GST TRAN-1 Return form is use to claim credit of input of taxes (VAT, Excise) paid under the pre-GST regime issued by the Central Board of Excise and Customs.

We all are worried about the input credit of taxes that we already paid while purchasing, inputs, raw materials, semi-finished goods, under the old regime. These taxes are available as input credit on 30th July each year.

CBEC has released 2 transition forms GST TRAN-1 and GST TRAN-2, to help the businesses to carry forward their input tax credit.

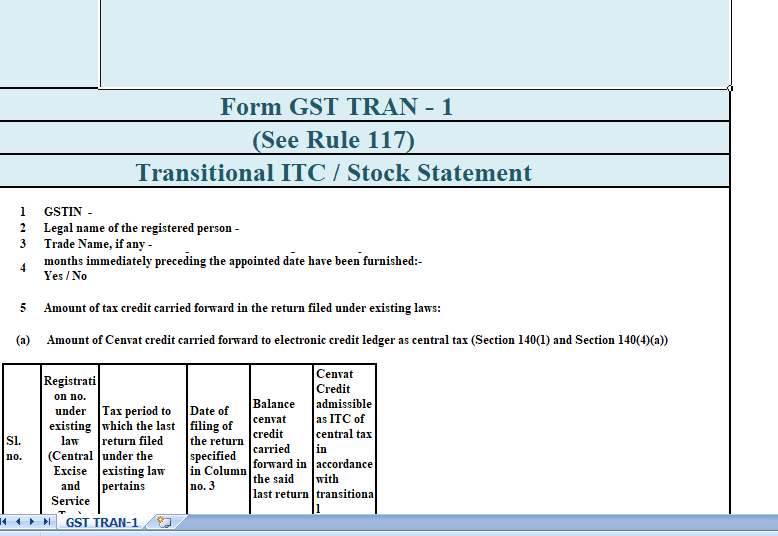

We have create an Excel Template for the GST TRAN-1 form to simplify the filing of return. This form can be filled online on GSTN Portal.

Contents of GST TRAN-1 form Excel Template

This form GST TRAN-1 includes a total of 12 points which are explained below:

1. GSTIN: GSTIN number of yours is auto-populate.

2. Legal Name of Register Person: Your register legal name in full. Auto populate.

3. Trade Name: Name of the company if you are using any Trade Name.

4. Confirm that you have submitted All the returns required under existing law for past 6 months: Here you need to select Yes or No from the drop-down list.

5. Amount of tax credit carry forward in return filed under existing laws:

6. Details of capital goods for which un-availed credit has not been carry forward under existing law (section140 (2)).

(a)Hence, Amount of duties and taxes on inputs claimed as credit excluding the credit claimed under Table 5(a)

(b) Therefore, Amount of vat and entry Tax paid on inputs supported by invoices/documents evidencing payment of tax carried forward to electronic credit ledger as SGST/UTGST

7. Furthermore, Details of the inputs held in stock in terms of sections 140(3), 140(4)(b) and 140(6).

(a) Moreover, Amount of duties and taxes on inputs claimed as credit excluding the credit claimed under Table 5(a)

(b)So, Amount of vat and entry Tax paid on inputs supported by invoices/documents evidencing payment of tax carried forward to electronic credit ledger as SGST/UTGST

(c) Also, The stock of goods not supported by invoices/documents evidencing payment of tax (credit in terms of rule 1 (4)) (To be there only in States having VAT at a single point)

8. So, Details of transfer of cenvat credit for registered person having centralized registration under existing law (Section 140(8))

9. Moreover, Details of goods sent to job-worker and held in his stock on behalf of principal under section 141

(a) Also, Details of goods sent as principal to the job worker under section 141

(b) Details of goods held in stock as a job worker on behalf of the principal under section 141

10. Details of goods held in stock as an agent on behalf of the principal under section 142 (14) of the SGST Act

(a) Details of goods held as an agent on behalf of the principal

(b) Hence, Details of goods held by the agent

11.Also, Details of credit availed in terms of Section 142 (11 (c ))

12. Finally, Details of goods sent on approval basis six months prior to the appointed day (section 142(12))