Streamline Your Payroll Process with Our Salary Computation Excel Template

Running payroll is an essential task for every business, but it can be a complex process, especially when you have to consider factors like gross salary, deductions, income tax, and net salary. Our free, editable Salary Computation Excel Template is designed to simplify this process, enabling you to accurately compute employee salaries and create salary slips with ease. Download our template now and revolutionize your payroll management process.

Overview of the Salary Computation Excel Template

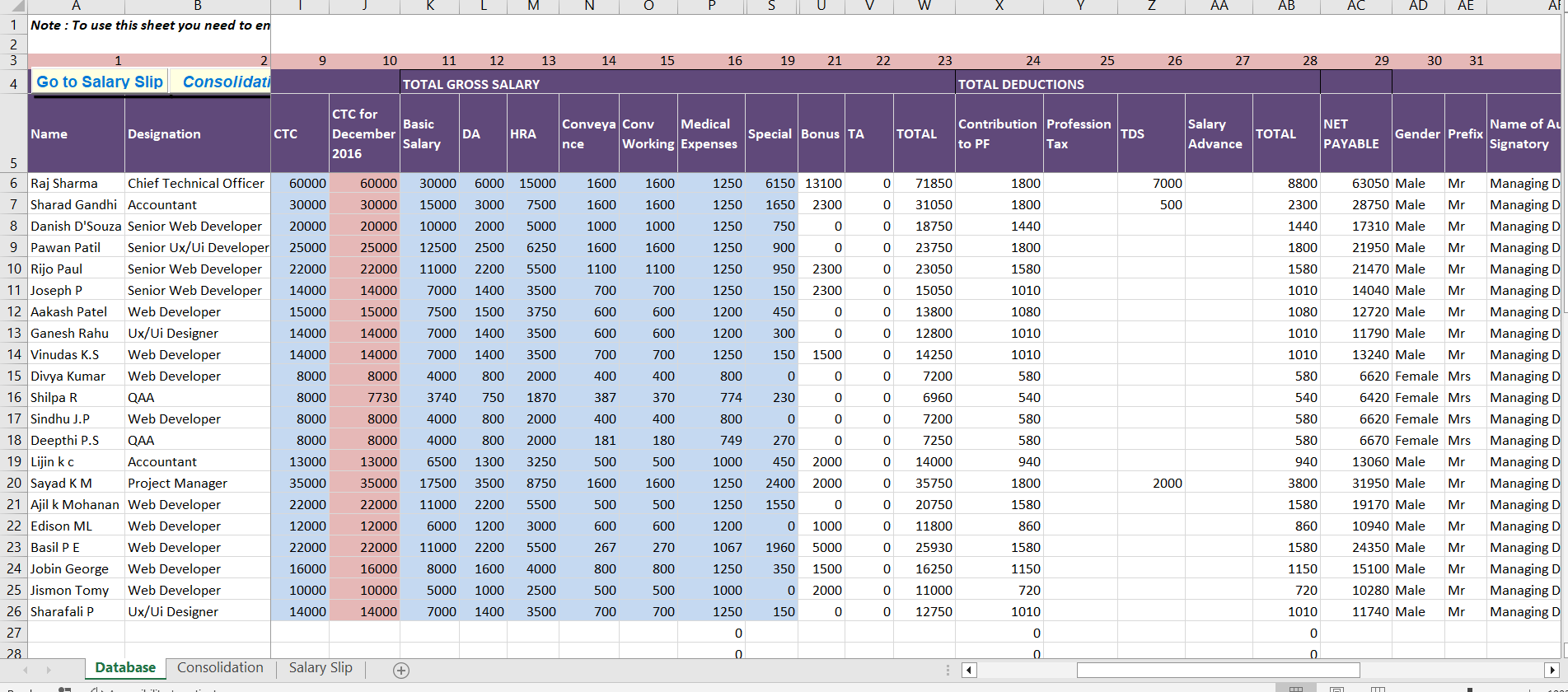

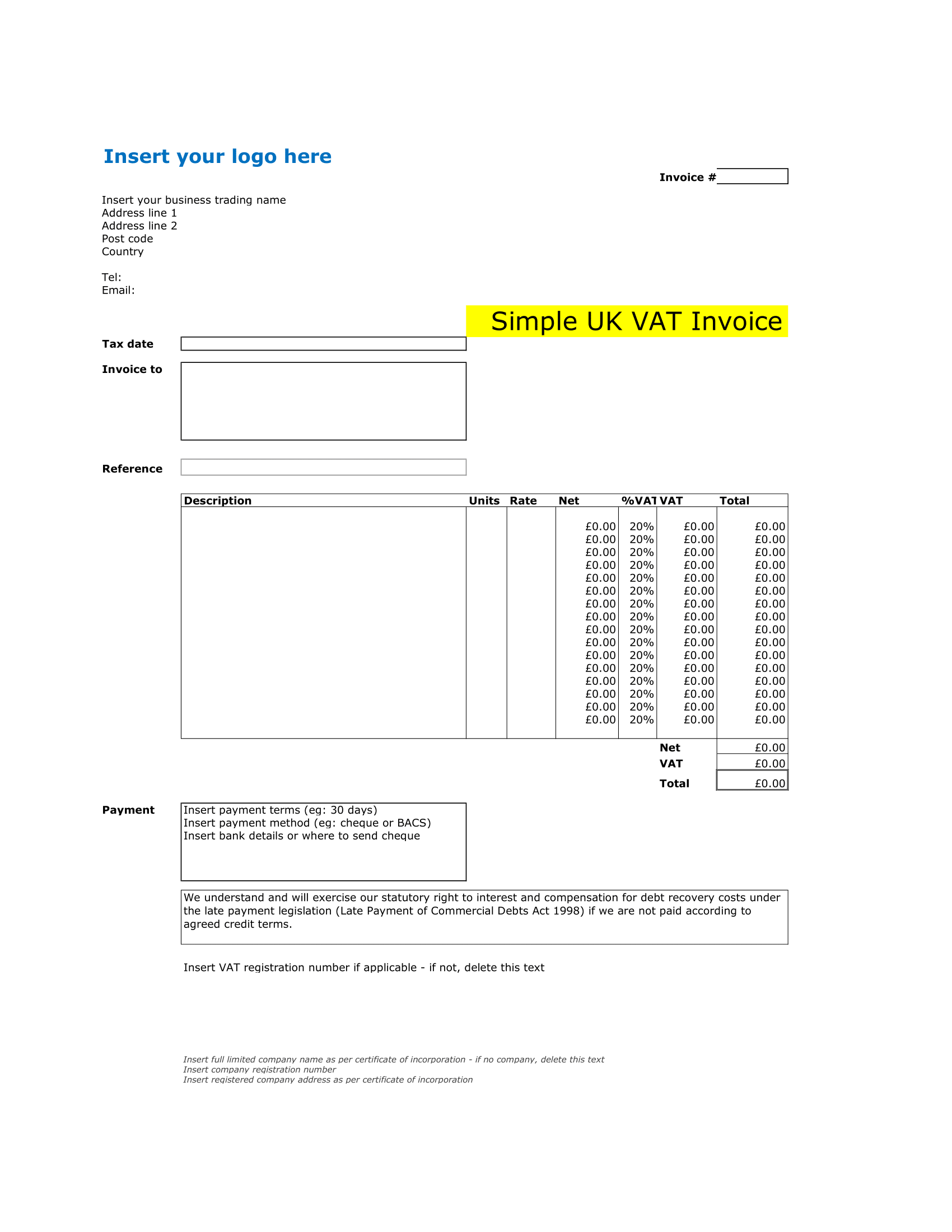

Our Salary Computation Excel Template is a comprehensive tool that takes the guesswork out of payroll management. The template includes several key components, enabling you to calculate:

- Gross Salary: This is the total income earned by an employee before any deductions are made.

- Deductions: These could include mandatory contributions, such as social security and health insurance, as well as any other deductions agreed upon by the employer and employee.

- Income Tax: The template includes a section for calculating income tax based on the current tax regulations in your location.

- Net Salary: This is the final amount paid to the employee after all deductions, including income tax, have been subtracted from the gross salary.

In addition to these features, the template also includes a sheet for creating a salary slip, providing a complete payroll solution in a single, easy-to-use tool.

How to Use the Salary Computation Excel Template

Using our Salary Computation Excel Template is straightforward. Here’s a simple guide to help you get started:

1. Enter Employee Details

Start by entering the employee’s details, such as their name, ID, department, and designation. This information is essential for personalizing the salary computation and the salary slip.

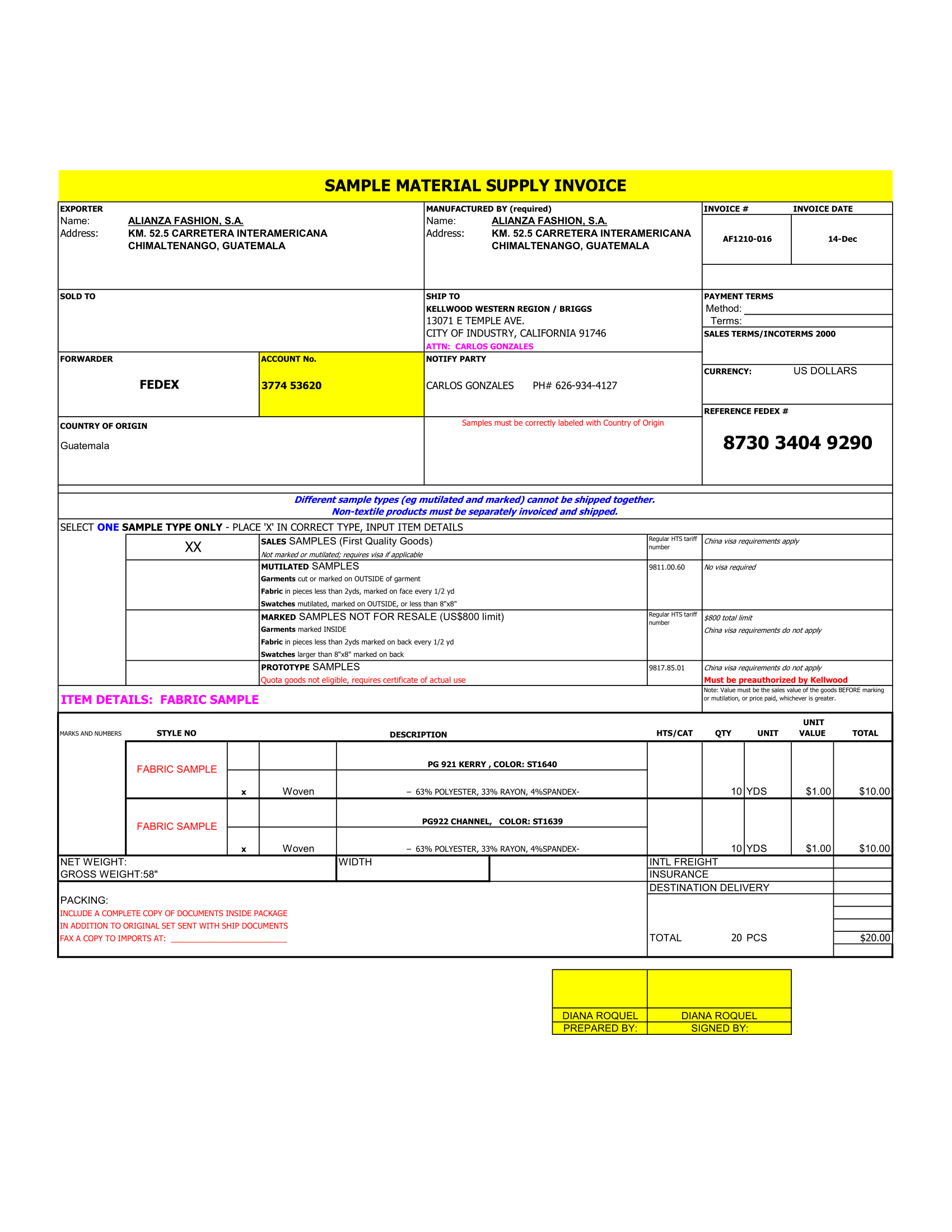

2. Input Gross Salary and Deductions

Next, input the employee’s gross salary and any deductions. The deductions could include items like pension contributions, health insurance premiums, or any other agreed-upon deductions.

3. Compute Income Tax

Use the income tax computation section to calculate the employee’s tax based on their gross salary and any tax-free allowances or deductions they’re entitled to. This calculation will depend on the tax regulations in your location.

4. Calculate Net Salary

Once all the deductions and income tax have been subtracted from the gross salary, the template will automatically compute the net salary – the final amount payable to the employee.

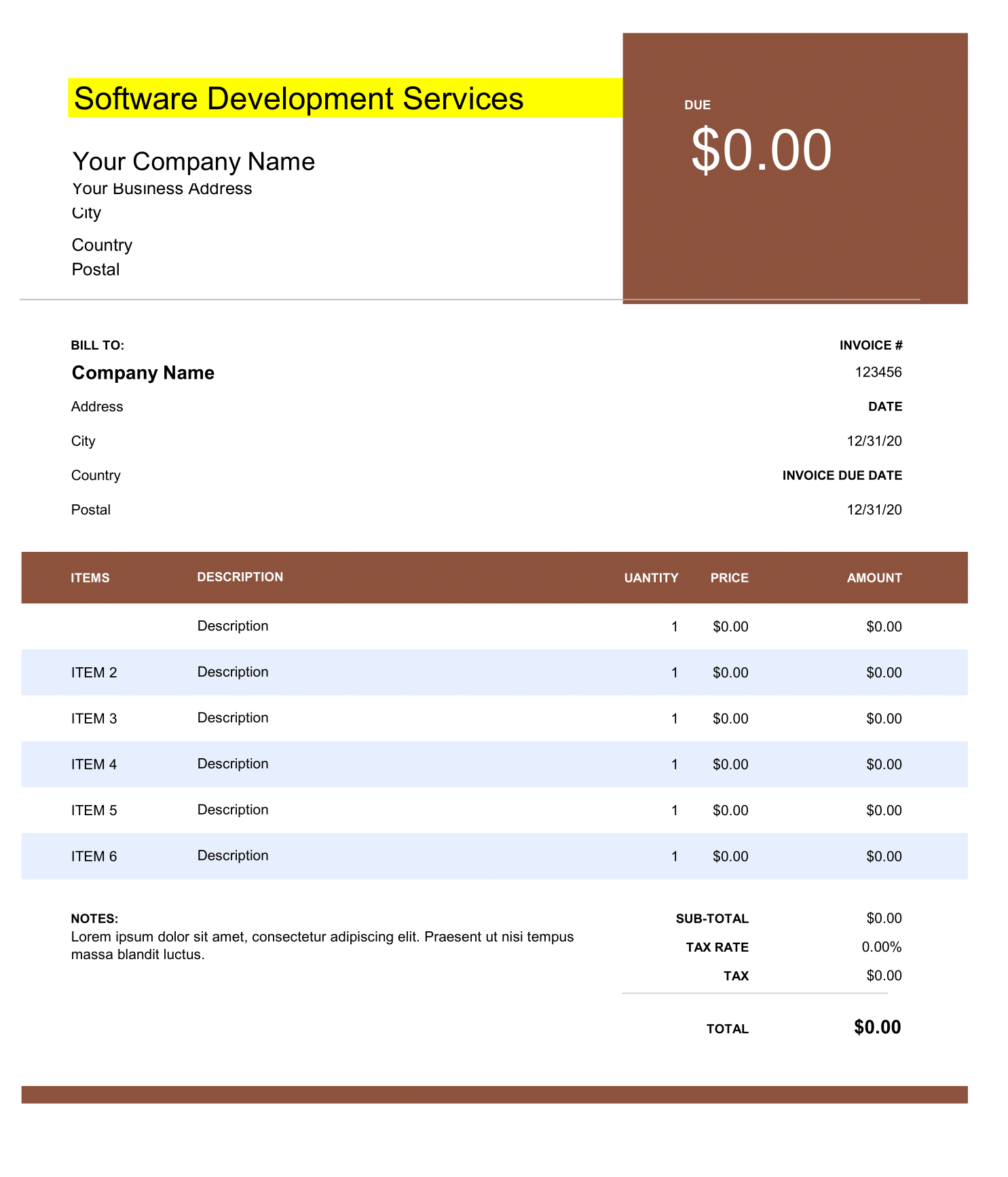

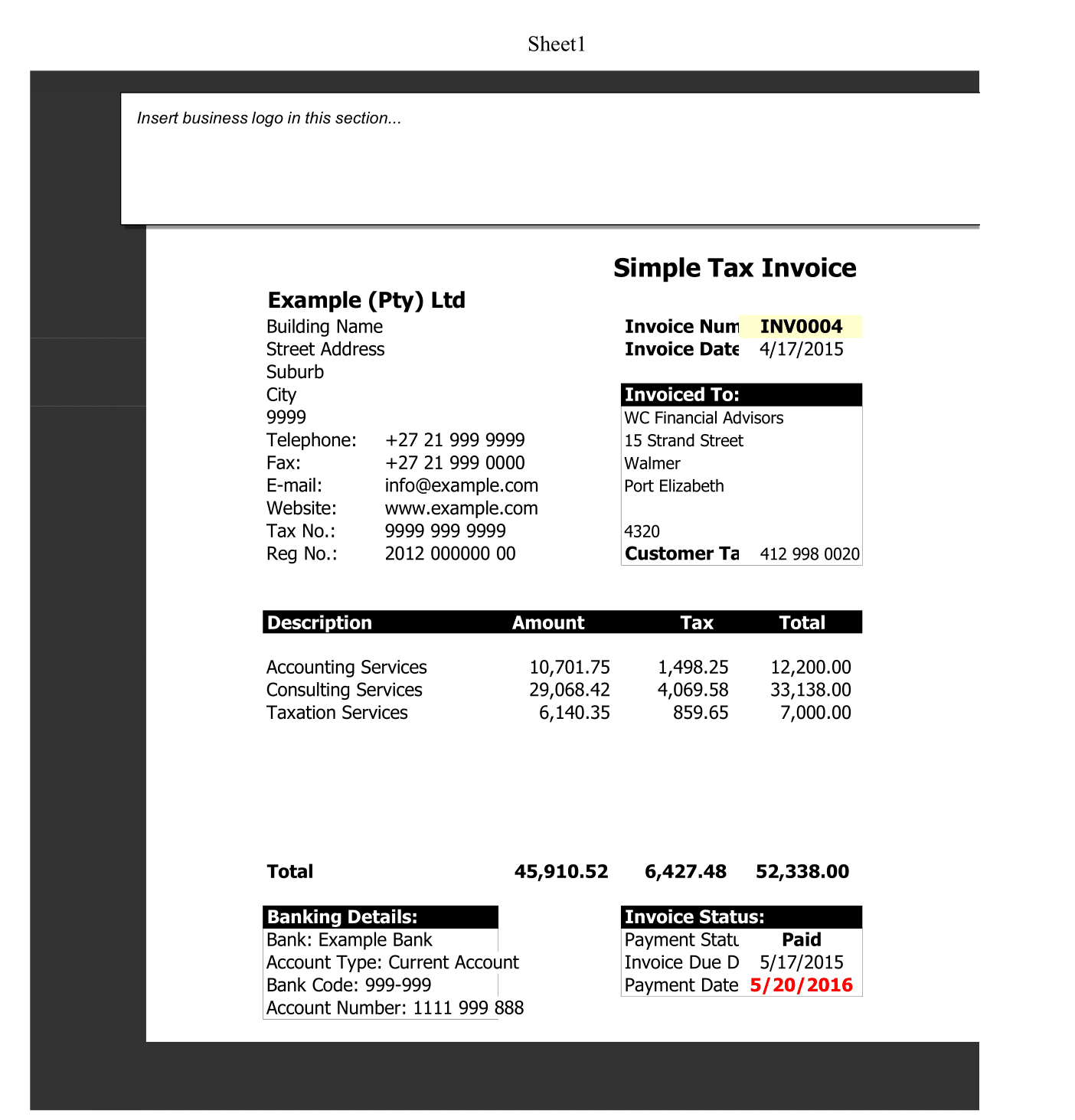

5. Generate Salary Slip

Use the salary slip sheet to generate a detailed salary slip for the employee. This slip will include a breakdown of the gross salary, deductions, income tax, and net salary, ensuring transparency and accuracy.

Benefits of Using the Salary Computation Excel Template

Our Salary Computation Excel Template provides several advantages for your payroll management:

1. Accuracy: The template reduces the risk of errors in your payroll process by automatically calculating deductions, income tax, and net salary based on the data you input.

2. Efficiency: With a standardized format, you can quickly compute salaries for all your employees, saving you time and effort.

3. Transparency: The template provides a detailed breakdown of all salary components, promoting transparency and trust between you and your employees.

4. Customizable: You can easily modify the template to suit your specific payroll needs, ensuring that all relevant salary components are captured.

Conclusion

Efficient and accurate payroll management is essential for any business. Our free Salary Computation Excel Template simplifies this process by providing a comprehensive, easy-to-use solution for calculating employee salaries and generating salary slips. Download the template now and take the first step towards a more streamlined payroll process.