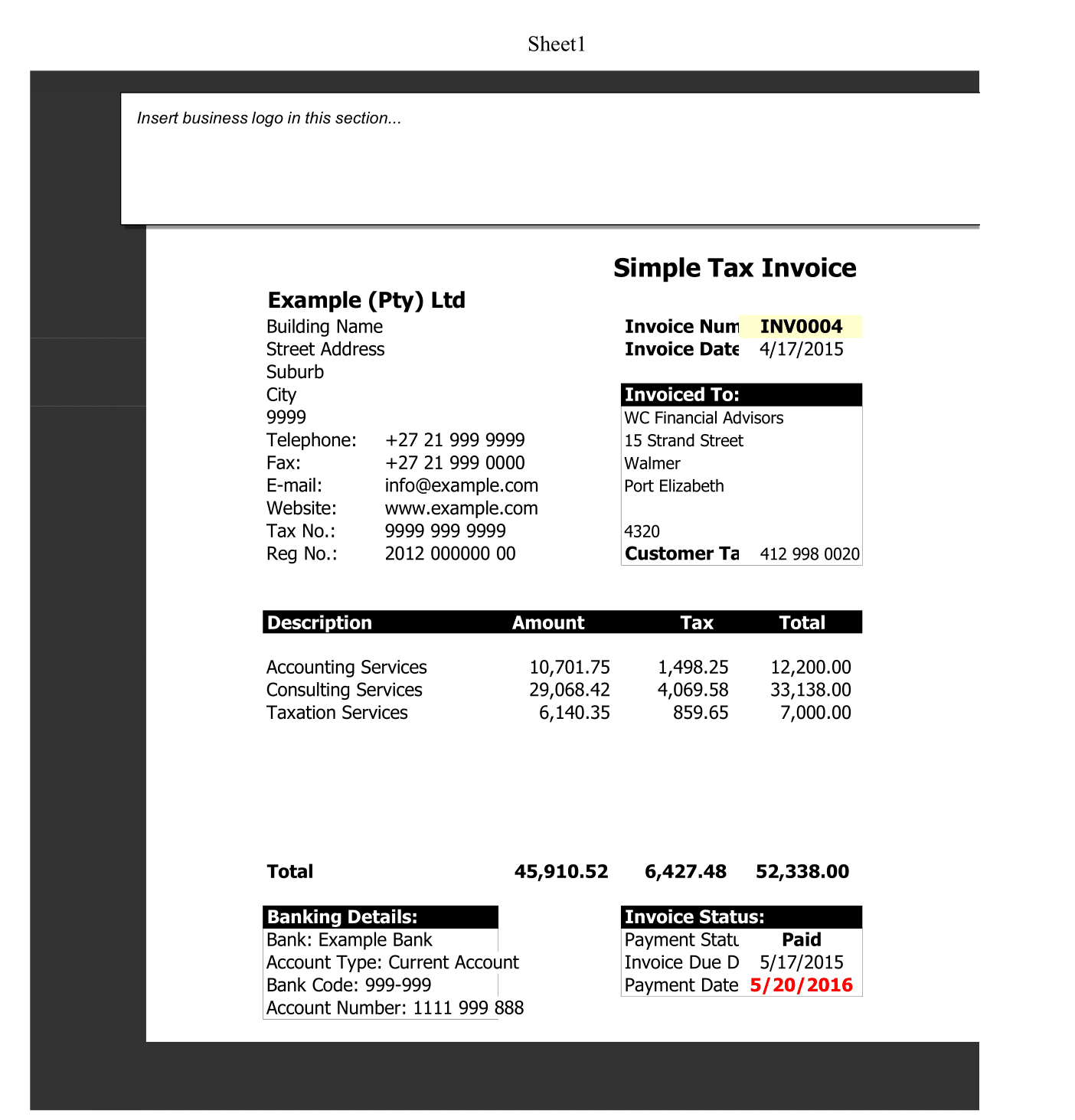

Cash Flow Statement Template

There are two methods of preparing Statement of Cash Flows, direct and indirect method.

Direct Method

Direct method is a re-examination of each post (or accounts) statements of income in order to report how much cash received or issue in connection with the post. Moreover, This method generate more useful information in estimating future cash flows that can not produce by the indirect method.

The main advantage of direct method is consistent in showing a report of cash receipts and disbursements for the purpose of cash flow statement. In addition, direct method is easier to understand and provide more information in decision-making. Moreover, The disadvantage of this method is require data is often quite difficult to obtain.

Indirect Method

The indirect method use accrual accounting information to present the cash flows from operations section of the cash flow statement.

Adjustment is in three things:

- Income and expense not involving cash inflows and outflows.

- Gains and losses for investment or investment activity financing.

- Adjustments for changes in current assets and liabilities that identifies source of non-cash income and expenses.

Indirect method is more focus on the difference between net income and net cash flow from operating activities. That is its main advantage. So, it provides a useful bond between net income and income statement and balance sheet.