A loan monitor is an essential part of the credit risk management process for banking and credit. This free template provides the knowledge and basis for developing loan monitoring skills that are necessary to detect potential loan losses before they become unrecoverable.

For the loan monitoring process, core knowledge is acquired to help the bank executive, business and person to advance in commercial and corporate lending. So, the advanced understanding is necessary for the skills in identifying business loan problems before they become a reality.

Many business owners needed financing will automatically think for loan monitoring. So, the relationship between banks and small businesses has been enhanced as more and more banks realize the power and importance of this growing market. Similarly, corporations and real estate developers are looking to monitor the loans.

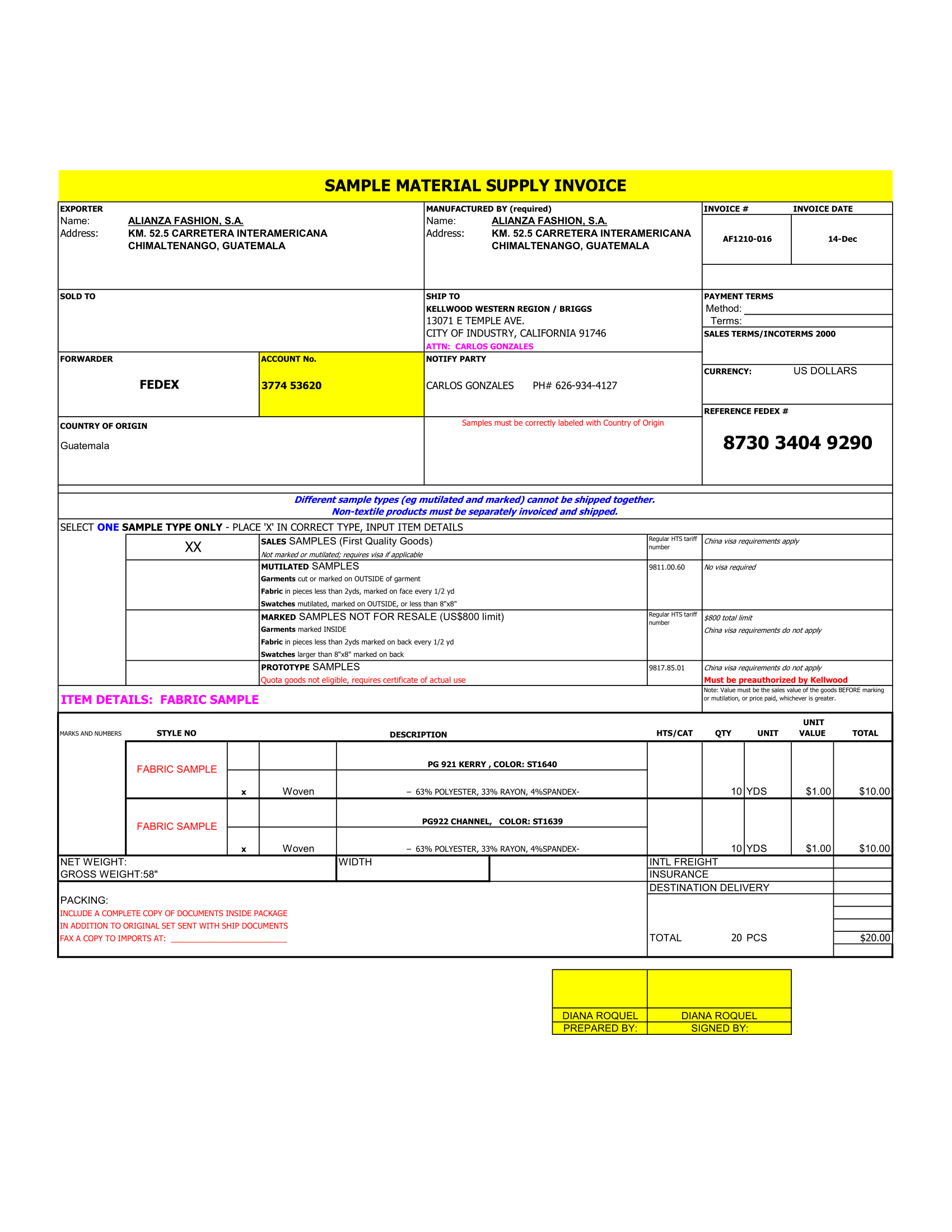

Many banks have added special services for small businesses. Others are simplifying their loan paperwork and approval method to get the monitoring process faster.

How to Use Loan Monitor in EXECL

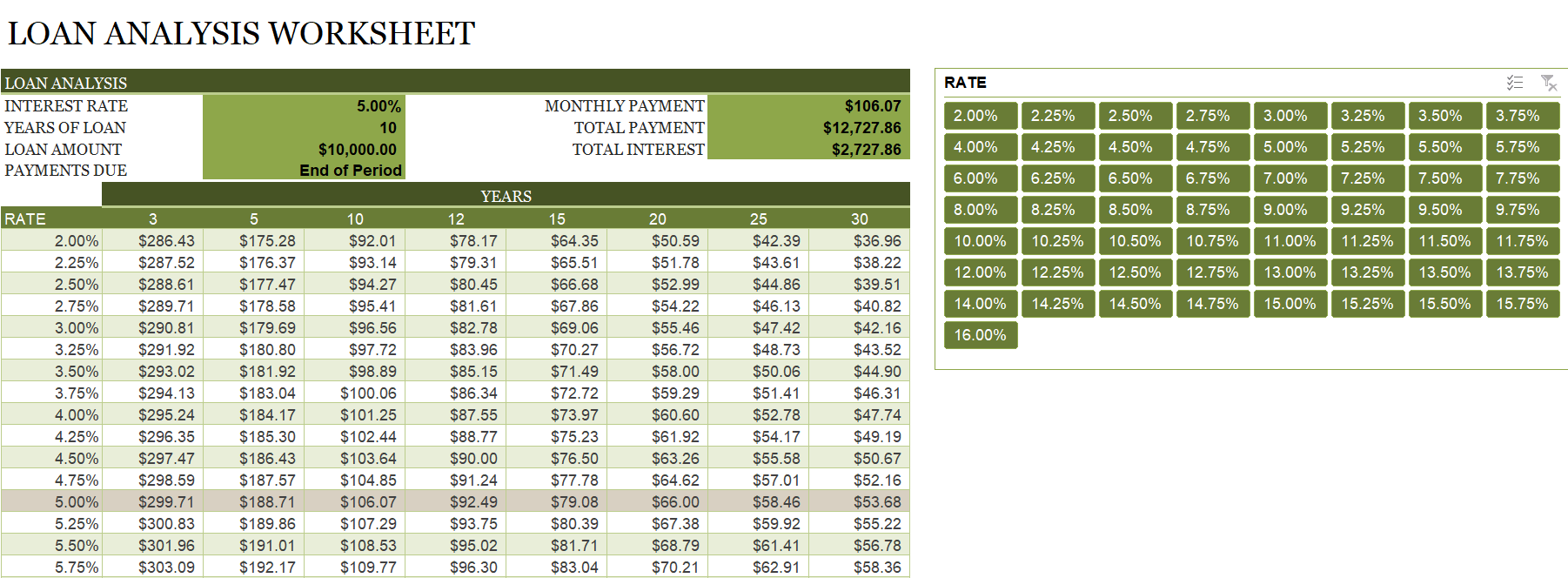

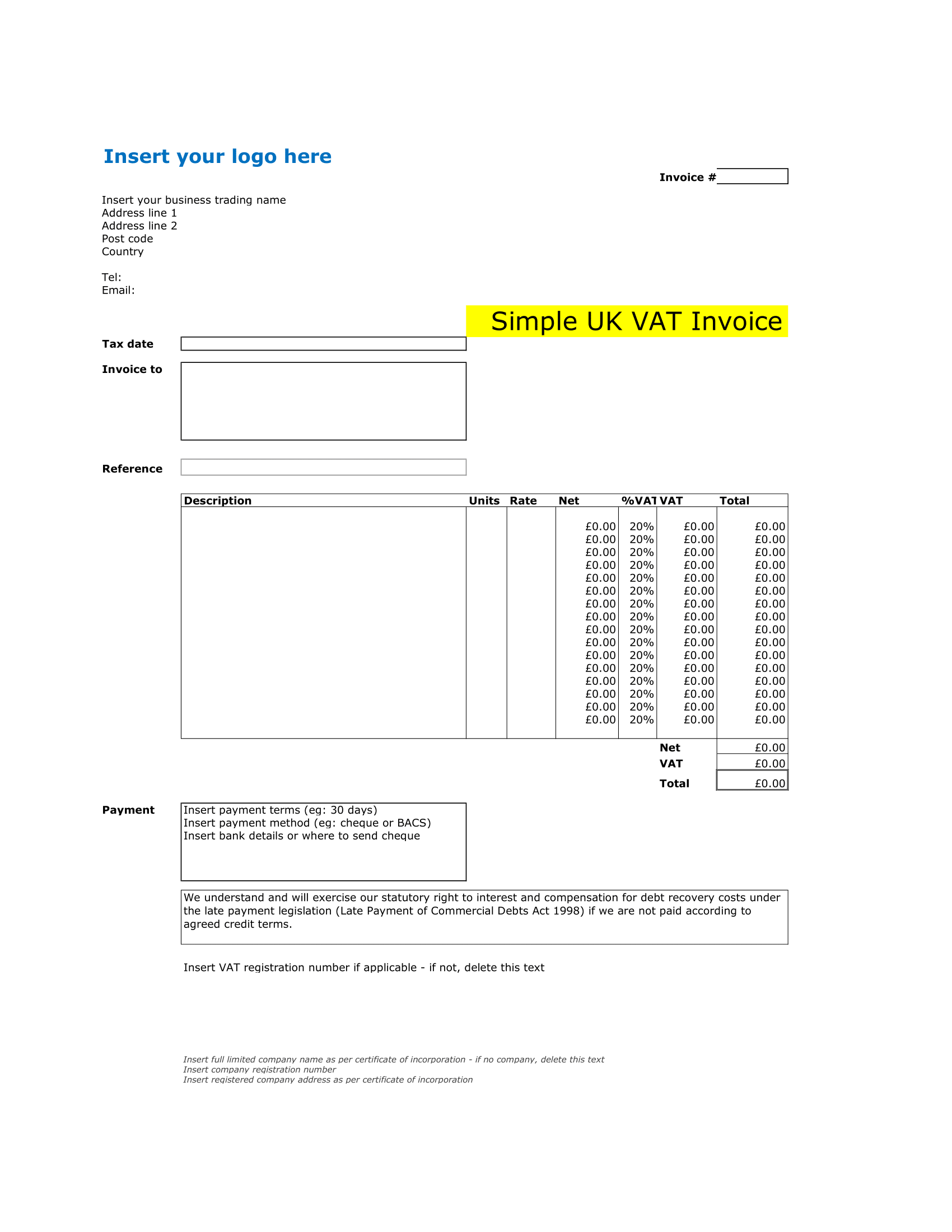

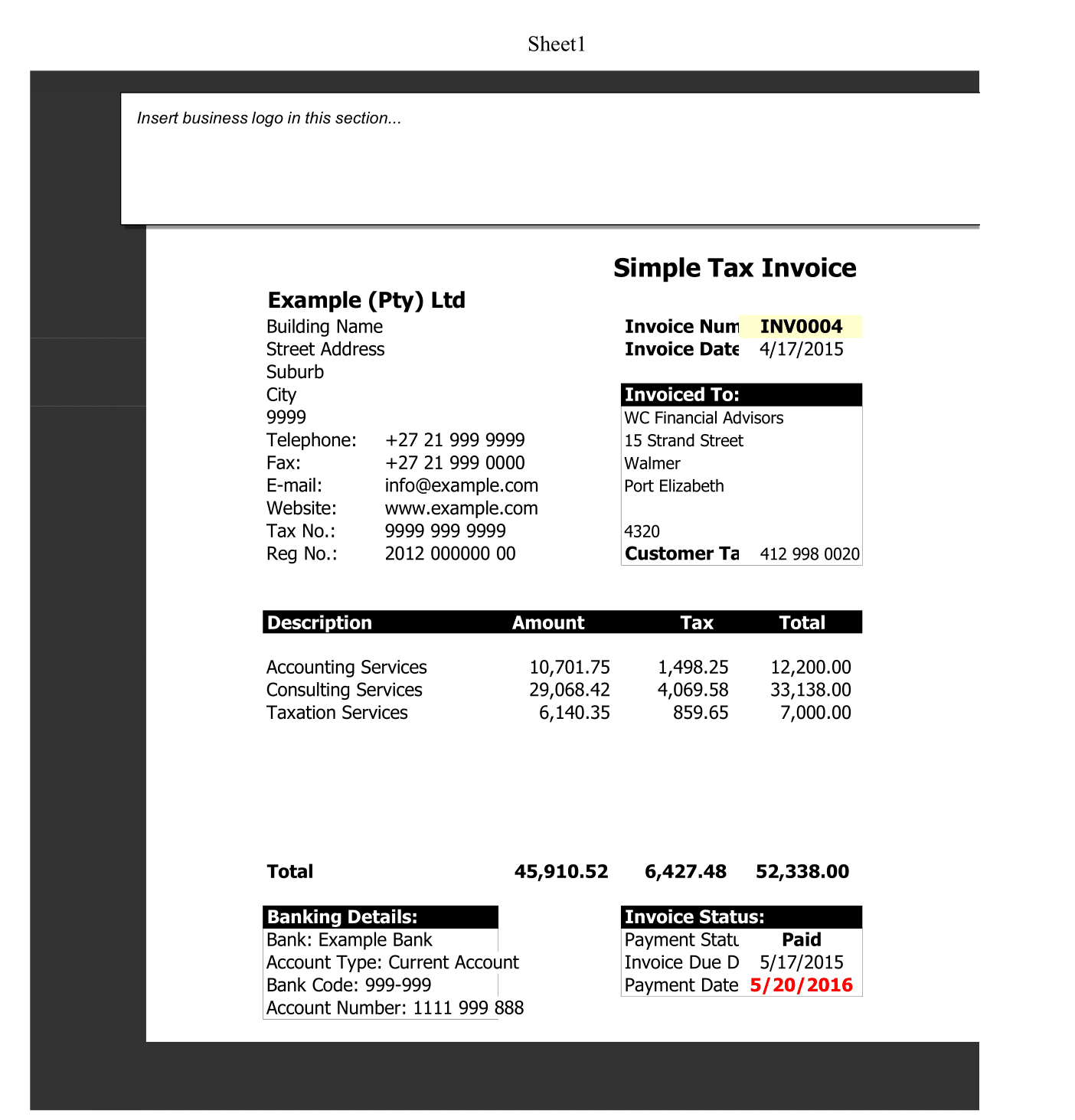

This Loan Monitor Worksheet Template is specially designed to calculate loans, with functions and formulas built-in within the sheet.

Loan Monitor Template in Excel features a complete table of the loan rates over the years for various terms of mortgages and instalment loans. This sheet also provides a table of comparisons for the contract terms.

A table with a given set of rates and the years covered in specific terms depending on the loan. This data are automatically updated as soon as you enter the necessary data required on the top part of the sheet.

The Loan statistics include

- Interest Rate

- Years of Loan

- Loan Amount

- Payments Due

- Monthly Payment

- Total Payment and Total Interest.

So, if you are planning to apply for a loan or already have one. This sheet is helpful and free in allowing you to see the bigger picture of your financial decision. Provides a good idea of how long it would take for you to pay off the loan and how much you need to pay monthly.

Use of this Worksheet

Using the loan monitor is very easy.

Yet, you should only change the loan details like-

Annual interest rate

Loan period in years

Start date of the loan

This is the easiest calculator where you can alter the payment periods. Using a monitor saves you time from doing calculations. Plus, you’re less likely to get errors.

Importance of Loan Monitor

It will produce some major results, which helps you to analyze your financial requirements before beginning to buy a home. Because it is not possible to calculate the processing fees or any other charges associated with the loan on your own.

This monitor can surely ease your tension and also help you in selecting the best personal loan providers in India. It includes a lot of paperwork involved in getting auto loans; therefore, it is advisable to check the references cautiously before signing up for any personal loan. Moreover, use this free worksheet to simplify your paperwork.

The personal loan monitor helps you in calculating your Equated Monthly Installment (EMI) on the loan amount and interest rate. Similarly, to calculate the loan amount from the personal finance calculator, you have to enter the amount, the interest rate, monthly payment and loan amount. And in last The Total Payment and Interest.