Insurance Quote

Introduction: Streamlining Insurance Quotations An insurance quote is a vital document in the insurance industry, serving as a preliminary estimate …

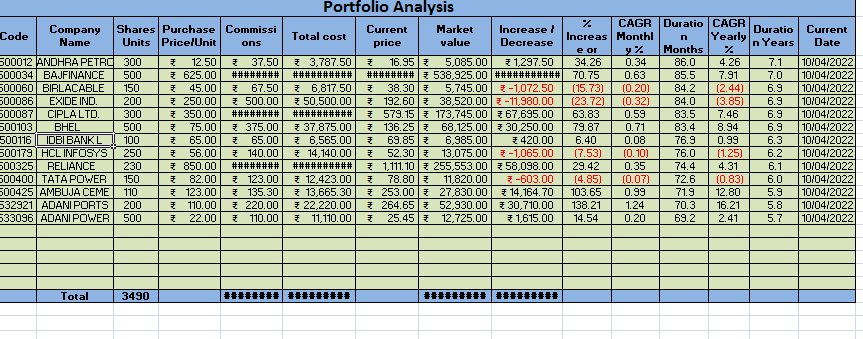

Portfolio Analysis is the examination of securities over a period of time to get an overview of investments is called Portfolio Analysis. Thus, Portfolio analysis

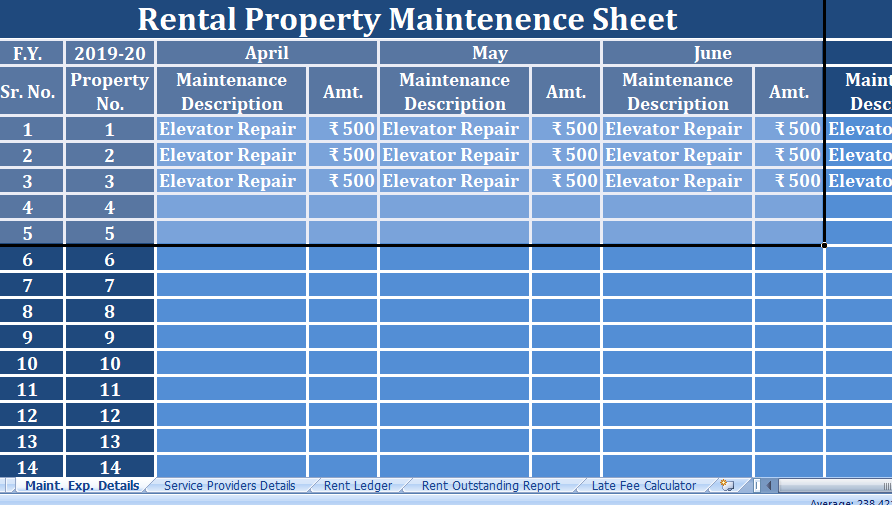

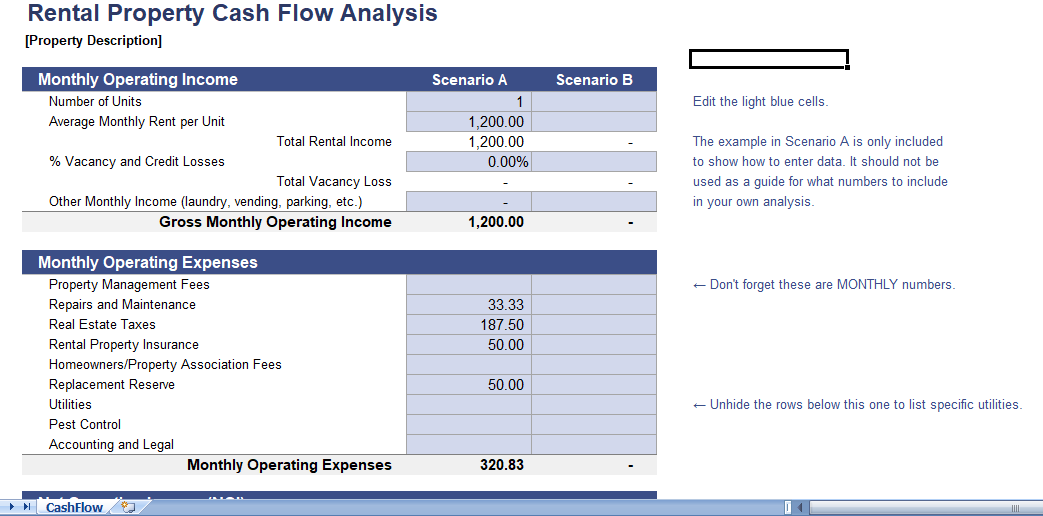

Rental Property Management template is a ready-to-use template to maintain records of your property, rent collection with multiple reports. Thus, a real estate company can

Personal Income Expense Tracker is an excel template display in easily manage your finance by recording your monthly incomes and expenses. Sometimes at the end

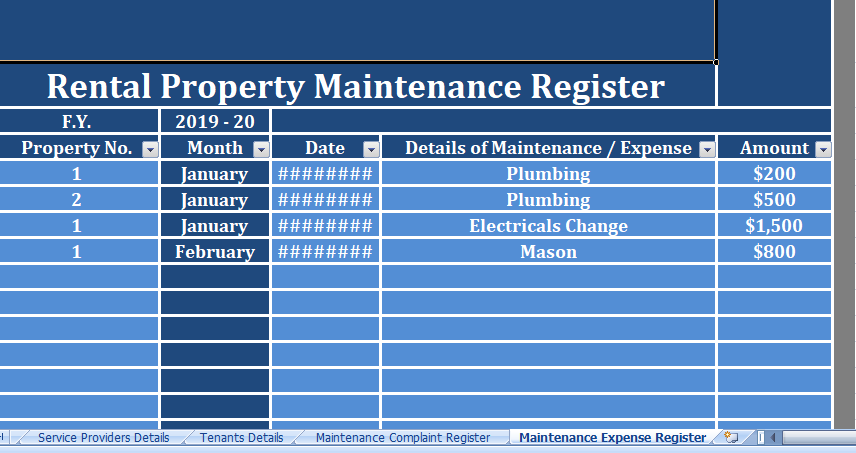

Rental Property Maintenance Register is an excel template that helps manage the maintenance records of multiple rental properties. Additionally, you can record individual entries of

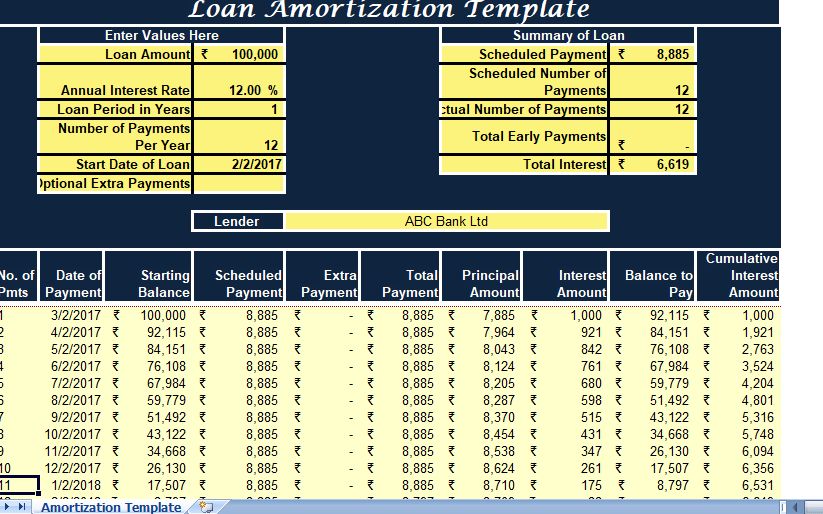

Loan Amortization is gradual repayment of a debt over a period of time. In order to amortize a loan, your payments must be large enough

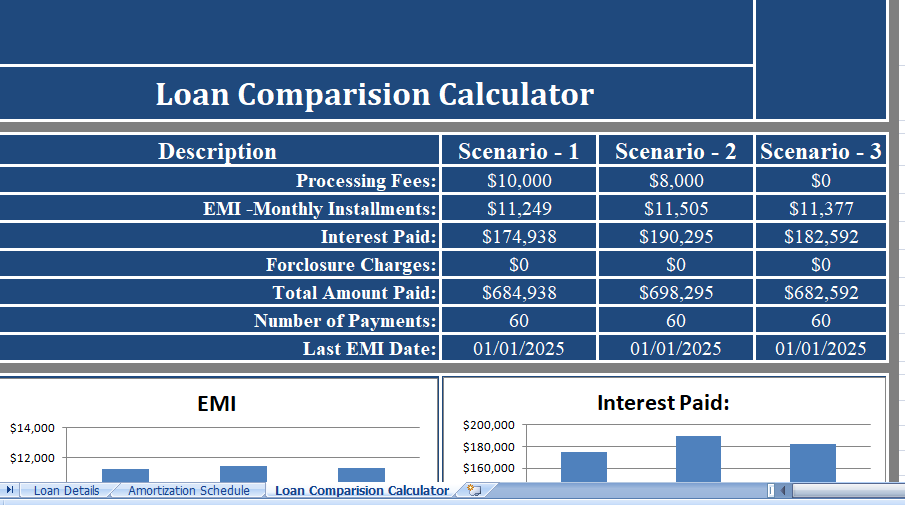

Loan Comparison Calculator is a ready excel template to compare multiple scenarios. Comparison is based on 4 different criteria; interest rate, installments, repayment duration and

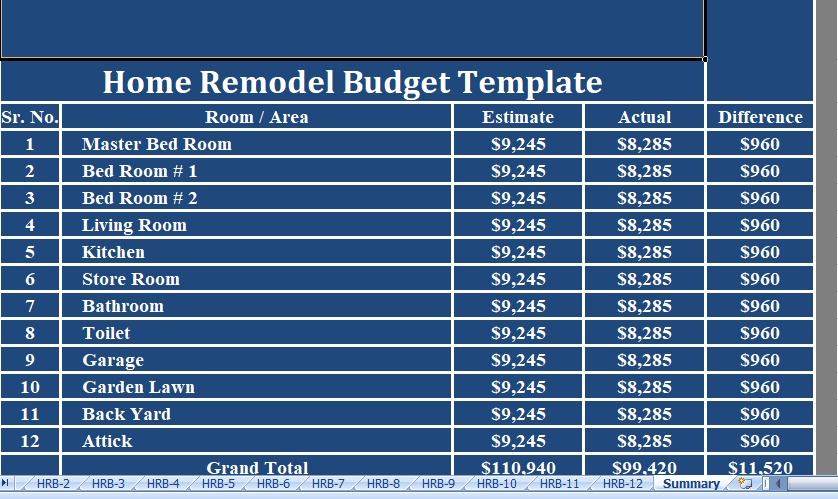

Home Remodel Budget is a ready excel template that helps you to prepare and compare budget estimates of remodeling of your home. With this sheet,

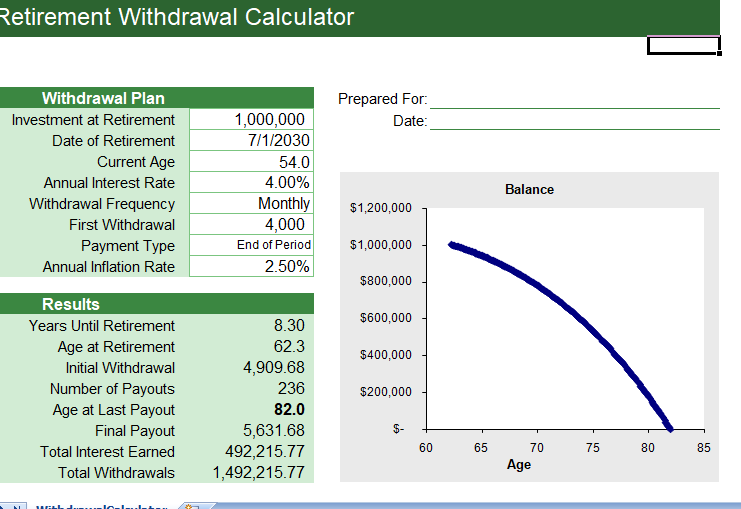

How much of your personal salary do you need to save to reach your retirement goal? That is not a simple question to answer, but

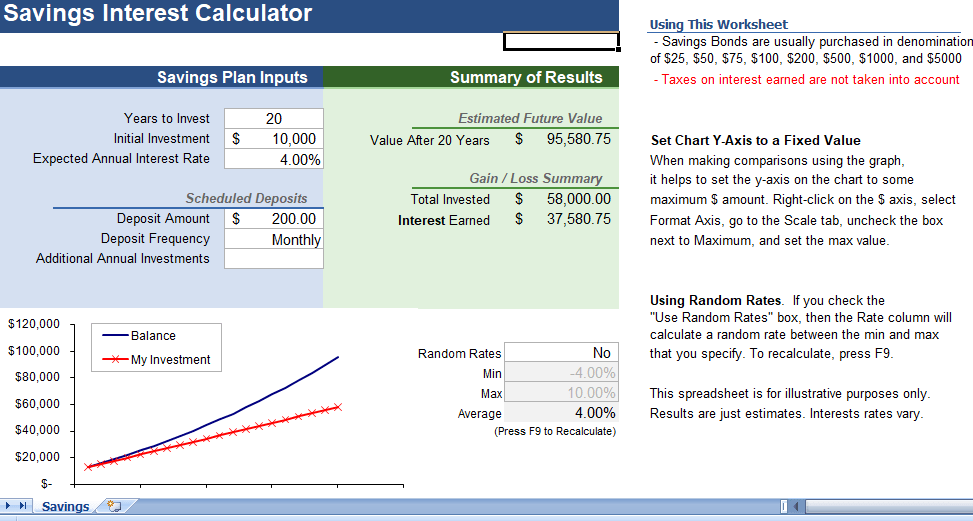

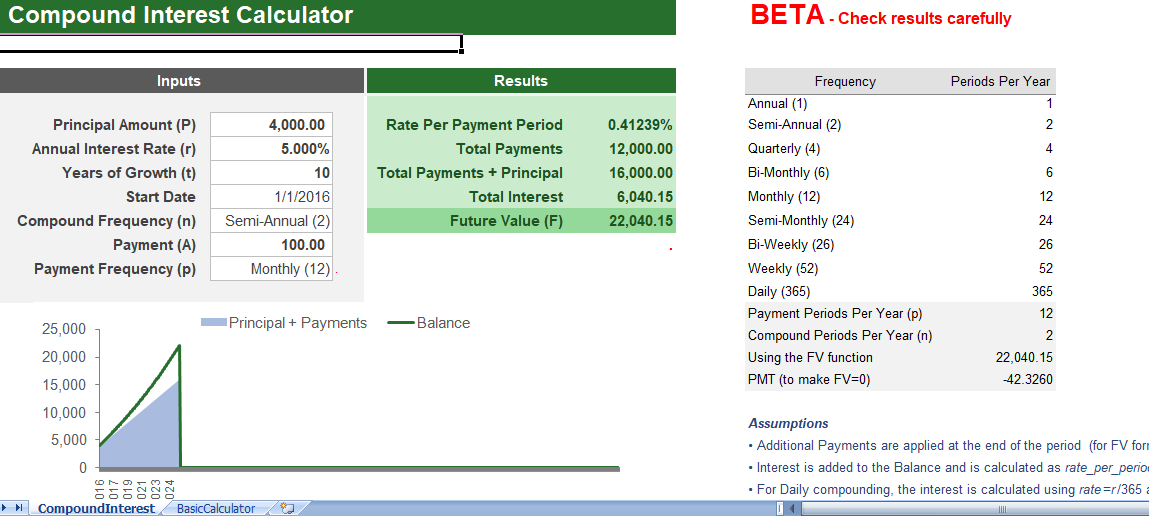

Our Savings Interest Calculator spreadsheet is simple to use and much more powerful than most online calculators that you’ll find. It estimates the future value of

This Rental cash flow spreadsheet is for those who are thinking about purchasing rental property for the purpose of cash flow and leverage. It is

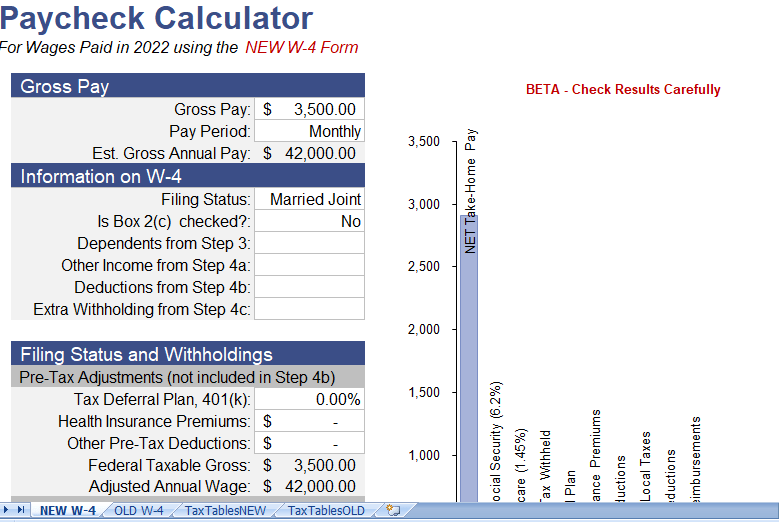

Use our Free Paycheck Calculator spreadsheet to estimate the effects of deductions, holdings, federal tax, and allowances on net take-home pay. Most online paycheck calculators, using

Unlock the Power of Compounding with Our Free Excel Compound Interest Calculator. Download Now! There’s a popular quote attributed to Albert Einstein: “Compound interest is

There are times when Personal Finance and budget management can seem like a daunting task.

When you have multiple personal finances to manage—your savings, your checking account, your bills, and your debts—it’s easy to be unsure of how it all fits together in the big picture.

Many personal finance apps exist that provide software solutions for personal finance management . You can use personal finance apps to set up budgets or digital financial planners that will help you achieve growth in various aspects of personal finance.

However, one of the most effective ways to get a grip on personal finances is by using Excel templates to plan out budgets over certain periods of time. One very popular type of personal-finance spreadsheet is a monthly budget planner from Microsoft Excel. Monthly budget planners allow you to track spending and personal finances while also planning ahead for upcoming expenses.

With a personal finance spreadsheet, you can set up a personal budget while making informed financial decisions about your future while staying on top of personal finances.

Personal finance management is not always an easy task—and personal finance spreadsheet templates can help you to plan your personal finances and budget. With personal budgeting, you’ll be able to set yourself up for financial success because you can stay on top of personal budgets and plans for future expenses. If personal finance software isn’t what you need in order to effectively manage your personal finances but spreadsheets are, personal-finance spreadsheet templates can bring about great results in terms of helping you control spending and make sure that your money stays in line with your desired lifestyle. When it comes to managing personal finance, having useful tools like personal finance spreadsheet templates at hand will prove vital in getting all aspects of personal finances under control.

Unlock Efficiency with Our Excel Templates: Your Ultimate Tool for Effective Planning, Tracking, and Analysis

Are you tired of spending hours on mundane and repetitive tasks like managing budgets, tracking expenses, or maintaining schedules? Welcome to the future of efficiency, where our free Excel templates, tailored to your business and personal requirements, simplify these processes and much more!

With Microsoft Excel’s advent, tasks once considered tedious have become a thing of the past. Our website takes this innovation further by offering a myriad of professionally-designed Excel templates, completely free of charge. These templates are not just versatile; they are 100% customizable to fit your specific needs.

With this extensive collection of Excel templates, we cover nearly every aspect of business and personal needs. Each template is designed with expertise to offer functionality, ease of use, and efficiency. Explore and download these free Excel templates today, and elevate your productivity to new heights!

Our Excel templates are more than just a tool; they are your partner in streamlining business processes, enhancing productivity, and achieving better results. Created by professionals with years of experience, they are designed to significantly reduce the effort required for various tasks.

If you’re looking to simplify your work or take your project management to the next level, look no further than our free Excel templates. Entirely customizable, user-friendly, and crafted to meet your daily needs, our templates are here to make your life easier. Download today and embark on a journey towards efficiency and success!

Learn about various tips and tricks in Microsoft Excel and Spreadsheet. Create best templates and dashboards using free tricks and tutorials in excel and spreadsheet. These tutorial posts are useful for everyone who wants to master the skills in excel and spreadsheet.

Introduction: Streamlining Insurance Quotations An insurance quote is a vital document in the insurance industry, serving as a preliminary estimate …

Introduction: Mastering Freelance Quotations In the world of freelancing, creating an effective quotation is crucial for outlining the scope and …

Introduction: Navigating Fencing Service Quotations A fencing service quotation is an essential tool for businesses in the fencing industry. It …

Introduction: Excelling with Event Planning Quotations An event planning quote is a critical document for event planners, detailing proposed services …

Introduction: Optimizing Construction Quotations A construction quote is a fundamental document in the construction industry, serving as a formal proposal …

Introduction: Perfecting Cleaning Service Quotations Creating an effective cleaning service quotation is crucial in the cleaning business. It serves as …

Welcome to Excel Templates – your ultimate destination for all things related to Excel! We pride ourselves on being a comprehensive, 100% free platform dedicated to providing top-notch, easily editable Excel templates, step-by-step tutorials, and useful macro codes. With fresh templates uploaded daily, we aim to meet every conceivable Excel need you may have. Whether you’re a student, a business professional, or someone looking to make sense of their data, our range of templates has you covered. Dive into the world of Excel Templates today and transform your number-crunching experience into an effortless journey of discovery and efficiency. Join our growing community and elevate your Excel game now.

© 2023 xlsxtemplates all rights reserved