UAE VAT Sales Register is a document that maintains records of your sales during a specific period along with details of Output VAT collected on these sales.

Earlier, we have maintain records of sales, but those records were without VAT calculations.

The VAT collected by you in sales of goods or services is called Output Tax.

Whenever you make any sales, you are entitled to collect the VAT on goods or services you supply.

At the end of tax period, you have to pay the difference between the output VAT collected and recoverable Input VAT paid.

So, We have created the UAE VAT Sales Register Excel Template to maintain your sales records and help you to easily calculate your output tax.

Contents of UAE VAT Sales Register

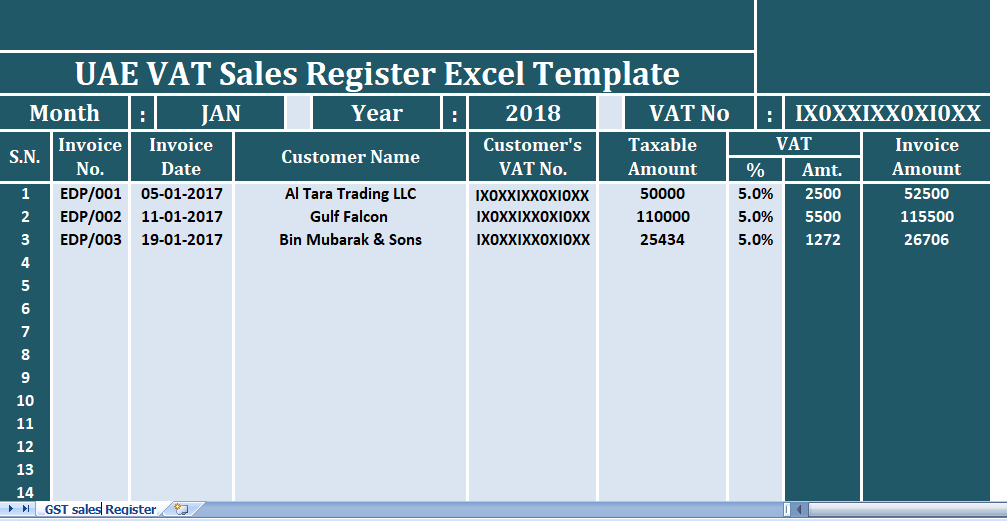

The UAE VAT Sales Register template consists of 2 sections:

- Header Section

- Sales Details Section

Header Section

Usually, the header section consists of the company name, template heading.

Apart from this, it consists of Month, Year, and your VAT registration number.

Sales Details Section

This section consists of multiple subheadings:

Serial.No.: A serial number is a place to know the number of sales made during a particular period.

Invoice No: You have to enter the Invoice number of the issued against the supply made to your customer.

Invoice Date: Date on which sale has taken place and invoice was issued.

Customer Name: You need to enter the name of company to which the supply has been made.

Customer’s VAT No.: If your customer is a register person, enter the VAT registration number.

Taxable Amount: Amount on which the applicable 5% VAT will calculate. In other words, the sales price on which the 5% VAT is calculate.

VAT % and Amount: Just enter the applicable tax percentage tax of VAT and it will automatically calculate the amount.

Above all, VAT percentage in UAE is a flat rate of 5%. Thus, enter 5% in each cell.

Invoice Amount: Invoice amount = Taxable Amount + VAT Amount.

Lastly, the total of each column is at the end of the column.

So, There is a provision to enter up to 100 invoices in this template.

Moreover, If you have more than 100 invoices, you can insert additional rows as per your requirement.

To maintain records for a longer time, either make a copy of this sheet and you can use it for other tax periods.