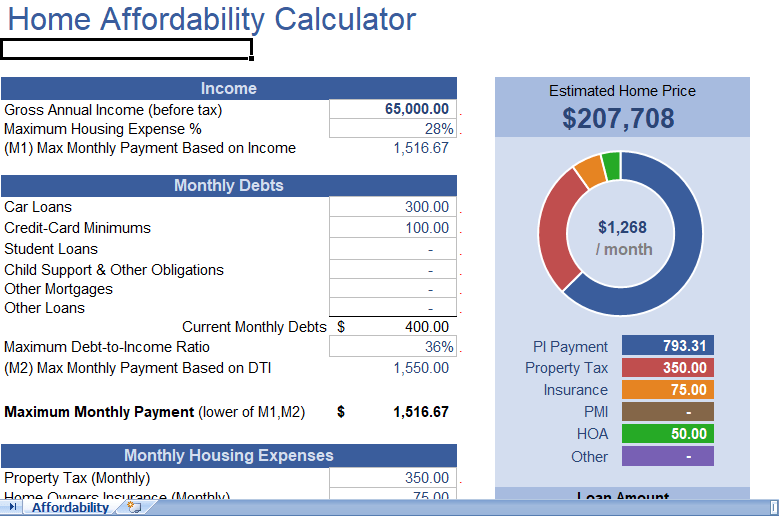

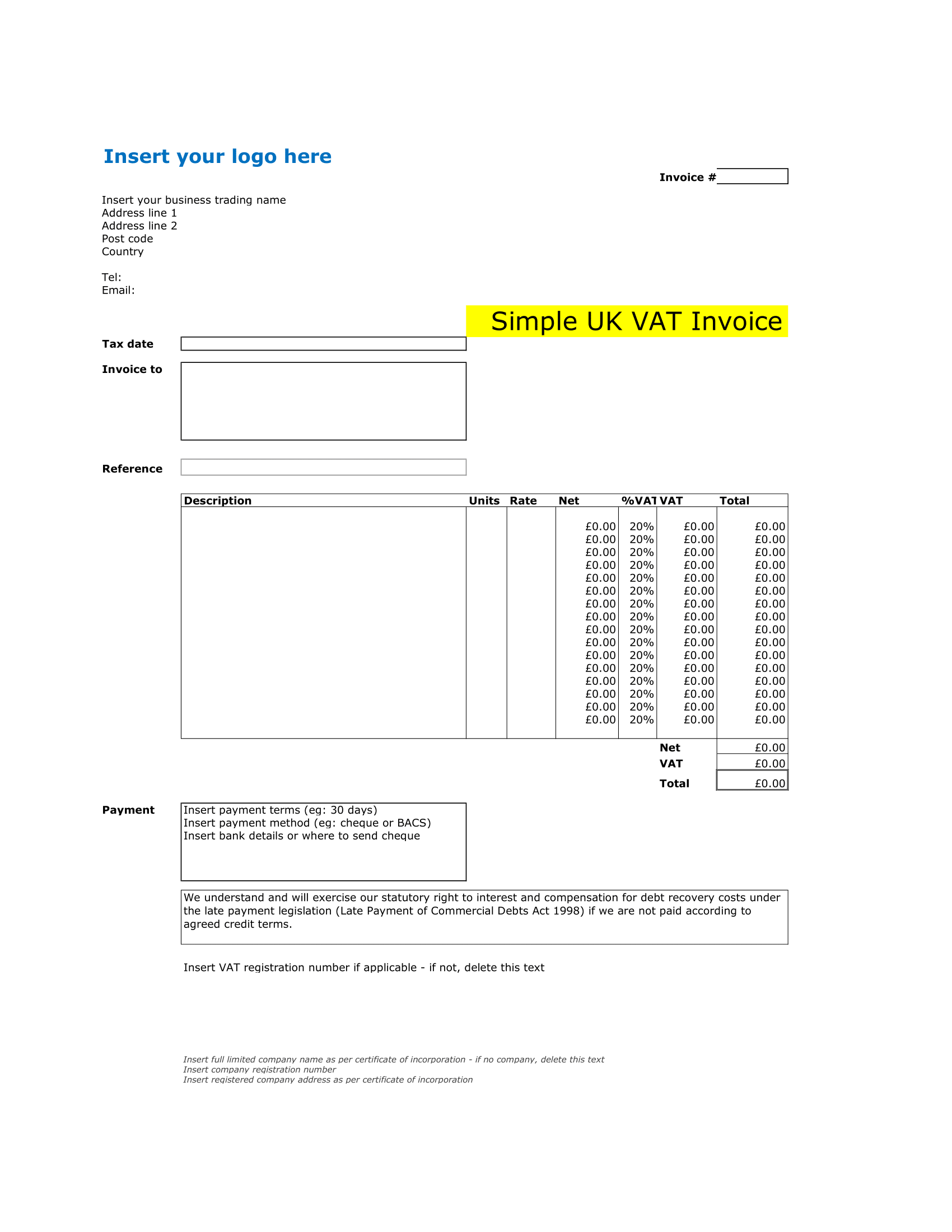

There are many factors to consider when figuring out how much for the home you can afford. Our home affordability calculator considers the following 4 common factors to estimate the mortgage you can afford:

- Housing expenditure to income ratio

- Total debt to income ratio

- Available funds

- Housing expenses

Mortgage borrowing calculator

Some of the factors may not be considered in this calculator include your other savings goals, income stability, the housing market. The best thing about this home affordability calculator is that unlike online calculators, you can actually look at the formulas to see exactly how it works.

How much of a mortgage can I afford

Buying a home is a bit complicated. Some tools like this can help you simplify and explain things, but at the end you have to consider all the different factors when making a huge financial decision. So, we’ll step through this calculator works in detail, also do more research to about the other factors involved in home buying.

Find the Minimum of the Maximums

This calculator works by finding the minimum of multiple maximum. There are various rules of thumb employed by lenders to figure out how much they will risk lending you. The spreadsheet calculates the maximum mortgage payment and number of different ways and then uses the minimum of these to determine what can be afforded (a fairly conservative approach).

Step 1: Find the Maximum Housing Expense Based Solely on Income

In the 28/36 rule, this is the “28” part. You enter your annual income (by looking at the AGI from your previous year’s tax return). The calculation of this maximum is very simple:

Step 2: Calculate the Debt-To-Income Ratio (DTI) to Find the Maximum Housing Expense

Enter all your current monthly debt obligations, such as car loan payment, minimum credit card payments, student loan payments, etc. These payments, in addition to your mortgage, cannot exceed the maximum debt-to-income ratio set by your lender.

Step 3: Find the Maximum PI Payment Based on Expenses

When talking about a “mortgage payment” we are often talking about the full PITI payment. PITI stands for Principal + Interest + Taxes + Insurance. The PI payment is just the Principal and Interest.

The expenses are then subtracted from your Maximum Monthly Housing Payment found after step 2 to calculate your Maximum PI Payment Based on Expenses. This involves subtraction, so I’m not going to list the formula.

Expense Amounts Based on Home Value

Property Taxes: Remember that home affordability calculator helps you enter the MONTHLY cost. You can enter a formula like =3000/12 if you don’t want to use some other calculator to divide the annual property tax by 12.

Step 4: Find the Maximum PI Payment Based on Available Funds

This is something I haven’t seen in many online calculators do, but it is important. You will need funds on hand to pay both the down payment and closing the costs. So, one of the limiting factors will be available funds.

Closing Costs: This calculator estimates closing costs as a percentage of the home value. You might pay between 2% and 5% of the home value, but some more if you are “paying points.” However, you may have some closing costs that are fixed amounts, so you have option to enter fixed closing costs as well. The total closing costs will be the fixed amounts PLUS the variable costs.

Down Payment: The down payment is usually one of the main limiting factors in home affordability. You’ll need at least 20% down payment to avoid paying PMI, but you may have a situation where it is okay to make a lower down payment. So, this spreadsheet allows you to adjust the minimum percentage.

Step 5: The Rest of the Story

Knowing the Maximum PI Payment is the key to this calculator. You can adjust the term and rate in financing section. From that we calculate the loan amount, then the down payment and closing costs, and finally the Maximum Home Price. The results are then displayed in a nice graph. There is also a Depreciation section.