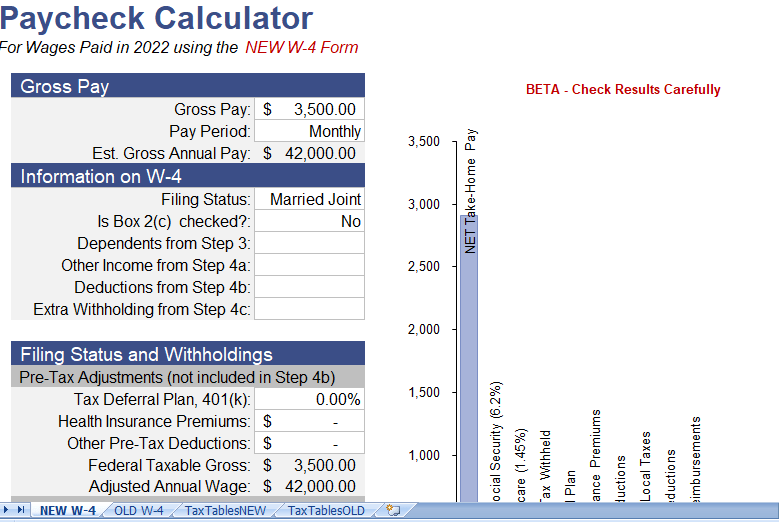

Use our Free Paycheck Calculator spreadsheet to estimate the effects of deductions, holdings, federal tax, and allowances on net take-home pay. Most online paycheck calculators, using our spreadsheet will allow you to save your results.

Take home pay calculator

Calculate your Net Take Home Pay using this Paycheck Calculator for Excel. Answer questions such as:

- How do the number of allowances can affect the federal tax withholdings?

- How much will my take-home pay change if I contribute more than 401(k)?

Some Notes About the New W-4 Form

Here are some notes about the differences with the new W-4 form that I learned as I created the new calculator.

- The New W-4 form is more complicated but designed to help you in estimate your tax withholding more accurately.

- The New W-4 form eliminated the concept of “Allowances” but added in the option to specify dollar amounts for other income, additional deductions, dependents, and extra holding.

- The amount from Step 3 is subtract and the federal tax withholding is calculate, unlike deductions which is subtract from the gross wage prior to the calculation.

- For the New W-4, the federal tax in tables have the standard deduction built into them. There is a new table for Head of Household.

- If Box 2(c) is check, then the federal tax is calculate using the “HIGHER” withholding tables, which is design to withhold tax base on assumption that the second job is earning similar pay.

- Read the W-4 carefully. Most of what you need to know is on there.

Paycheck Calculator online

– Use the worksheet corresponding to the W-4 form.

– Enter your Gross Payment for monthly, semi-monthly, biweekly, or weekly pay periods.

– Federal tax is calculated from tables in IRS Publication 15.

– FICA Social Security Tax and Medicare is calculate on percentage of your Gross Pay.

– State and Local taxes are estimated by multiplying the federal taxable in gross by a percentage that you input.

– Read the cell comments for more information for an input or calculation.