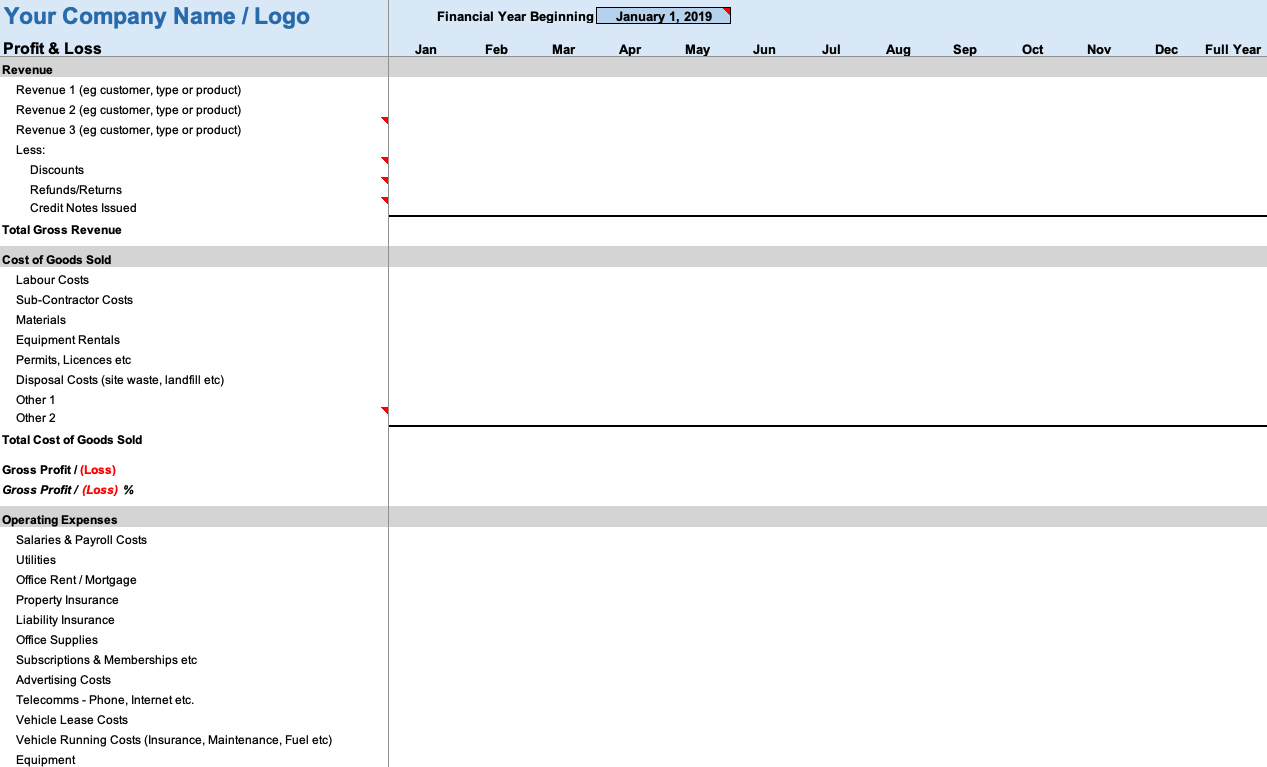

Working as an independent contractor Profit and Loss Statement, I’ve used variety of accounting solutions to manage my business income and expenses. More recently, I prefer ease and accessibility of an online solution. But, during initial stages of all my ventures, I usually began the process with a simple Excel spreadsheet.

Profit and Loss Account

I have a couple of goals in writing the article. One is to give you some information regarding business Profit and Loss Statement. Hence, The other goal, using your knowledge of an Income Statement. It is to help you evaluate downloadable Independent Contractor Profit and Loss Statement template will help you as an independent contractor.

Economic Profit

As small business owner, there are a couple of advantages to using an Excel template that you should consider: simplicity and inexpensiveness. Assuming you have a basic understanding of Excel, it’s very easy to enter the data into a spreadsheet. The rows and columns are on the screen in one window. You simply scroll to location where you need to enter the data.

Profit and Loss Account Format

Now, you also need to realize that Excel isn’t the end-all solution. There are a couple of disadvantages of using Excel: limited export options and no accounting system integration. Hence, The spreadsheet is a “flat” file versus a “relational” database. The result of this single-file approach is that the spreadsheet data can only be exported. Through copy/paste functions or as a printout.

Also, going with a simple accounting spreadsheet will hinder any potential for that data to be integrated with accounting systems. Hence, The spreadsheet will give you gross income and net income summary that can manually carry over to other accounting software. He won’t be able to automatically export to another system without a series of steps to get there.

Before we dive into details of this template, let’s make sure we’re on same page and cover a few accounting basics.

Accounting Basics

In helping you understand some basic accounting principles, let’s briefly review two main accounting reports: Balance Sheet and Income Statement.

Balance Sheet

The Balance Sheet “provides detail information about a company’s assets, liabilities, and net worth. A Balance Sheet represents a business’s point-in-time snapshot of the relationship between assets, liabilities, and net worth.

You might also see “net worth” replaced with “shareholders equity.” It’s same concept but the name varies based on whether the business has shareholders or owners.

The relationship between balance sheet elements is represented by common accounting formula below:

Assets: “Things that a company owns that have value.” (*1)

Liabilities: “Amounts of money that a company owes to others.” (*1)

Net Worth: “Money that would be left if a company sold all of its assets and paid off all of its liabilities.”

Income Statement

The Income Statement (also called Profit and Loss Statement) is a “report that shows how much revenue a company earned over a specific time period…[it] also shows the costs and expenses associated with earning that revenue (U.S. Securities and Exchange Commission).” The bottom line for this statement is business’s net income or net loss and can display with the following formula:

The definition of Income Statement elements is intuitive. But, as we start to look at the Independent Contractor Profit And Loss Statement template. Moreover, You’ll see that income section also has some items that count against the net income we’ll cover that later in this article.

So, you now have basic comparison between a spreadsheet and packaged accounting software plus an understanding of basic accounting reports and terminology. Let’s move into specifics of this spreadsheet. To see if the downloadable Independent Contractor Profit And Loss Statement template will work well for you.

Note: I’m not an accounting or tax professional. My knowledge comes from over 20 years of self-employment and running my own corporation, a Bachelor’s degree in Business. Also, My experience is practical but not infallible and information in this article should not be taken as professional accounting or tax advice. I recommend that you use any knowledge you gain from this article as a starting point for your own research.

Quick Overview

The single worksheet in this template (called “Independent Contractor P&L”) has the typical Profit And Loss sections (Income and Expenses).