Insurance Quote

Introduction: Streamlining Insurance Quotations An insurance quote is a vital document in the insurance industry, serving as a preliminary estimate …

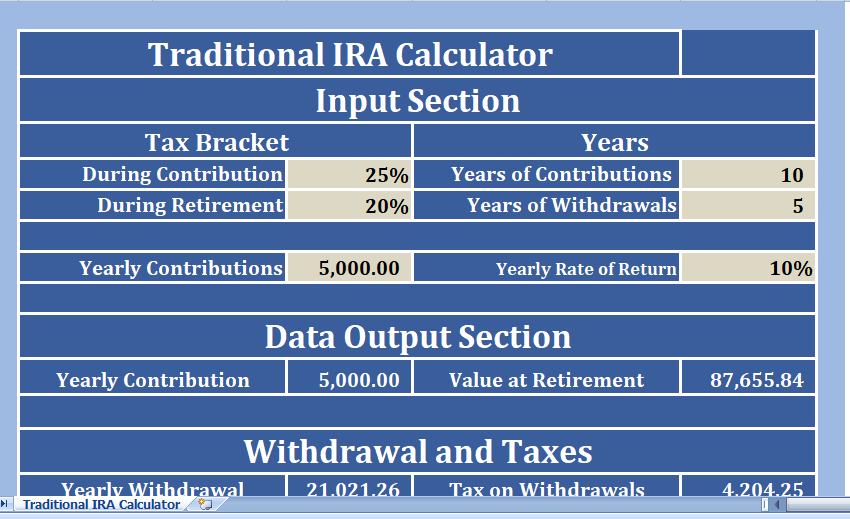

In this article, we discuss the Traditional IRA Calculator which is helpful for you to decide the amount of savings you need to invest for

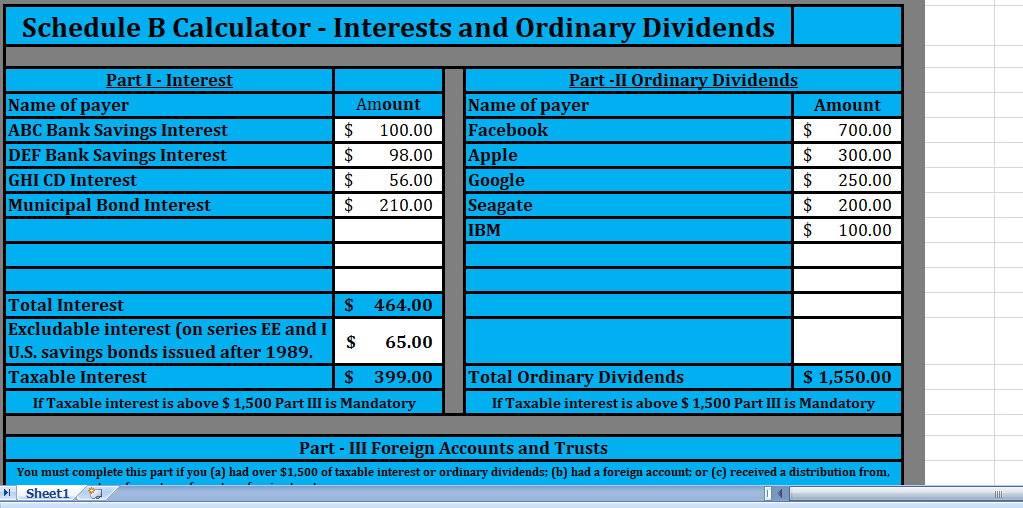

Schedule B Calculator is excel template that consists of calculations of taxable interest and ordinary dividends under Schedule B of Form 1040 and 1040A for

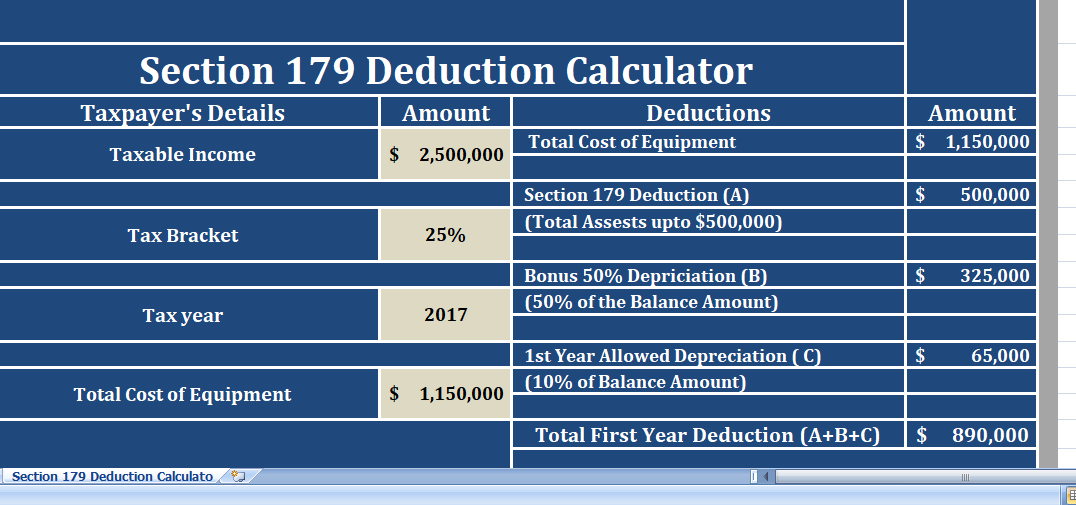

Section 179 Deduction Calculator is an excel template that helps to calculate the amount you could save on your tax bill by taking the Section

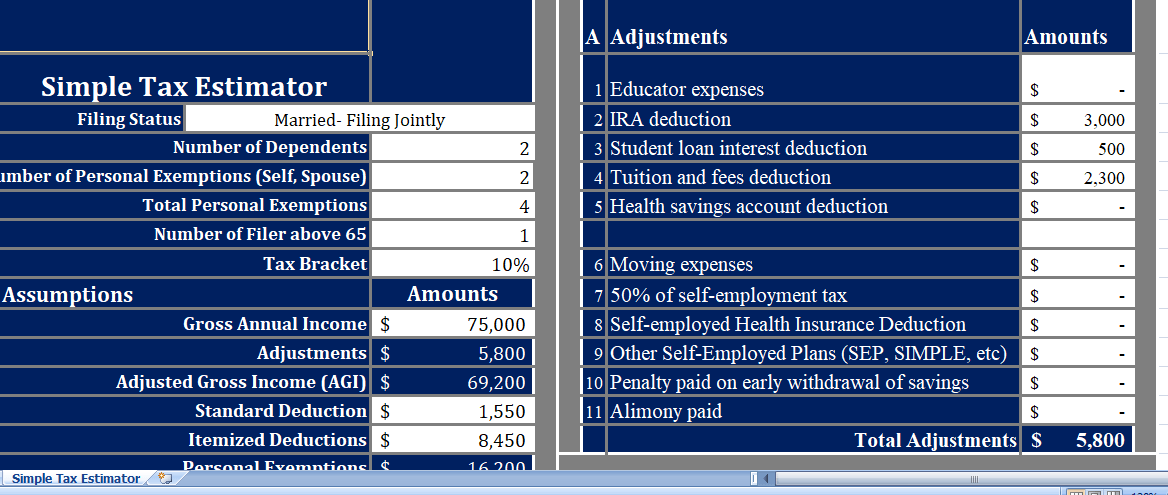

Simple Tax Estimator is an ready-to-use Excel Template that help you compute your federal income tax. So This template consists of computations of adjustments, Tax

In this article, we will discuss Roth IRA Calculator. This calculator helps you decide the amount of contribution you need to put in Roth IRA

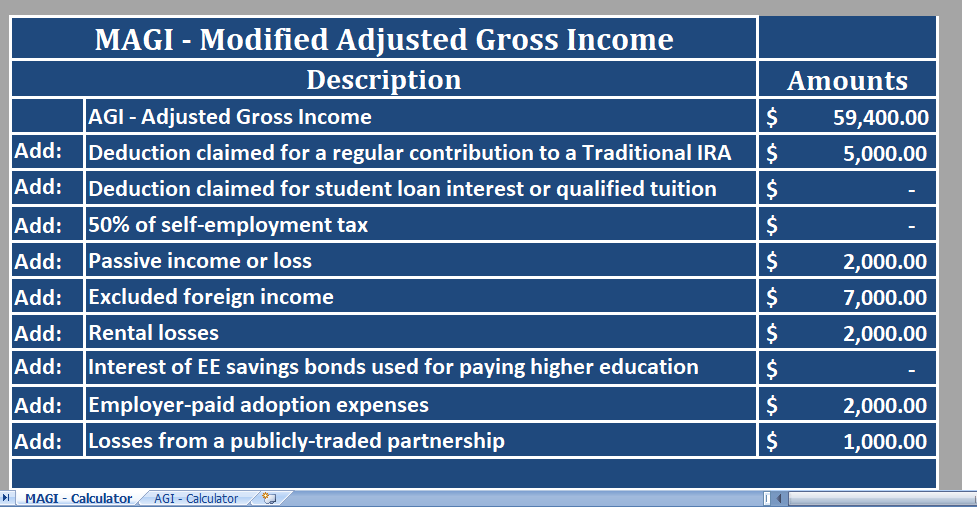

Modified Adjusted Gross Income Calculator is an excel sheet which helps you calculate your MAGI very easily and accurately. MAGI is calculated just by adding

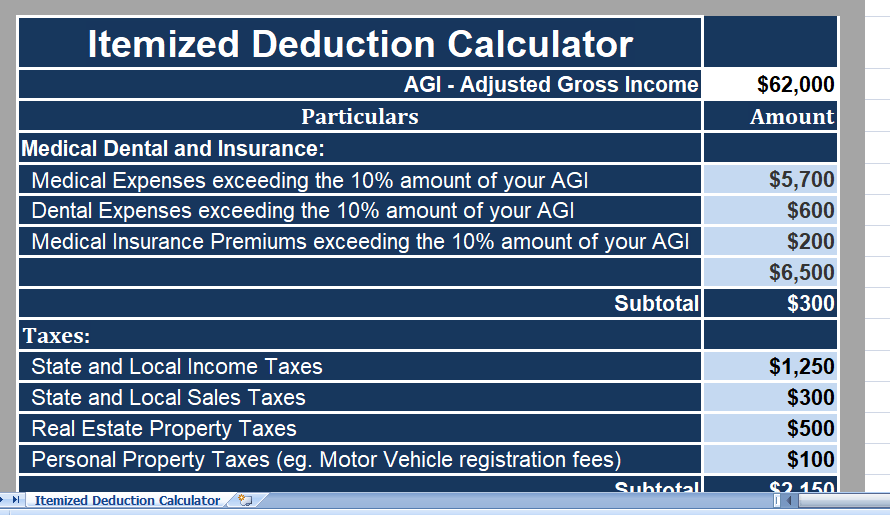

Itemized Deduction Calculator is an excel template. It also helps the taxpayer to choose between Standard and Itemized Deductions. A taxpayer have to choose between

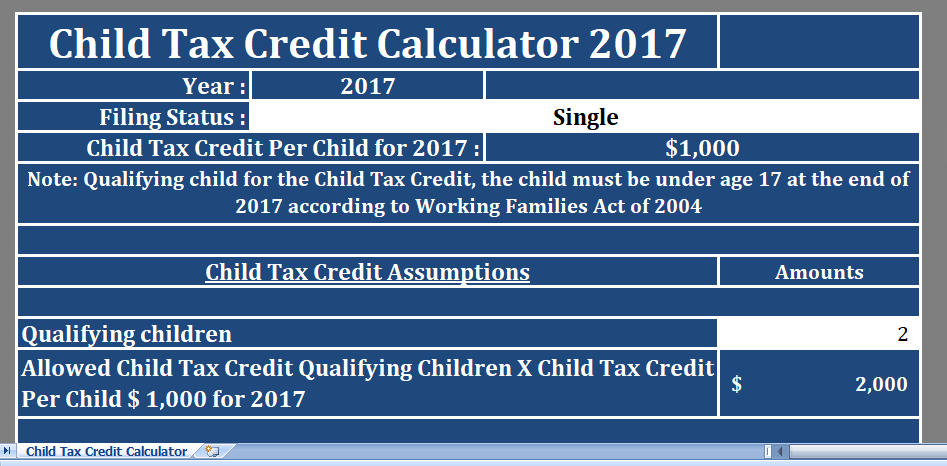

Child Tax Credit Calculator is an excel template that help you to easily calculate your Child Tax Credit amount. Child Tax Credit is a provision

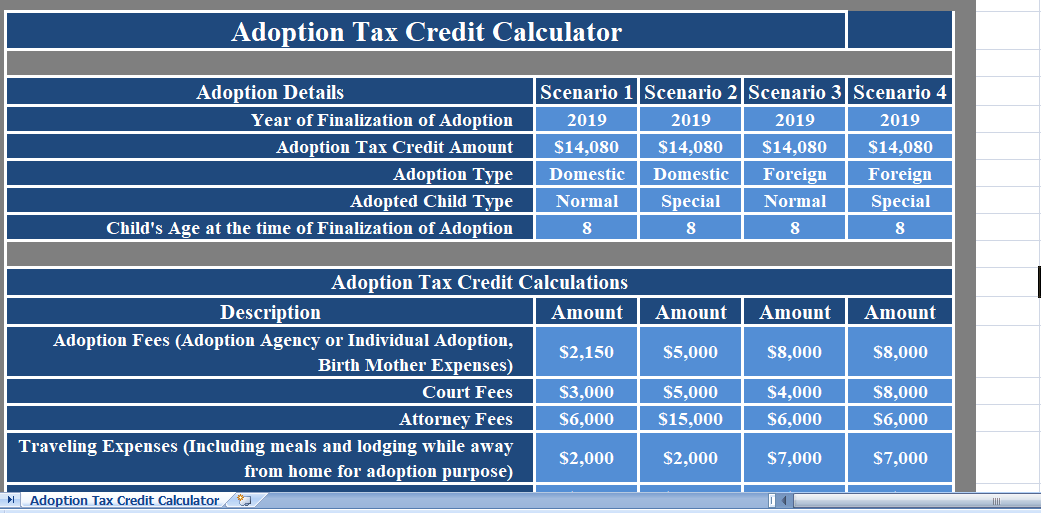

Adoption Tax Credit Calculator is ready-to-use excel template which helps you to calculate the Adoption Tax Credit for 4 different scenarios. So, With the help

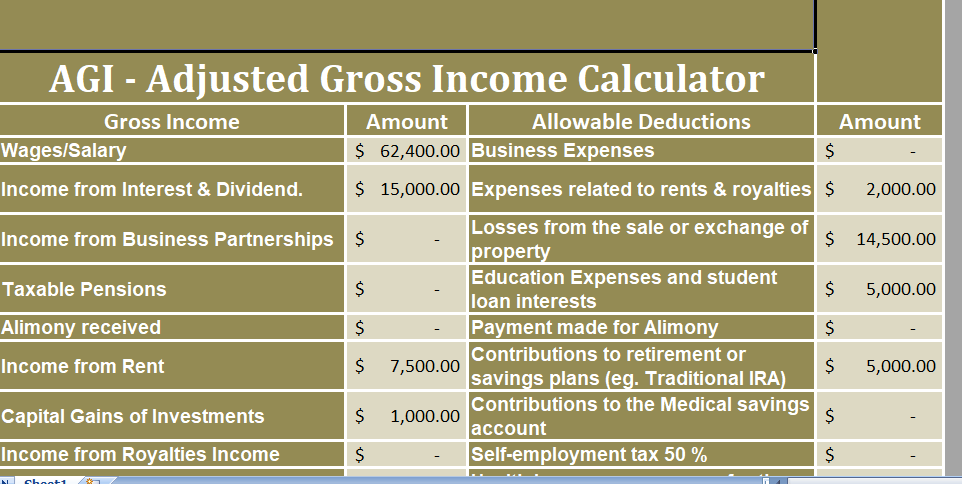

AGI or Adjusted Gross Income Calculator helps you calculate your tax bracket as well as tax liability. What is Adjusted Gross Income? AGI is the basis of

Unlock Efficiency with Our Excel Templates: Your Ultimate Tool for Effective Planning, Tracking, and Analysis

Are you tired of spending hours on mundane and repetitive tasks like managing budgets, tracking expenses, or maintaining schedules? Welcome to the future of efficiency, where our free Excel templates, tailored to your business and personal requirements, simplify these processes and much more!

With Microsoft Excel’s advent, tasks once considered tedious have become a thing of the past. Our website takes this innovation further by offering a myriad of professionally-designed Excel templates, completely free of charge. These templates are not just versatile; they are 100% customizable to fit your specific needs.

With this extensive collection of Excel templates, we cover nearly every aspect of business and personal needs. Each template is designed with expertise to offer functionality, ease of use, and efficiency. Explore and download these free Excel templates today, and elevate your productivity to new heights!

Our Excel templates are more than just a tool; they are your partner in streamlining business processes, enhancing productivity, and achieving better results. Created by professionals with years of experience, they are designed to significantly reduce the effort required for various tasks.

If you’re looking to simplify your work or take your project management to the next level, look no further than our free Excel templates. Entirely customizable, user-friendly, and crafted to meet your daily needs, our templates are here to make your life easier. Download today and embark on a journey towards efficiency and success!

Learn about various tips and tricks in Microsoft Excel and Spreadsheet. Create best templates and dashboards using free tricks and tutorials in excel and spreadsheet. These tutorial posts are useful for everyone who wants to master the skills in excel and spreadsheet.

Introduction: Streamlining Insurance Quotations An insurance quote is a vital document in the insurance industry, serving as a preliminary estimate …

Introduction: Mastering Freelance Quotations In the world of freelancing, creating an effective quotation is crucial for outlining the scope and …

Introduction: Navigating Fencing Service Quotations A fencing service quotation is an essential tool for businesses in the fencing industry. It …

Introduction: Excelling with Event Planning Quotations An event planning quote is a critical document for event planners, detailing proposed services …

Introduction: Optimizing Construction Quotations A construction quote is a fundamental document in the construction industry, serving as a formal proposal …

Introduction: Perfecting Cleaning Service Quotations Creating an effective cleaning service quotation is crucial in the cleaning business. It serves as …

Welcome to Excel Templates – your ultimate destination for all things related to Excel! We pride ourselves on being a comprehensive, 100% free platform dedicated to providing top-notch, easily editable Excel templates, step-by-step tutorials, and useful macro codes. With fresh templates uploaded daily, we aim to meet every conceivable Excel need you may have. Whether you’re a student, a business professional, or someone looking to make sense of their data, our range of templates has you covered. Dive into the world of Excel Templates today and transform your number-crunching experience into an effortless journey of discovery and efficiency. Join our growing community and elevate your Excel game now.

© 2023 xlsxtemplates all rights reserved