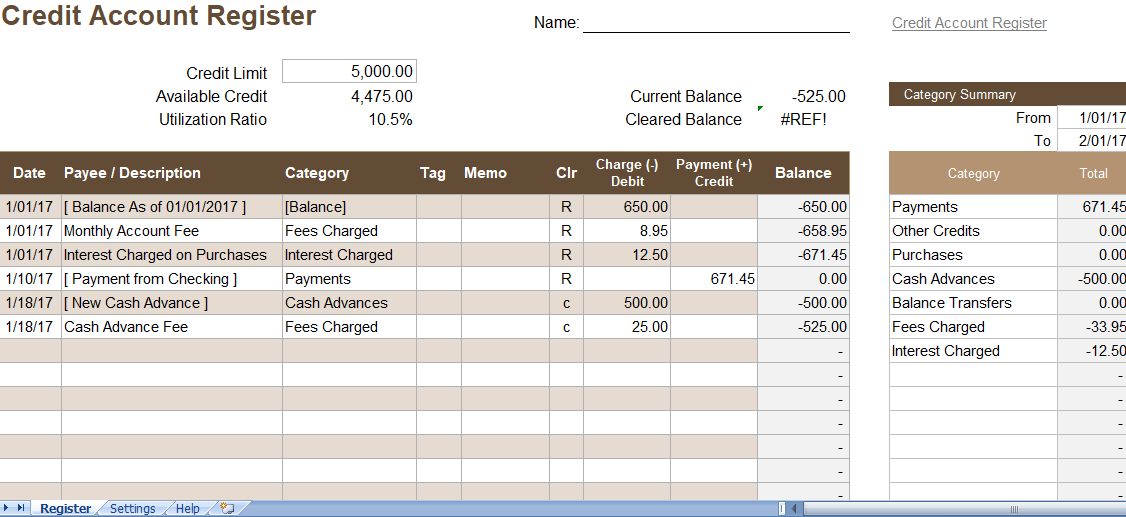

To use a credit card responsibly, you must keep a detailed record of your transactions, fees and payments. You can use a credit account register which will help you do that. Certainly you can set up accounts for your active credit cards and keep the track of them just like you would checking account. This is what this template is design for.

Credit one bank register

I created this credit account register template based on my Excel Checkbook template. However it includes some summary details specific to credit cards such as the credit limit, available credit and current utilization ratio. If you are worried about your credit score, you will want to keep your utilization ratio less than about 25%.

The register also includes a Tags column and a Memo column for including other details. The Tags column are useful if you want to sort or filter the table based on criteria other than that in the payee or category column.

Reconciling with Your Credit Card Statement

Your credit card statement will mostly show your current balance as a positive number. Even though it represents the amount that you owe. Like the account register in the money management and checkbook register, this template shows a negative balance means you owe money. So keep that in mind as you are comparing it to your official statement.

Enter an “R” for those transactions that you have compared and matched to your statement.

The categories that shows up in the drop down lists in the table are mainly customizable in the Settings worksheet. The default list of categories is the common for all the list that may show up on your credit card statement. Use the Category Summary table to summarize the amounts in these categories for a specific time period of time.