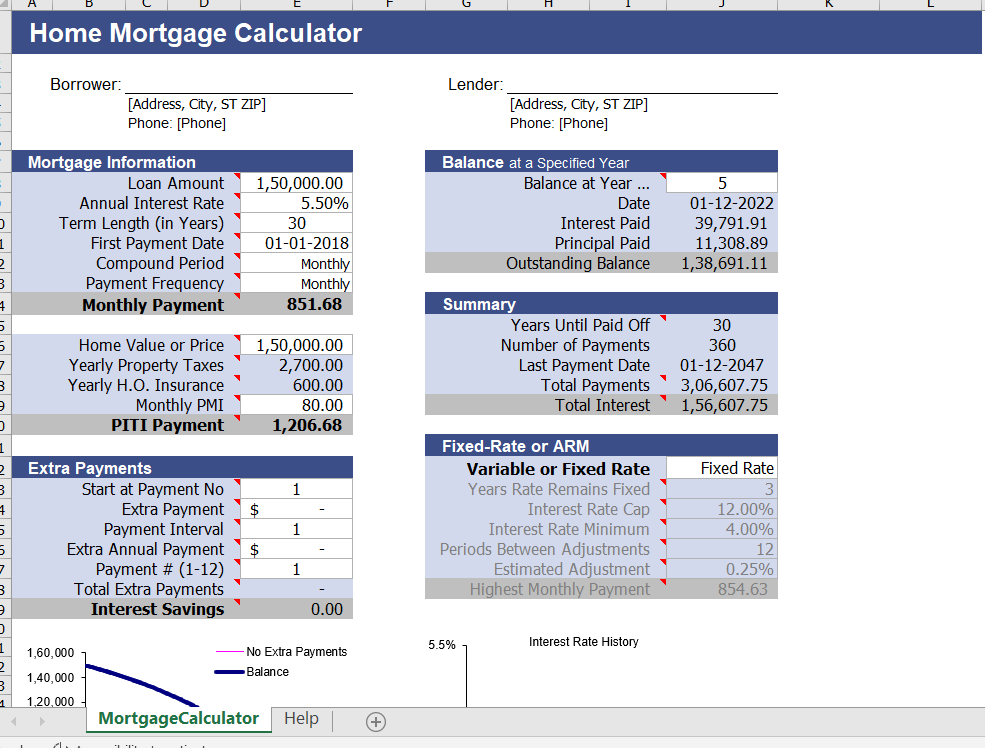

Download our free Home Mortgage Calculator for Excel. It is a powerful all-in-one spreadsheet that combines many of the features from our other mortgage and Home loan calculators. It lets you analyze a variable-rate mortgage or fixed-rate mortgage. Also, figure out how much you can save by making extra payments.

It helps you estimate the loan repayment (including insurance and interest payments). Also, If you want to estimate other monthly expenses for owning a house, you can try our Home Expense Calculator . Check out our other mortgage spreadsheets as well from category, and let us know if you need something that we don’t have.

Best Home Mortgage Excel Calculator

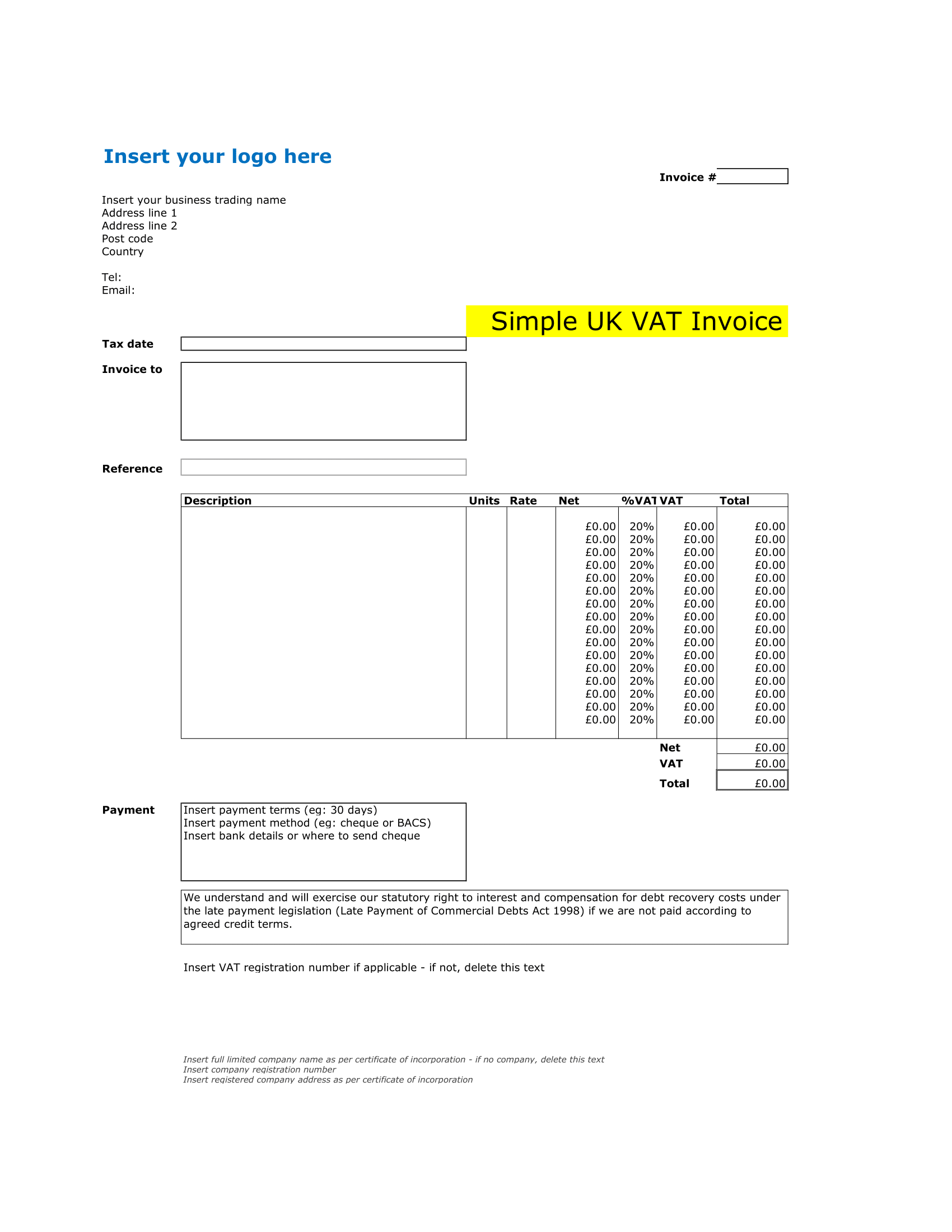

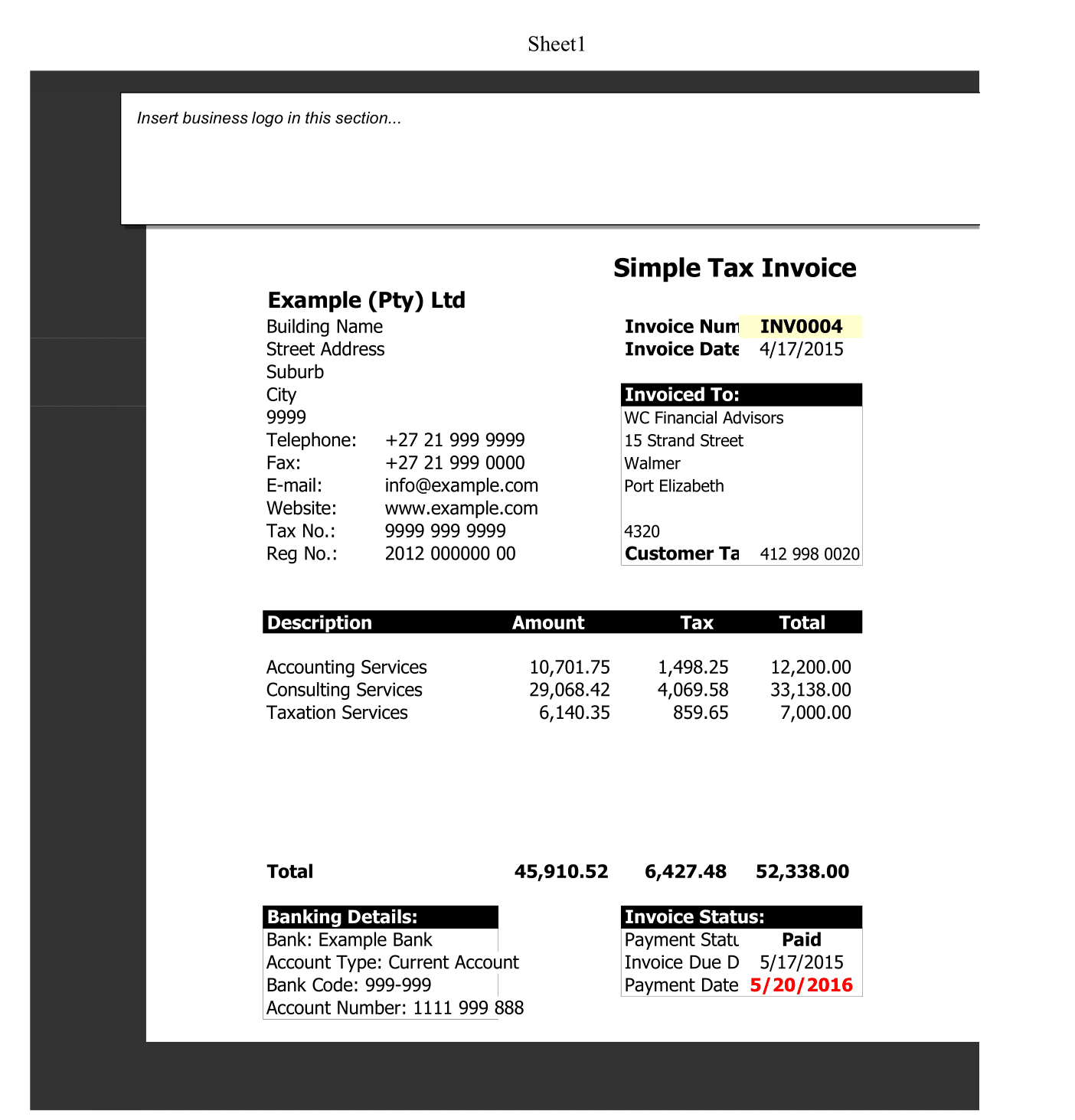

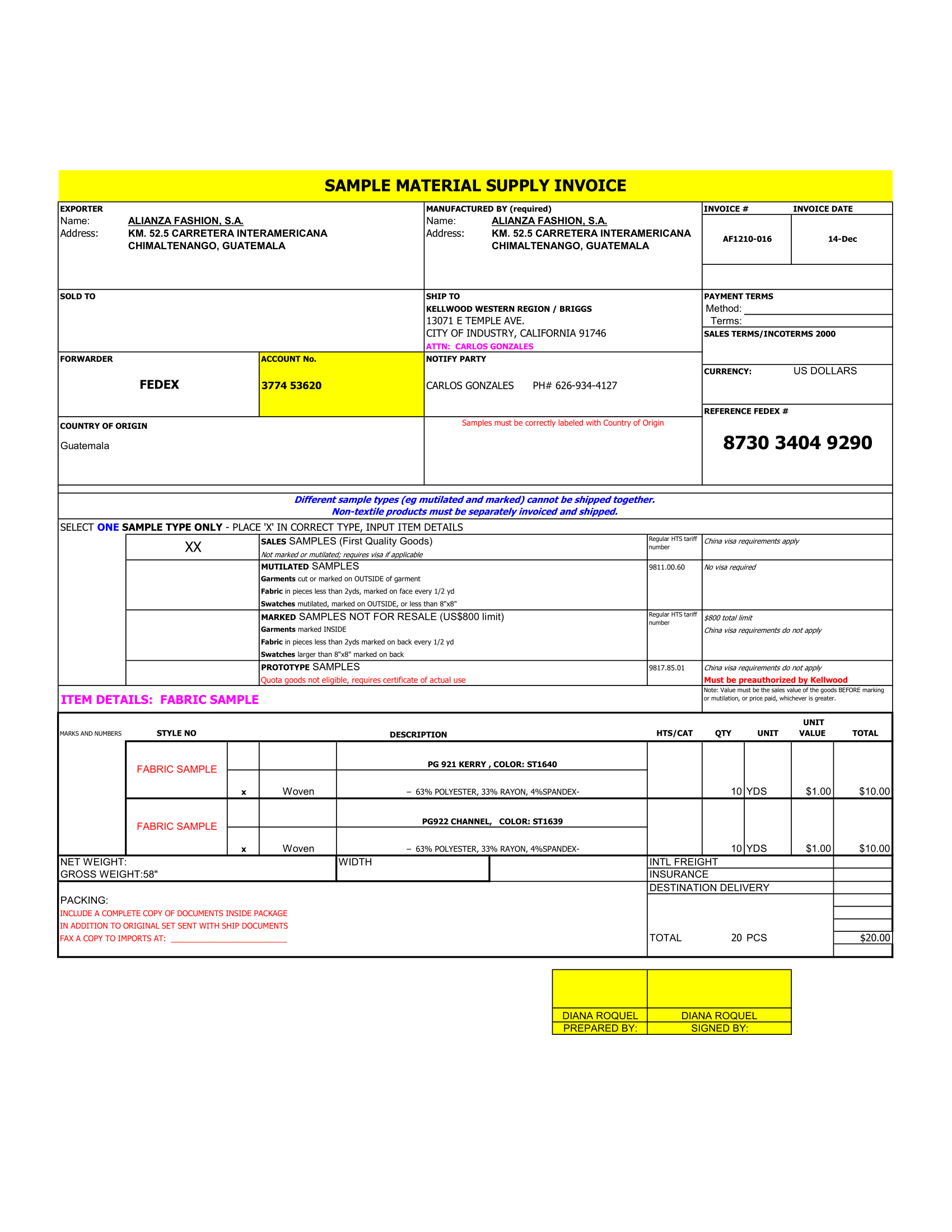

This Excel spreadsheet is an formula driven automated home mortgage calculator. It lets you analyze a fixed or variable interest rate home mortgage. Moreover, You can also set up periodic extra payments, or add additional payments manually within the Payment Schedule. In fact, Use the spreadsheet to compare different term lengths, rates, loan amounts, and the savings from making extra payments. It also calculates the outstanding balance at the end of a specified number of years and the tax returned if the interest paid is tax deductible.

How to use free home mortgage calculator?

Definitions of some of the terms are included as cell comments in the spreadsheet. So, if you have questions, you can hover the mouse cursor over any cell that has a little red triangle in the corner.

This mortgage calculator can help you answer some of the following questions:

- you can save by making extra payments

- Also get tax deduction from paying interest change over time?

- How much might my monthly payment change over time if I have a variable-rate mortgage?

- How soon could I pay off my home if I make extra payments?

- What will my loan balance be at the end of 3 or 5 years?

Feature of our Home Mortgage Calculator

- Estimates Property Taxes and Insurance for calculation of the Government payments.

- Automatically calculates so-called “Accelerated Bi-Weekly” payments.

- Highly flexible extra payment options.

- Select a fixed-rate or variable rate mortgage.

Choose when to start the scheduled extra payments.

How much house loan can I afford?

To calculate how much house you can afford, we should take into account a few primary items, such as your household income, monthly debts (for example, car loan and student loan payments) and the amount of savings available for a upfront down payment. As a home buyer, you’ll need to have a certain level of comfort in understanding your monthly Home EMI payments.

While your household income and regular monthly fixed EMI may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months cash reserve for payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

How to analyzing your existing mortgage before your buy new home

There are a couple of ways to analyze your existing home mortgage.

The first step is to enter the original loan amount and date and then make adjustments to the payment history within the repayment schedule as needed. That is the simplest solution, so we’ve added a feature to the additional payments section (at the suggestion of one of our users) that lets you specify what payment you want the extra payments to start at. So, if you’ve already been making payments for a couple of years, you can choose to have scheduled extra payments start on payment number 25.

The second approach is to enter the current mortgage balance and adjust the term length until the PI payment matches what you are currently paying. Remember that if paying monthly, you can enter a fraction of a year by entering a value like =10+5/12 (for 10 years and 5 months).