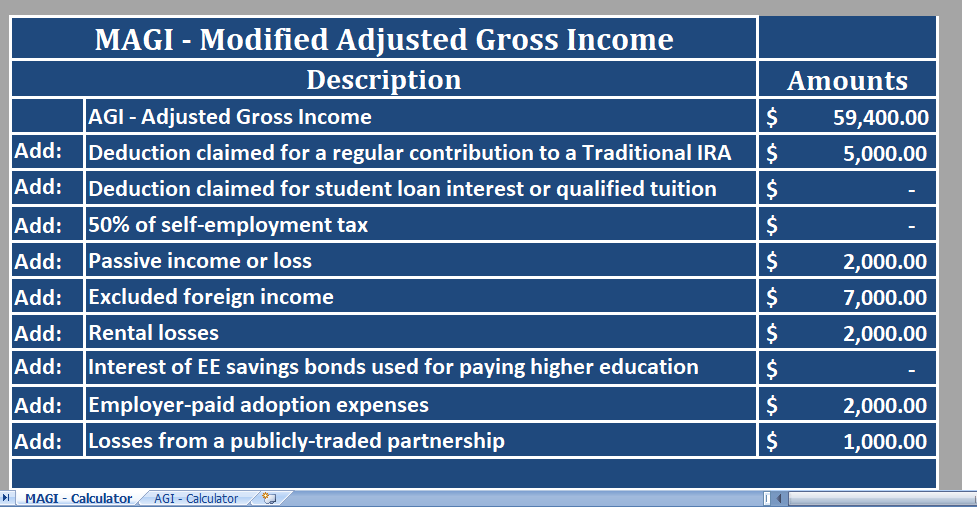

Modified Adjusted Gross Income Calculator is an excel sheet which helps you calculate your MAGI very easily and accurately.

MAGI is calculated just by adding back several deductions to your AGI – Adjusted Gross Income.

Modified adjusted gross income calculator

Usually, MAGI is very useful for determining the eligibility of Roth IRA Contributions as well as other IRA deductions. Several tax credits are also subject to MAGI. However, MAGI plays an important role for Traditional IRA and Roth IRA contributions. Your deduction can reduce if your MAGI score is higher.

MAGI Income

Tip to lower your MAGI: Put more your money into retirement plans through work as they aren’t added back to calculate your MAGI.

We have create a simple and usable Modified Adjusted Income Calculator in Excel.

Just enter relevant details and it automatically calculate your MAGI. This template is helpful to individuals and tax consultants.

Content of Modified Adjusted Gross Income Calculator

This template consists of two sheets one is the Adjusted Gross Income Calculator and other is the Modified Gross Income Calculator.

The Modified Adjusted Calculator consists 2 sections:

- Firstly Header Section

- Secondly Data Input Section

- Thirdly MAGI Calculations

1. Header Section

The header section consists of a name logo and other relevant details. If you are a company, tax consultant you can add your company name and logo in header section.

2. Data Input Section

The data input section consists of multiple items.

AGI: Adjusted Gross Income. AGI is Gross Income less of Allowable Deductions.

Thus AGI = Gross Income – Allowable Deductions

Therefore You can find AGI at the end of the first page of Form 1040 of Federal Tax Returns.

If you know your AGI, you can directly add up the figure in the cell adjacent to AGI.

IRA Deductions: Enter the deduction claim for a regular contribution to Traditional IRA.

Student Loan Interest Deductions: So deductions claim for student loan interest or qualified tuition.

Self Employment Tax: Taxpayers can add upto 50% of their self-employment tax.

Passive Incomes or Losses: If you have made any passive income or loses you can add them.

Excluded Foreign Incomes: In AGI your foreign income is not report because it is your source of income you can include if you have any such income.

Rental Losses: However If you made any losses in your rental income then you can add these to your MAGI.

The interest of EE Savings Bond: adding the interest of EE savings bonds that are use for paying the higher education expenses.

Adoption Expenses: Moreover Adoption expenses paid by employers are add here.

Losses from Partnerships: Report the losses from any publicly trade partnership in this cell.

3. MAGI Calculations

The formula for MAGI:

Therefore, AGI + All the above-mention items in data input section. Hence, The sum of all the above items is your MAGI – Modified Adjusted Gross Income.