Insurance Quote

Introduction: Streamlining Insurance Quotations An insurance quote is a vital document in the insurance industry, serving as a preliminary estimate …

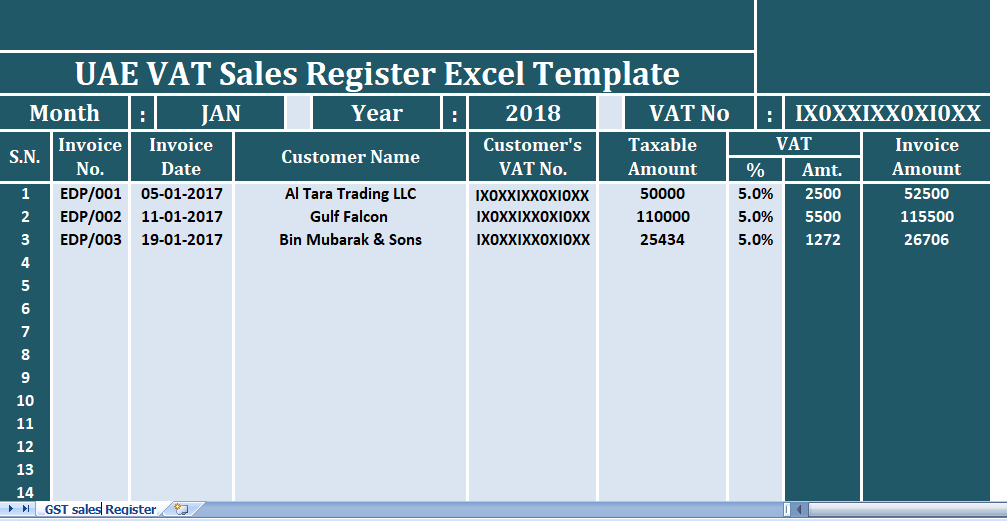

UAE VAT Sales Register is a document that maintains records of your sales during a specific period along with details of Output VAT collected on

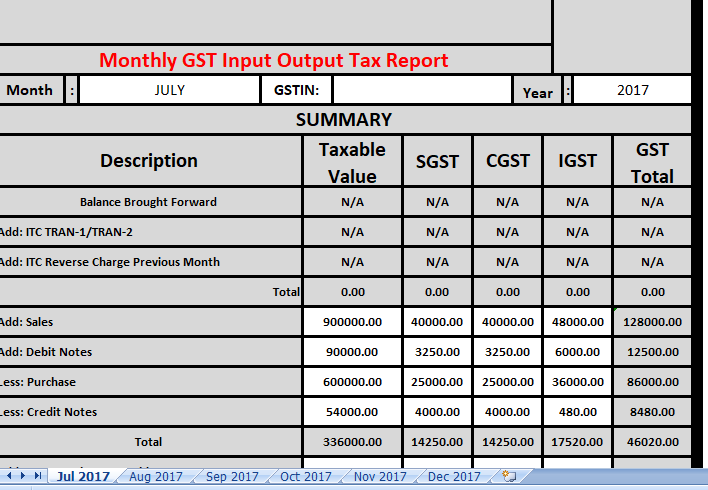

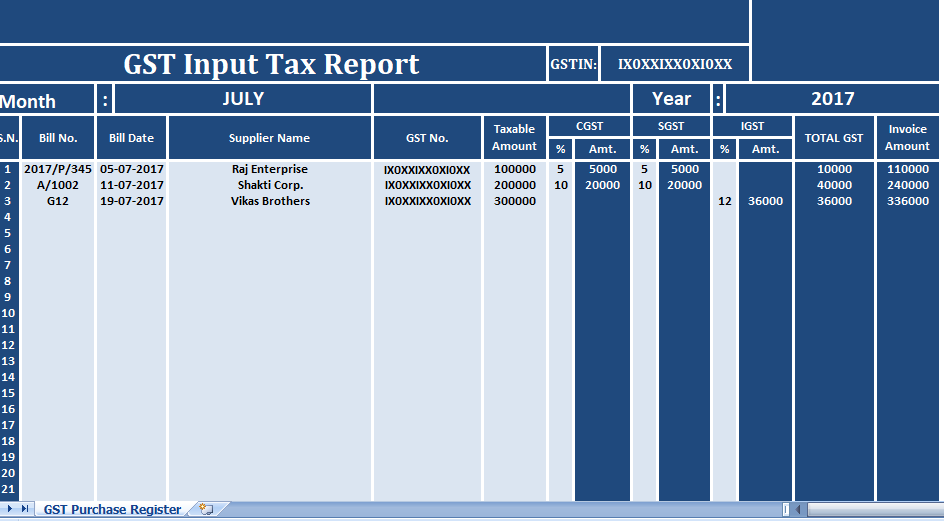

We have receive requests from our readers for making Monthly GST Input Output Tax Report in which they can maintain and carry forward their previous

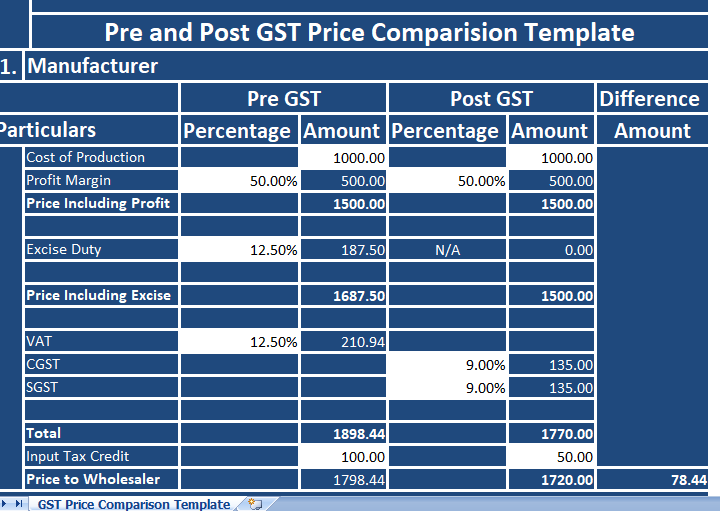

With continuous requests from our readers as well as authorities for making Pre GST and Post GST Price Comparison Template in excel, today we have

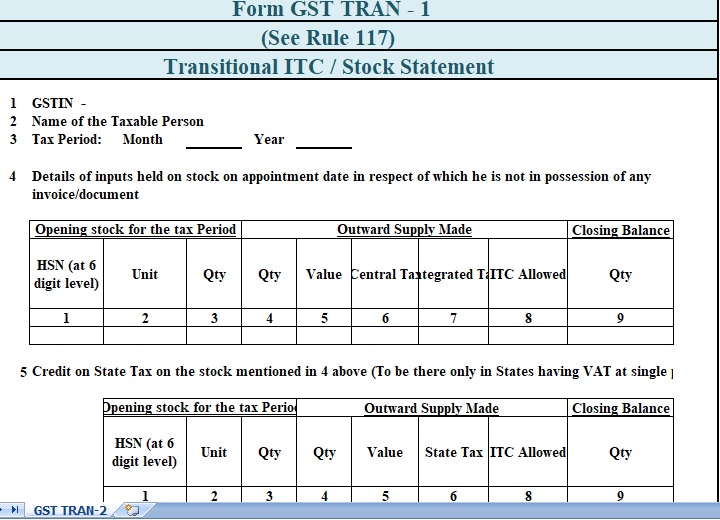

GST TRAN-2 return is filed by a dealers who are currently registered under GST but were previously unregistered VAT/Excise. Henceforth, these dealers do not have

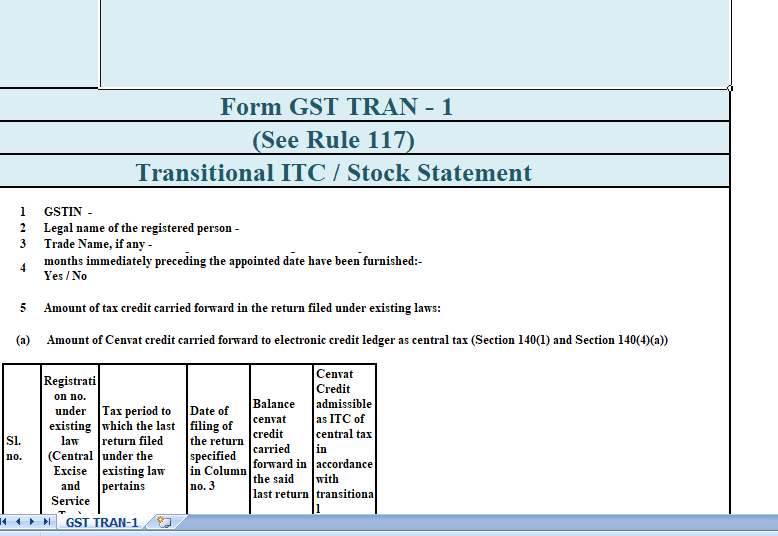

GST TRAN-1 Return form is use to claim credit of input of taxes (VAT, Excise) paid under the pre-GST regime issued by the Central Board

It is mandatory for all to maintain records of sales and purchase under the new GST regime. Every registered person has to maintain GST Sales

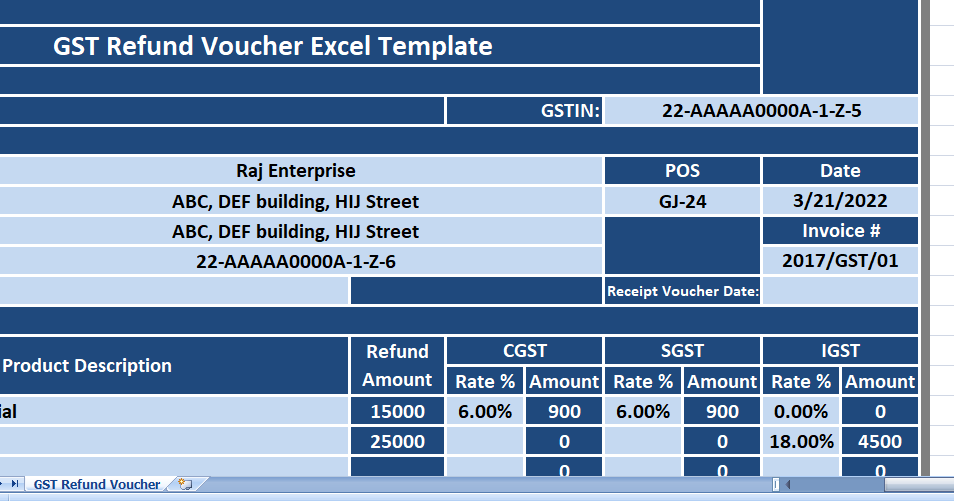

The long awaited GST Bill has been implemented. A business is liable to claim the refund of Goods and Service Tax before the expiry of

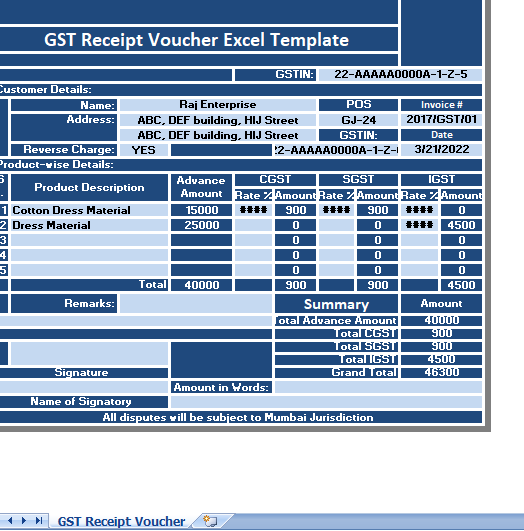

GST Receipt Voucher is an mandatory after the implementation of Goods & Service Tax. GST Receipt Voucher A receipt voucher referred to in clause (d)

Under the GST regime, register taxpayers will have to maintain this in order to calculate their Input Tax Credit and hence define the tax liability.

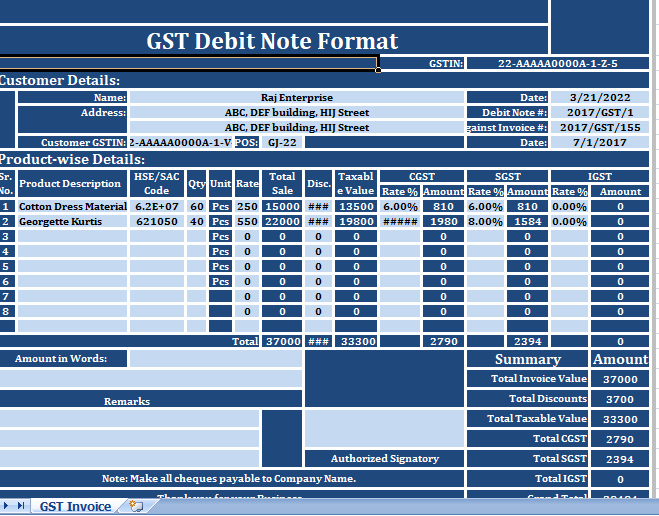

GST implement from 1st July 2017. As a register business will now have to issue GST Invoice for the supply of taxable goods or services.

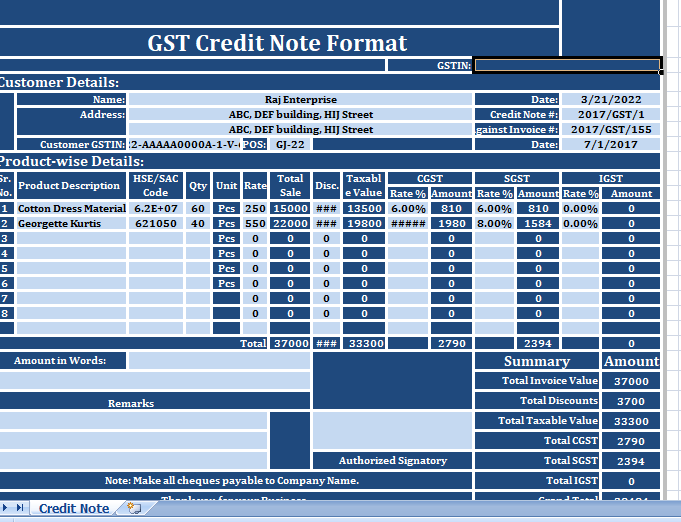

A registered supplier has to issue a GST Credit Note format to his customer when: The taxable value or the tax charged in the original

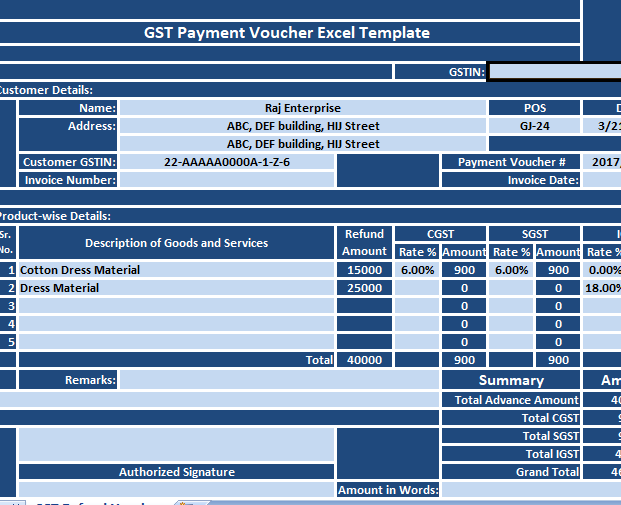

A recipient liable to pay tax under reverse charge is required to issue a GST Payment Voucher at the time of making payment to supplier.

Unlock Efficiency with Our Excel Templates: Your Ultimate Tool for Effective Planning, Tracking, and Analysis

Are you tired of spending hours on mundane and repetitive tasks like managing budgets, tracking expenses, or maintaining schedules? Welcome to the future of efficiency, where our free Excel templates, tailored to your business and personal requirements, simplify these processes and much more!

With Microsoft Excel’s advent, tasks once considered tedious have become a thing of the past. Our website takes this innovation further by offering a myriad of professionally-designed Excel templates, completely free of charge. These templates are not just versatile; they are 100% customizable to fit your specific needs.

With this extensive collection of Excel templates, we cover nearly every aspect of business and personal needs. Each template is designed with expertise to offer functionality, ease of use, and efficiency. Explore and download these free Excel templates today, and elevate your productivity to new heights!

Our Excel templates are more than just a tool; they are your partner in streamlining business processes, enhancing productivity, and achieving better results. Created by professionals with years of experience, they are designed to significantly reduce the effort required for various tasks.

If you’re looking to simplify your work or take your project management to the next level, look no further than our free Excel templates. Entirely customizable, user-friendly, and crafted to meet your daily needs, our templates are here to make your life easier. Download today and embark on a journey towards efficiency and success!

Learn about various tips and tricks in Microsoft Excel and Spreadsheet. Create best templates and dashboards using free tricks and tutorials in excel and spreadsheet. These tutorial posts are useful for everyone who wants to master the skills in excel and spreadsheet.

Introduction: Streamlining Insurance Quotations An insurance quote is a vital document in the insurance industry, serving as a preliminary estimate …

Introduction: Mastering Freelance Quotations In the world of freelancing, creating an effective quotation is crucial for outlining the scope and …

Introduction: Navigating Fencing Service Quotations A fencing service quotation is an essential tool for businesses in the fencing industry. It …

Introduction: Excelling with Event Planning Quotations An event planning quote is a critical document for event planners, detailing proposed services …

Introduction: Optimizing Construction Quotations A construction quote is a fundamental document in the construction industry, serving as a formal proposal …

Introduction: Perfecting Cleaning Service Quotations Creating an effective cleaning service quotation is crucial in the cleaning business. It serves as …

Welcome to Excel Templates – your ultimate destination for all things related to Excel! We pride ourselves on being a comprehensive, 100% free platform dedicated to providing top-notch, easily editable Excel templates, step-by-step tutorials, and useful macro codes. With fresh templates uploaded daily, we aim to meet every conceivable Excel need you may have. Whether you’re a student, a business professional, or someone looking to make sense of their data, our range of templates has you covered. Dive into the world of Excel Templates today and transform your number-crunching experience into an effortless journey of discovery and efficiency. Join our growing community and elevate your Excel game now.

© 2023 xlsxtemplates all rights reserved