GST Receipt Voucher is an mandatory after the implementation of Goods & Service Tax.

GST Receipt Voucher

A receipt voucher referred to in clause (d) of sub-section (3) of section 31 contains the following particulars:

- Name, address, and GSTIN of supplier

- A consecutive serial number not exceeding sixteen characters, for a financial year.

- Date of issue.

- Name, address and GSTIN or UIN, if registered, of the recipient.

- Description of goods or services.

- The amount of advance if taken.

- The rate of tax.

- The amount of tax charge in terms of taxable goods or services.

- Place of supply along with the name of State and code, in case of a supply in course of inter-State trade or commerce.

- Whether the tax is payable on reverse charge basis

- Signature or digital signature of supplier or authorize representative signature.

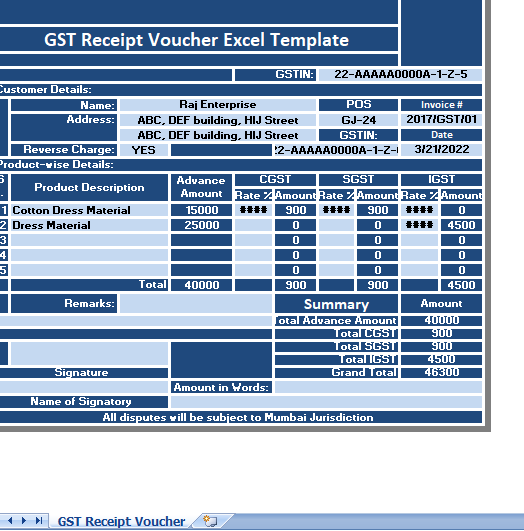

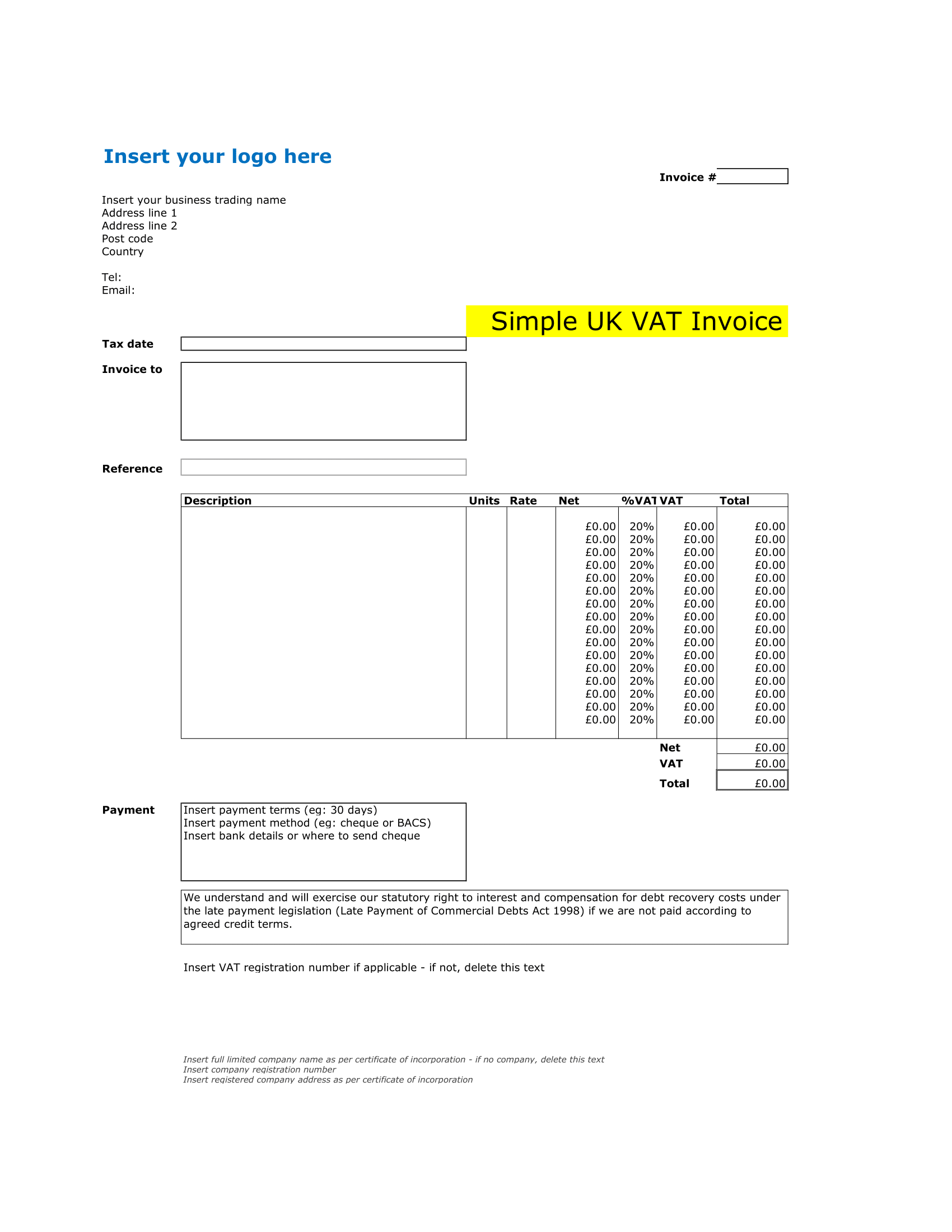

Receipt Voucher in GST Excel Template

We have created an easy to use GST Receipt Voucher following the above guidelines. Just enter few details and the template will compute all rest items content for you.

This template helps to efficiently and easily issue the voucher against the receipt of an advance amount for goods or services to be supplied in future.

It is useful for Accounts Assistant, Accountants, Audit Assistants.

Contents of the Receipt Voucher under GST

The template consists of 4 sections

- Header Section.

- Customer Details.

- Product Details.

- Signature Section.

1. Header Section

Header section consists of company name, company address, company logo, invoice number, GSTIN and the heading of the sheet “GST Receipt Voucher Excel Template”.

2. Customer Details

Customer Detail consists of customer such as the name of the customer, address, GSTIN, Place of Supply, Reverse charge applicability and Invoice Date.

3. Product Details

This section consist of multiple subheadings which are as follows:

Sr. No.: Serial number of items.

Product Description: Description of Product.

Advance Amount: The amount of advance received CGST

SGST: The rate is applicable rate of SGST which is enter manually. SGST amount is also calculate automatically where Advance amount X Rate of SGST.

IGST: The rate is the applicable rate of IGST which is enter manually. The Amount is Advance amount X Rate of IGST.

Total: Below each column total of each head is done for easy calculation purpose.

5. Signature and Summary Section

Signature Section consists of remarks, Signatures of receiver and name of the signatory.

The amount in words: The grand total of Receipt Voucher.

The summary consists of the total of receipt voucher by customer.

Thus, Grand Total = Total Advance Amount + CGST + SGST + IGST.