Itemized Deduction Calculator is an excel template. It also helps the taxpayer to choose between Standard and Itemized Deductions.

A taxpayer have to choose between itemized or standard deduction while filing the federal tax returns.

Standard Deduction Calculator

The standard deduction is fixed dollar amount that will deduct from taxable income with no questions asked. Whereas the itemized deductions are actual amounts of deductions claim.

When deciding between standard and itemized deductions the following points have to be considered:

- Total of the itemized deductions should be higher than the standard deduction amount.

- You must have proper documents to support the claim whenever asked by the IRS.

- If you have faced losses due to a federally announced natural disaster or a victim theft during the tax period.

- When you paid high mortgage interest payments or real estate taxes on your home during the tax period.

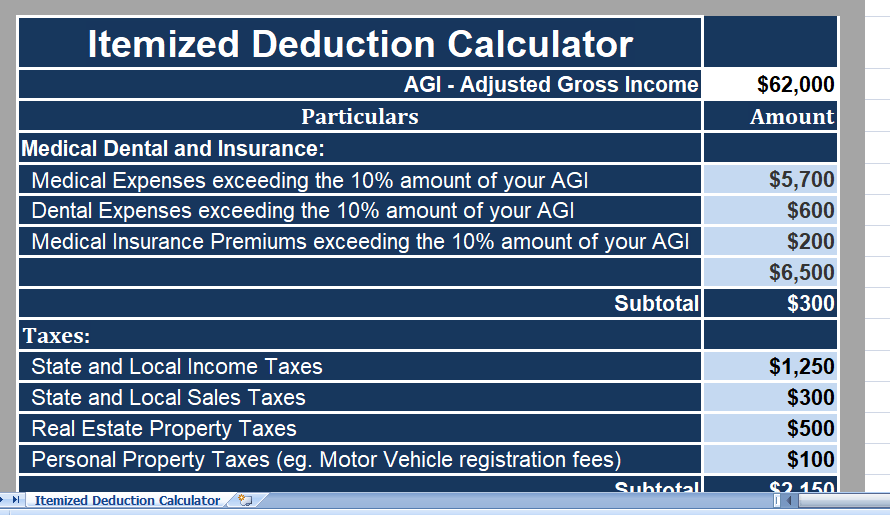

We have create an Itemized Deductions Calculator with predefine formulas. This template helps you easily estimate the itemized deductions.

Contents of Itemized Deductions Calculator

Itemized Deductions Calculator mainly consists of 2 main sections:

- Header Section.

- Calculation Section.

Estimated Deduction

Usually, the header section consists of name of the company, company logo and heading of the template ” Itemized Deductions Calculator”.

Tax donation Calculator

This section consists two columns; Particulars and amounts. The particulars section has all types of expenses reported under Itemized Deductions. The amounts columns contain respective amounts of expenses.

These expenses have been categorized in 5 different types:

- Firstly Medical, Dental and Insurance

- Secondly Taxes

- Thirdly Interest Paid Or Received

- Consequently Charitable Expenses

- And Miscellaneous Expenses

1. Medical, Dental and Insurance

This category report the medical, dental and insurance premium expenses that are above 10 % of your Adjusted Gross Income(AGI) as the laws.

You need to enter the actual expenses. With predefine formulas, it will automatically subtotal the amounts and calculate the amount higher than 10% of your AGI.

2. Taxes

State and local income taxes, State and local sales taxes, real estate and other personal property taxes are report here.

Enter the actual amounts and it will automatically sum up the total for you.

3. Interest Paid or Received

This category reports the home mortgage interests paid, student loan interest, interests paid or received on investments and other interest expenses.

Just enter the amounts and it will sum them up.

4. Charitable Expenses

Donation in the form of gifts or in form of cash amount are reported under this category. Similarly enter the respective amounts and totals will automatically appear.

5. Miscellaneous

Under the miscellaneous category, expenses related to losses due to theft or casualty, non-reimbursed employer expenses, tax preparation fees and losses to some extents of gambling winning are reported.