In business, there are three different common business classification you can find. They are service, merchandising and manufacturing businesses. Thus, In financial and accounting terms, it leads to different method on how to record and report its transaction.

Service Accounting

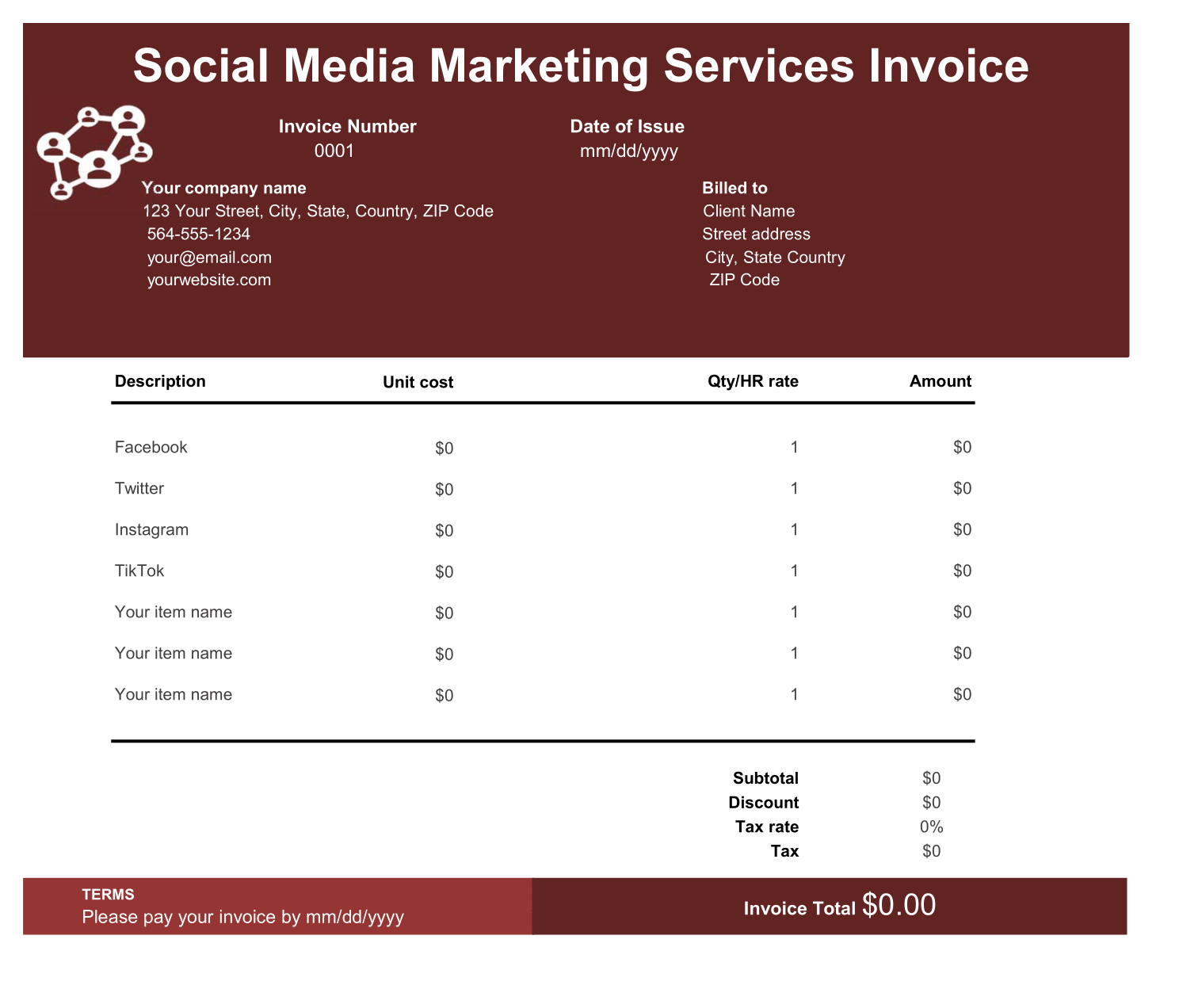

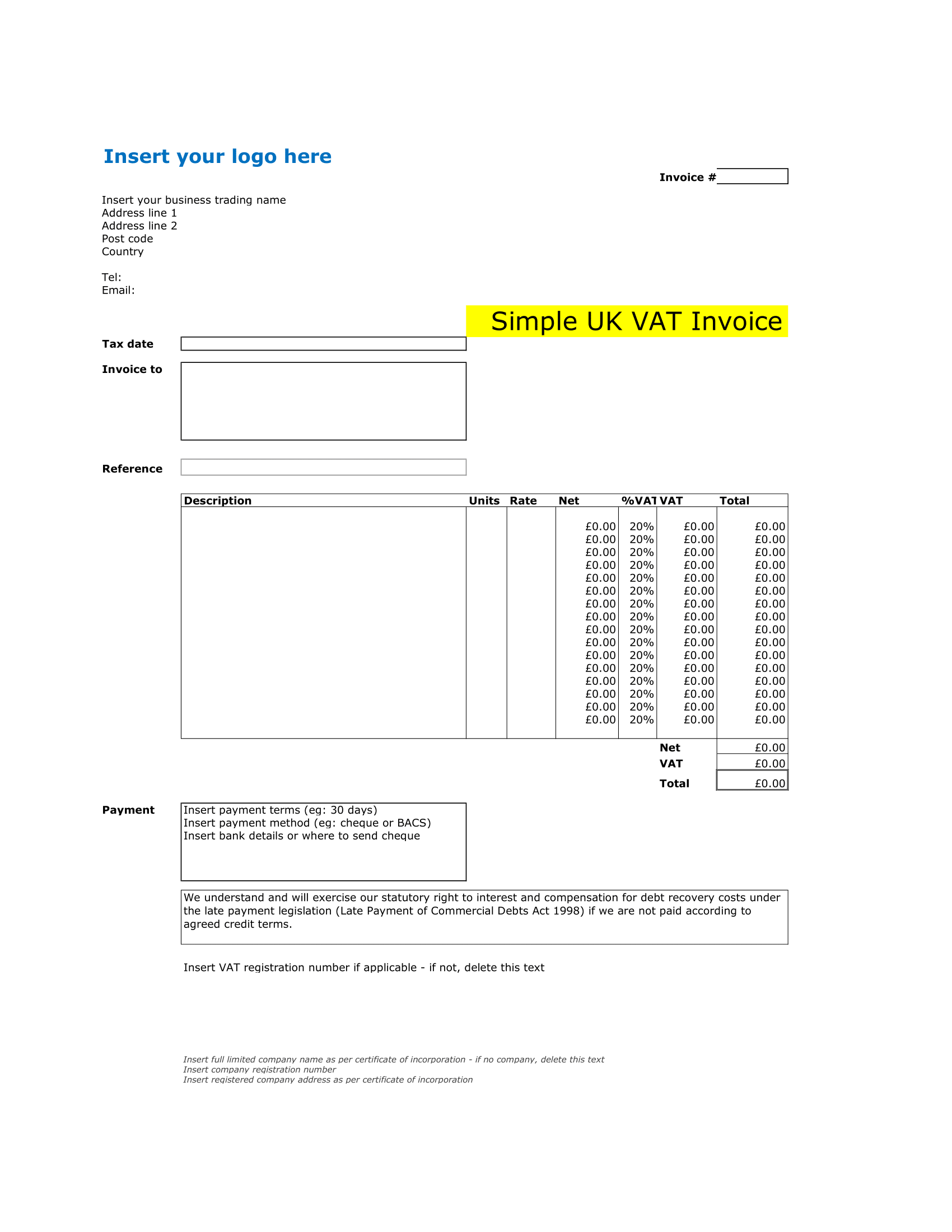

Moreover, Service business accounting is a business that provide intangible products. So, It doesn’t have any physical stocks/inventories. Hence, Consultant, law firms, cleaning services companies fall to this category. They provide services where they needed to complete at the agreed time.

Book Keeping

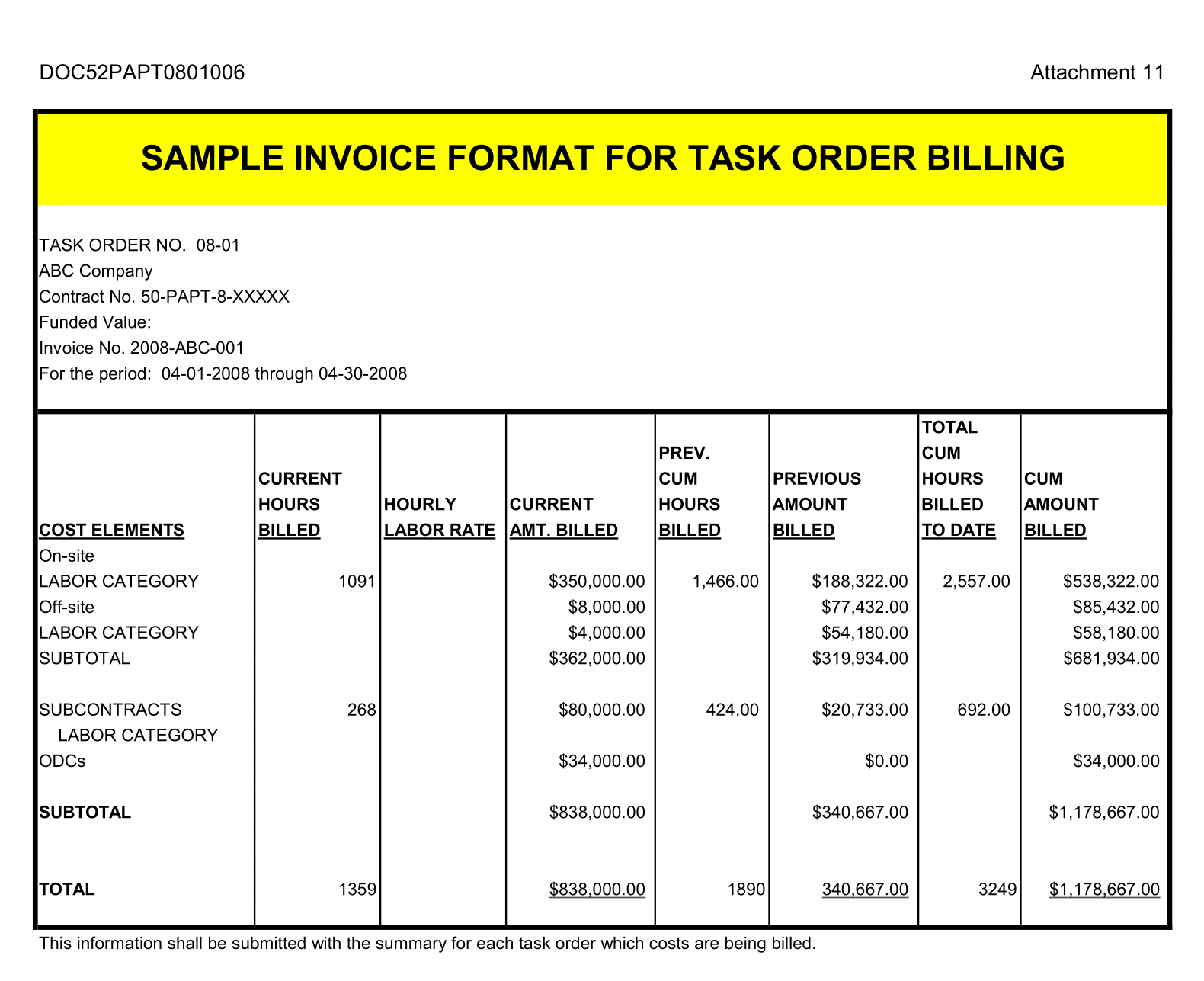

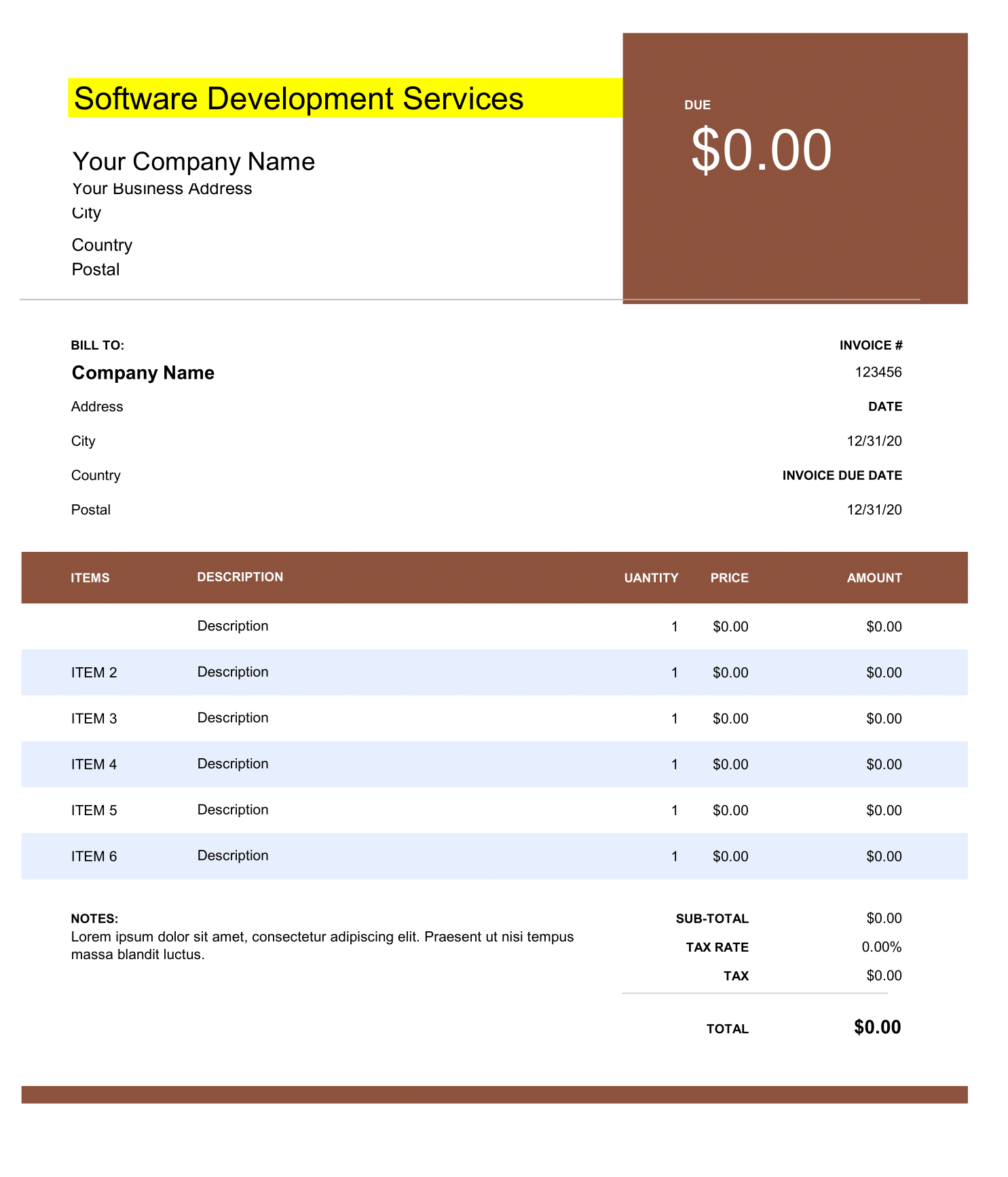

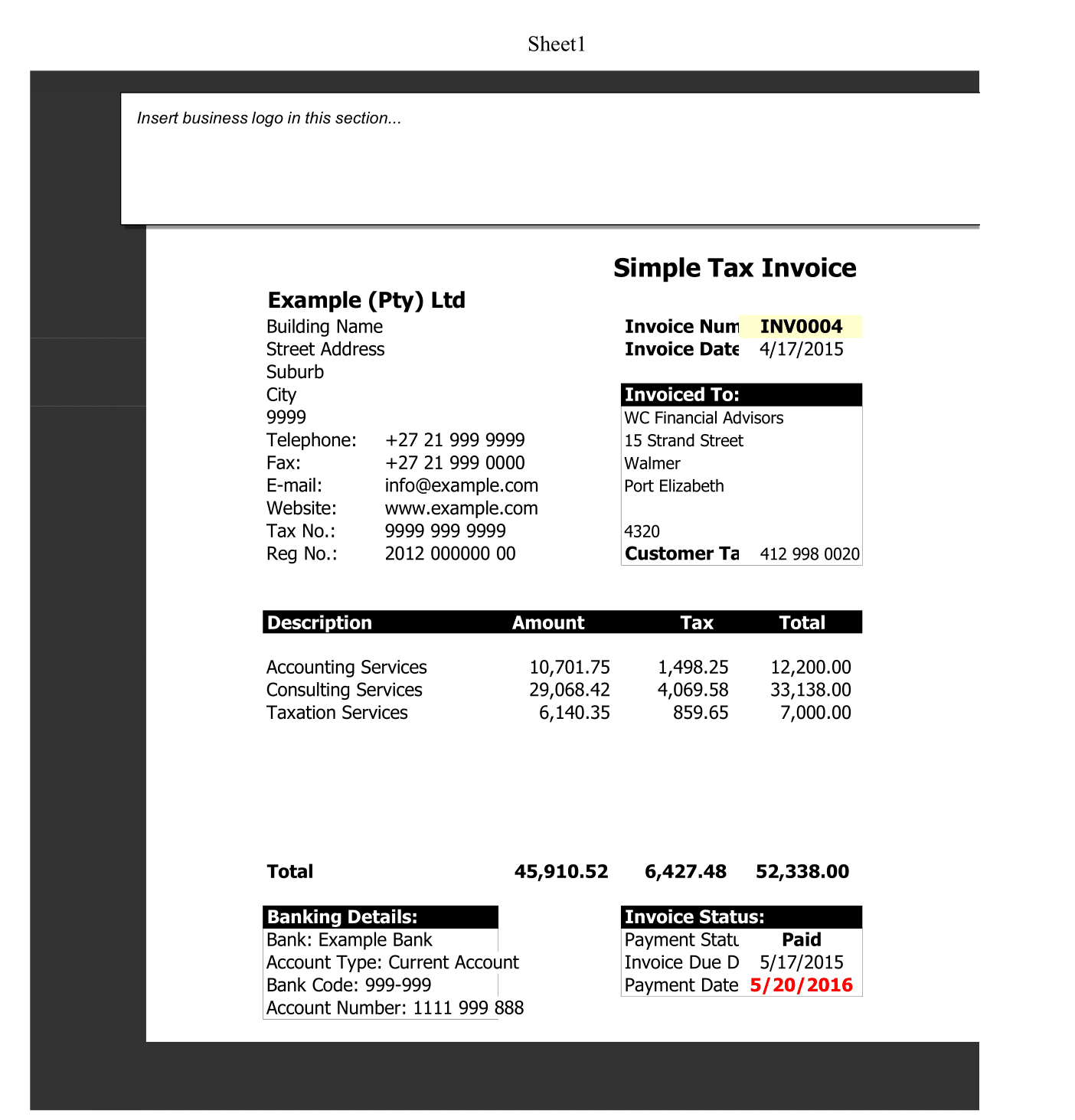

Service Business Accounting Templates will help you to record your transaction in Accounting way. Why accounting way, because it applies Double-Entry bookkeeping method where any recorded transactions in each journals must have the pairs in Debit and Credit columns. In accounting terms, debit and credit terms have different meaning with debit and credit in bank accounts. To use this spreadsheet, you need basic knowledge of accounting.

This accounting system for service company spreadsheet suit any type of businesses that don’t require CoGS as part of expenses calculation. Typically, a service company :

- doesn’t have physical product form. As for examples, consultant provides advises while singer provides good voices.

- has no standard prices so they are decided by quality, good and famous singer will be more expensive than unknown singer.

- doesn’t require warehouse or physical place to put stocks. Value is usually more on their talents.

Based on above accounting firm, here are some businesses that can be classified as service companies

- Architect and Management Consulting Firm

- Lawyer

- Saloon

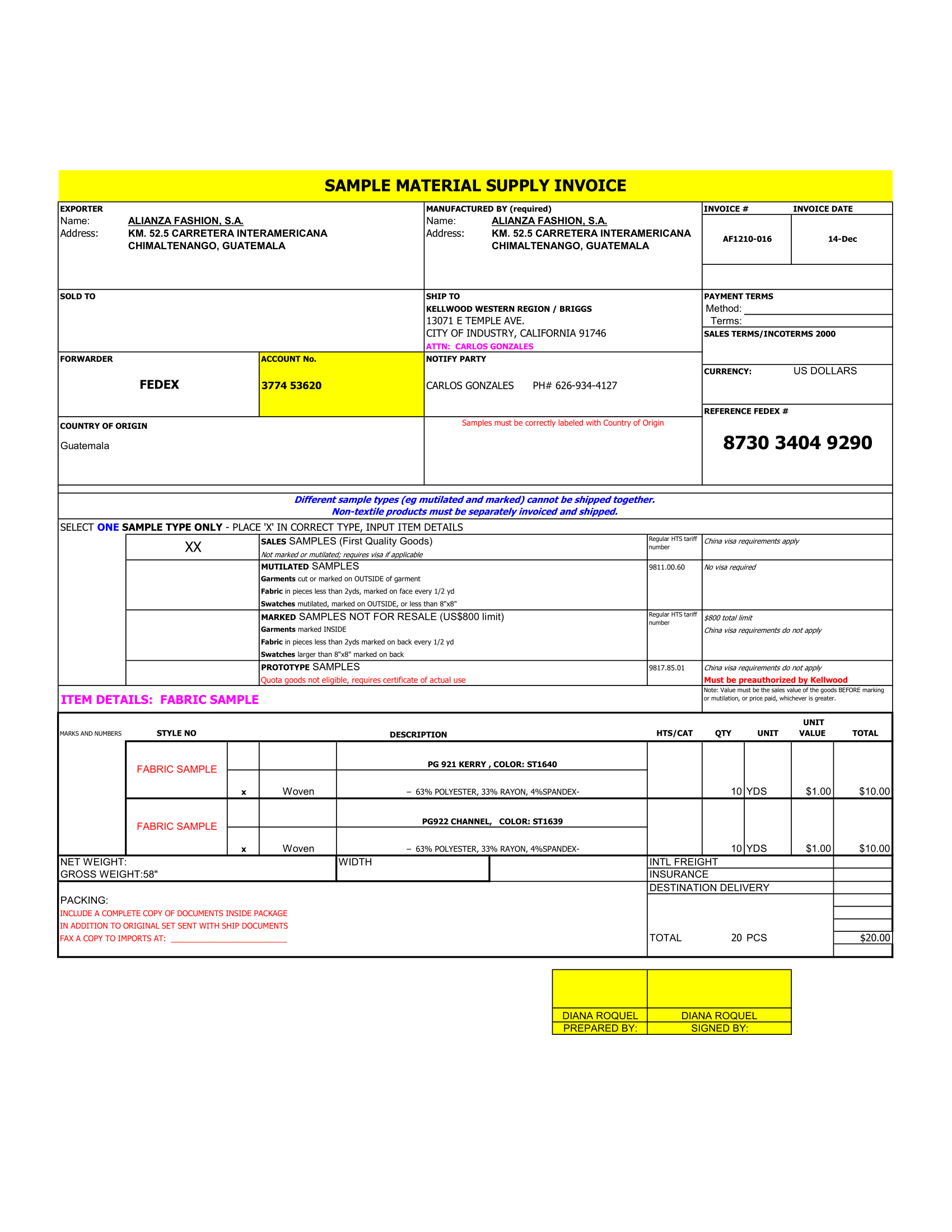

- Car rental

- Seminar equipment rental

- Language courses

- Artist Management

- Laundry services

- Car wash services

This spreadsheet is suitable for accounting services :

- Students who want to practice their accounting skills. They can find accounting cases and map it into this template.

- Accounting Managers and Staffs who want to record and track their company financial activities by using Microsoft Excel where the data can be processed and transferred easily between Excel and other Office Suites (Word, Power Point, Access)

- Small Business Owners who want to track their company financial situation using any type of devices without worrying about their incompatibilities.

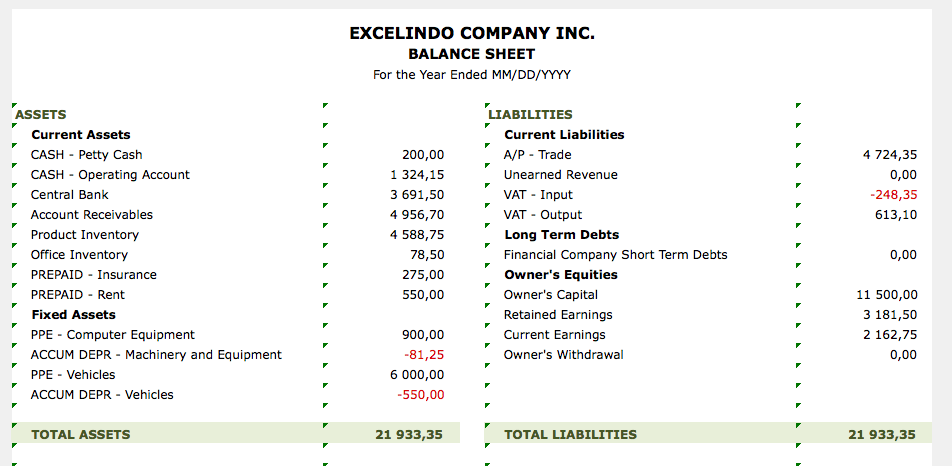

This service business do not require inventory no Cost of Sales or Cost of Goods Sold will appear in your financial report. Record your income and expenses in one General Journal. Then, adjust unbalance transactions at end of particular period (month or year) in Adjusting Journal before preparing your financial reports.

Public Accounting Features

These templates will automate your journal entries into General Ledger and financial reports automatically. You don’t have to write your transactions twice, by dates and accounts, like what you might do if you did it manually. Hence, You just select particular accounts in General Ledger and see its summary within one table.

So, You can access all worksheets from Home Panel inside the spreadsheet. Those buttons are arranged by flow of data entry. It should easy you on switching to other worksheet sequentially and very quickly.

Hence, You can use this Accounting for Service Business spreadsheet to record daily transaction within one accounting period. So, There are options to see financial summary in total or by months. Thus, This spreadsheet is not free, but you can do anything with the paid version. All worksheets and formulas are unprotected where you can modify to suit your own needs.