Introduction: Streamlining Insurance Quotations

An insurance quote is a vital document in the insurance industry, serving as a preliminary estimate of premiums for potential clients. It’s the first step in helping clients understand the cost and coverage details of an insurance policy. Crafting a clear and detailed insurance quote is crucial for transparency and building trust. Our guide on the Insurance Quote Format will aid you in creating quotes that are both informative and user-friendly, facilitating a smoother decision-making process for clients.

Key Elements of an Insurance Quote Format

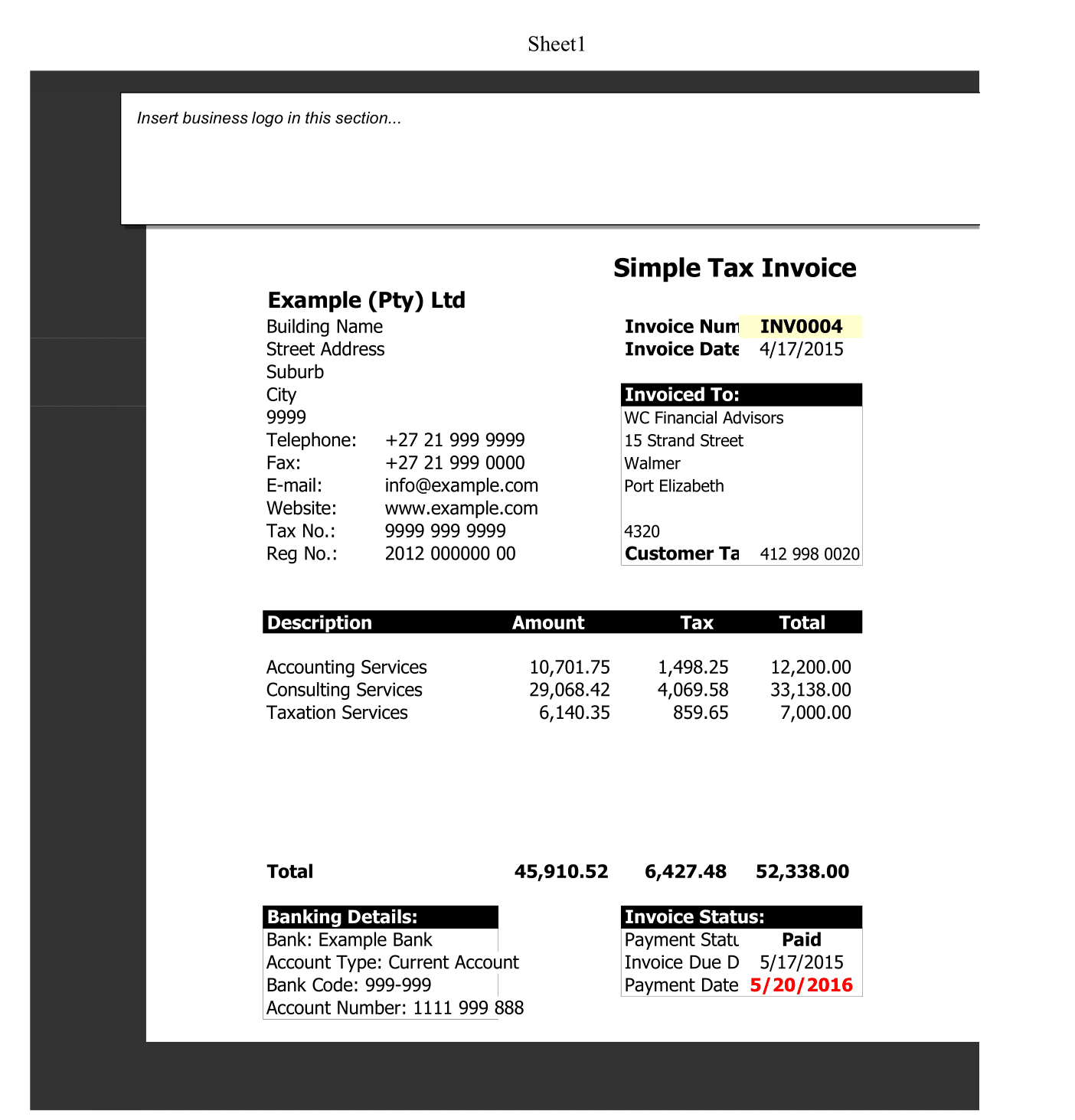

An effective insurance quote should include these essential elements:

- Header: The name, logo, and contact details of your insurance agency, with a clear indication that the document is an “Insurance Quote.”

- Client Details: The name and contact information of the individual or entity receiving the quote.

- Quote Number: A unique identifier for each quote for record-keeping and reference.

- Coverage Details: Detailed information about the coverage offered, including policy limits, deductibles, and any exclusions.

- Premium Breakdown: A clear breakdown of the premium costs, including frequency of payment (monthly, quarterly, annually).

- Total Premium: The total cost of the insurance premium for the policy period.

- Terms and Conditions: Information about the quote’s validity, underwriting requirements, and any other relevant terms.

- Disclaimer: A statement clarifying that the quote is an estimate and subject to change based on further underwriting.

- Signature and Date: Space for an authorized signature from your agency, adding authenticity to the quote.

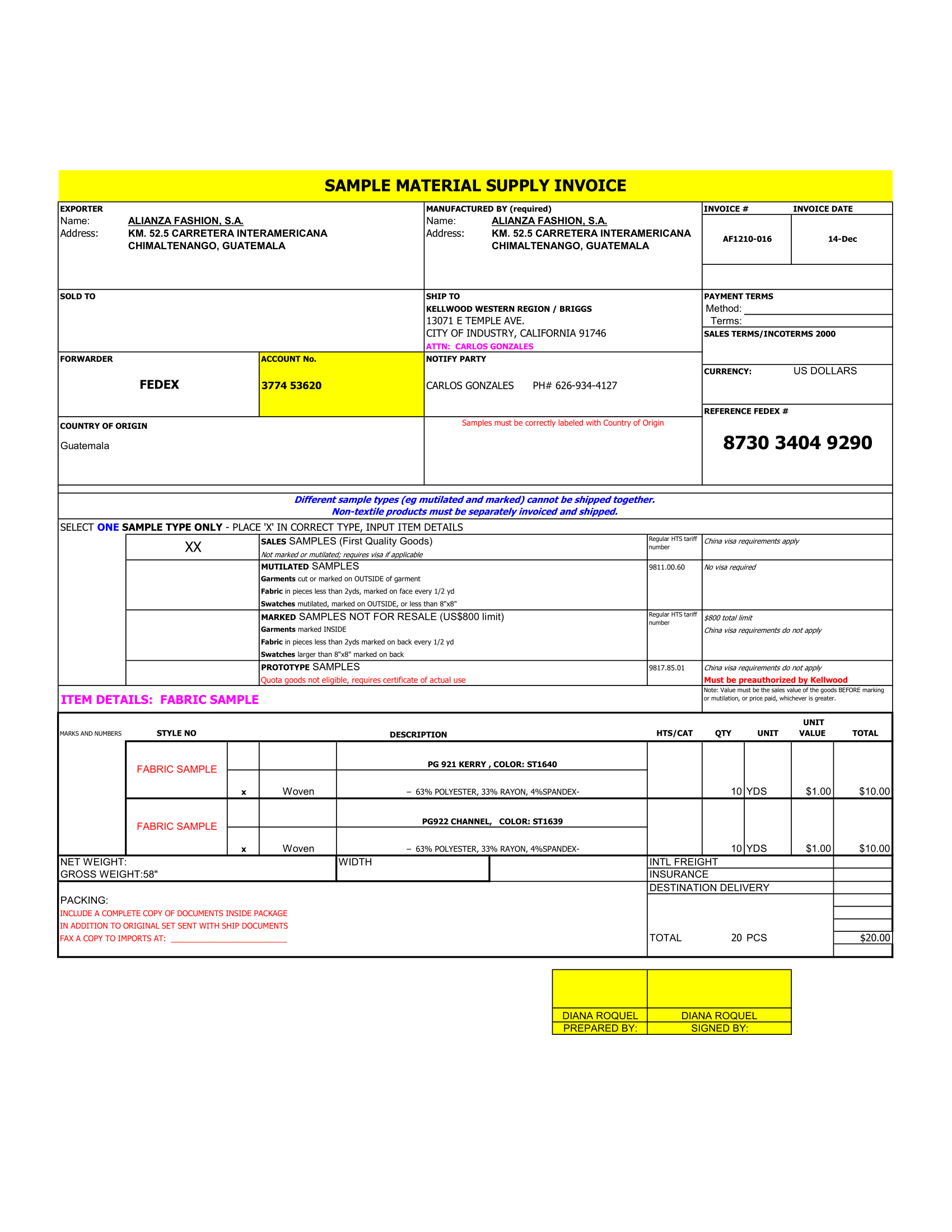

Creating an Insurance Quote with Our Template

Our Free Insurance Quote Template in Excel is designed to simplify the process of creating accurate and professional insurance quotes. It features an easy-to-use format for inputting coverage and premium details, with automatic calculation of total premiums. The template also includes customizable sections for your agency’s branding, terms and conditions, and signature space. This template is a valuable tool for insurance professionals, aiming to enhance efficiency and clarity in their client interactions.