A personal budget is a financial plan that limits the amount of money that we spend on any expenses category in any period of time. The most common period used is one month period. The limitation is usually based on income being received. The income must cover all expenses, fixed and flexible expenses, where fixed expenses become top priority to fulfil every month. Fixed expenses are usually obligation expenses. For example: mortgage, school fee, cable TV etc where the money spent is fixed per month. Flexible expenses are that related with variable amount of money that has to be spent based on people behavior. A good budget will consider all the factors above and still have some savings on income by the end of month.

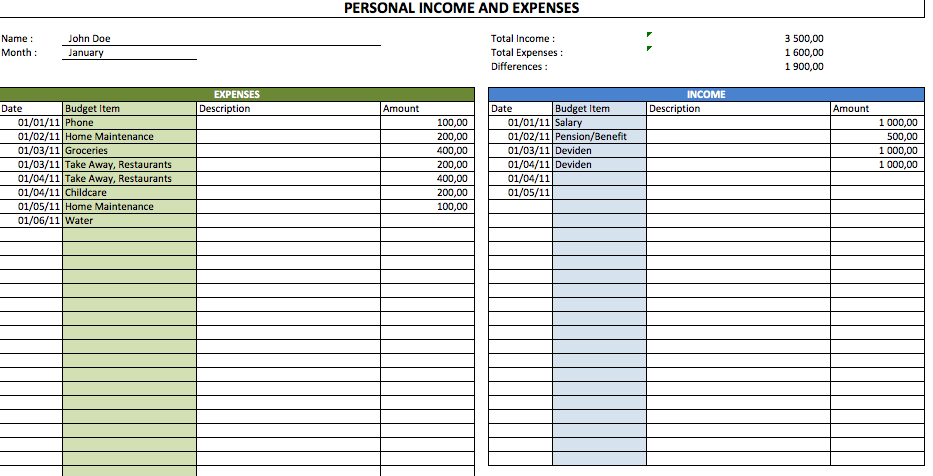

Simple Personal Budget Template Excel

There are few people who understand the needs of budgeting their expenses. Some people don’t know how to make it, some don’t have intention on limiting their expenses. That is the reason people or family are sort of money on last week in every month. We saw any marts, restaurants, stores are more quiet on those weeks comparing to previous weeks. Because people tends to spend their money as soon as they get paid and think about saving it several days before getting paid again. In order to reverse this, people need to become more responsible with their spending patterns. One tool to help people manage their expenses is a personal budget.

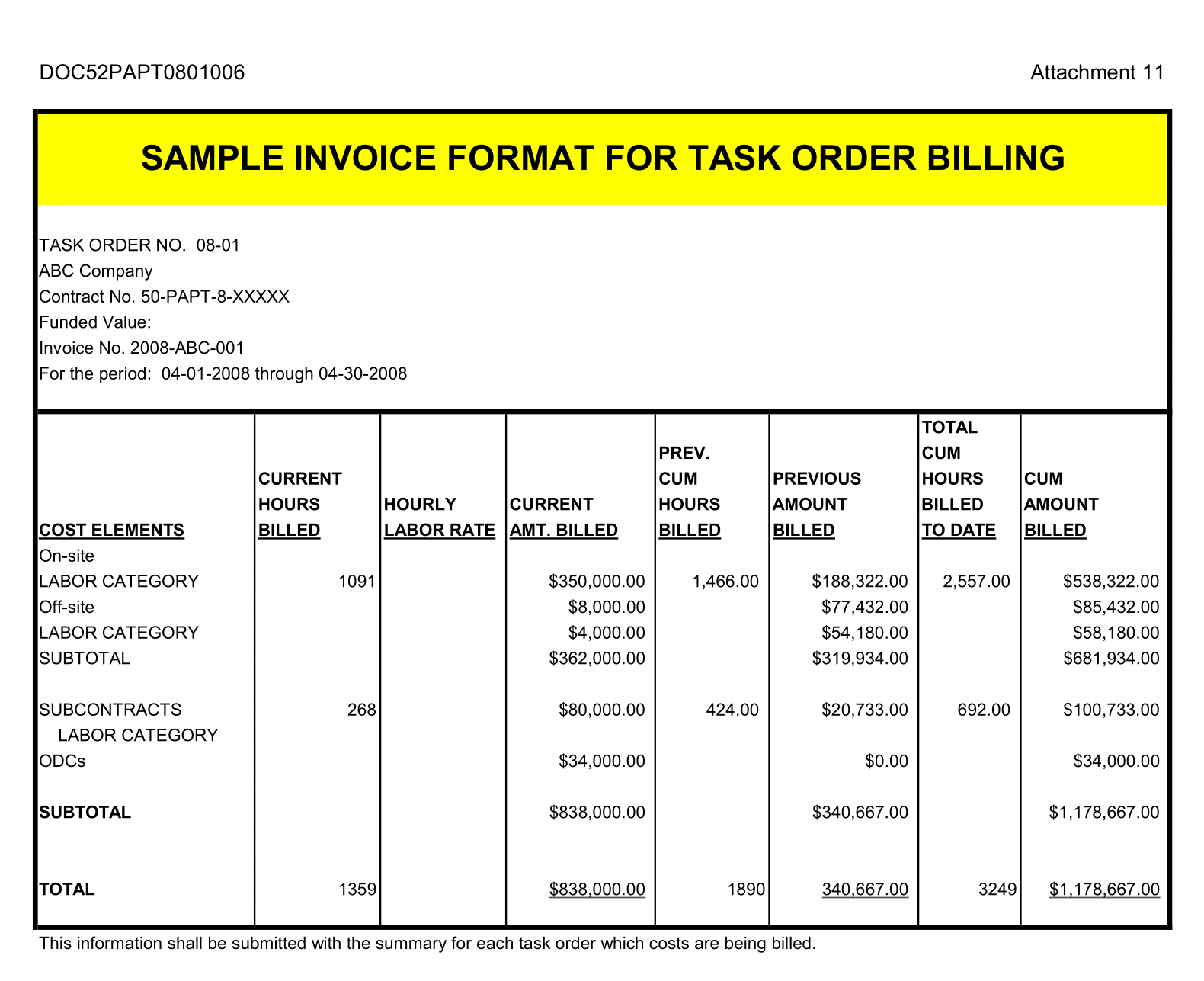

Simple Money Manager

Many people have no idea where or how they spend a good portion of their money. How many times have you taken money from the ATM only to realize couple of days later that it is gone? There is always situation where you have difficulties to remember how exactly you spent the money, and often times this money is wasted on unnecessary purchase. A budget will help you prevent this from happening by making a person accountable for the money that they spend.

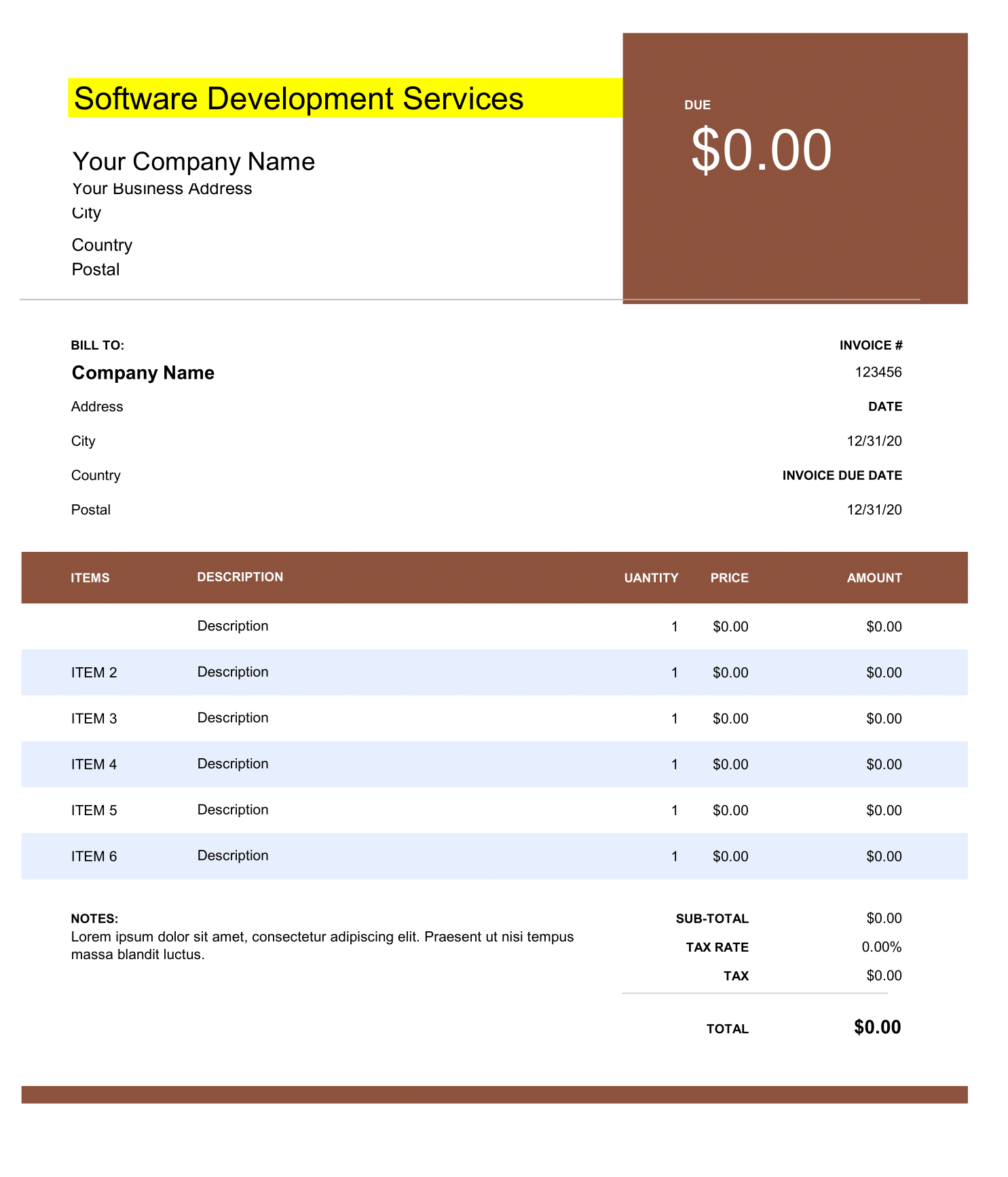

Simple Spending Tracker

There are many methods available on how to categorize expenses, which categories should have higher allocation, and many other considerations which should make people finally understand that they don’t have much money to cover all expenses. Another great benefit is that budget portrays an accurate idea of how much an individual can actually afford to pay for various consumer items. Whether it’s house, a car, or a new TV, a person will be able to determine whether or not a certain purchase will fit within their monetary constraints. This acts as a safeguard against getting over your head financially.

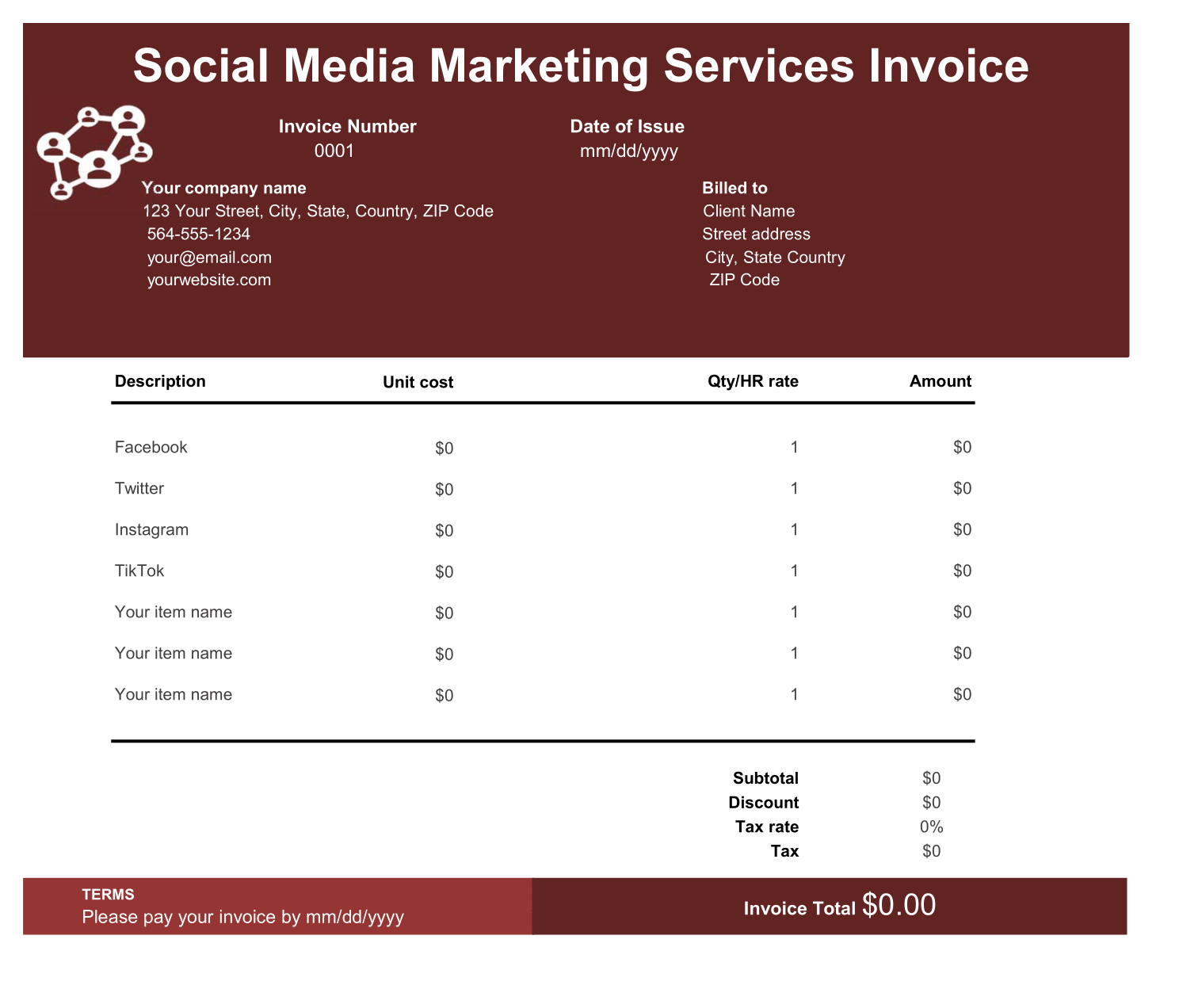

Basic Personal Budget Template

It is important to realize that simply creating a budget is not enough. This itself will do a person absolutely no good if he does not discipline himself to stick to it. At times this will be very difficult. If any person has established the habit of freely spending without a second thought. However, long term benefits of financial freedom, debt free living, and a comfortable retirement far outweigh any potential difficulty.

Easy Personal Budget Template

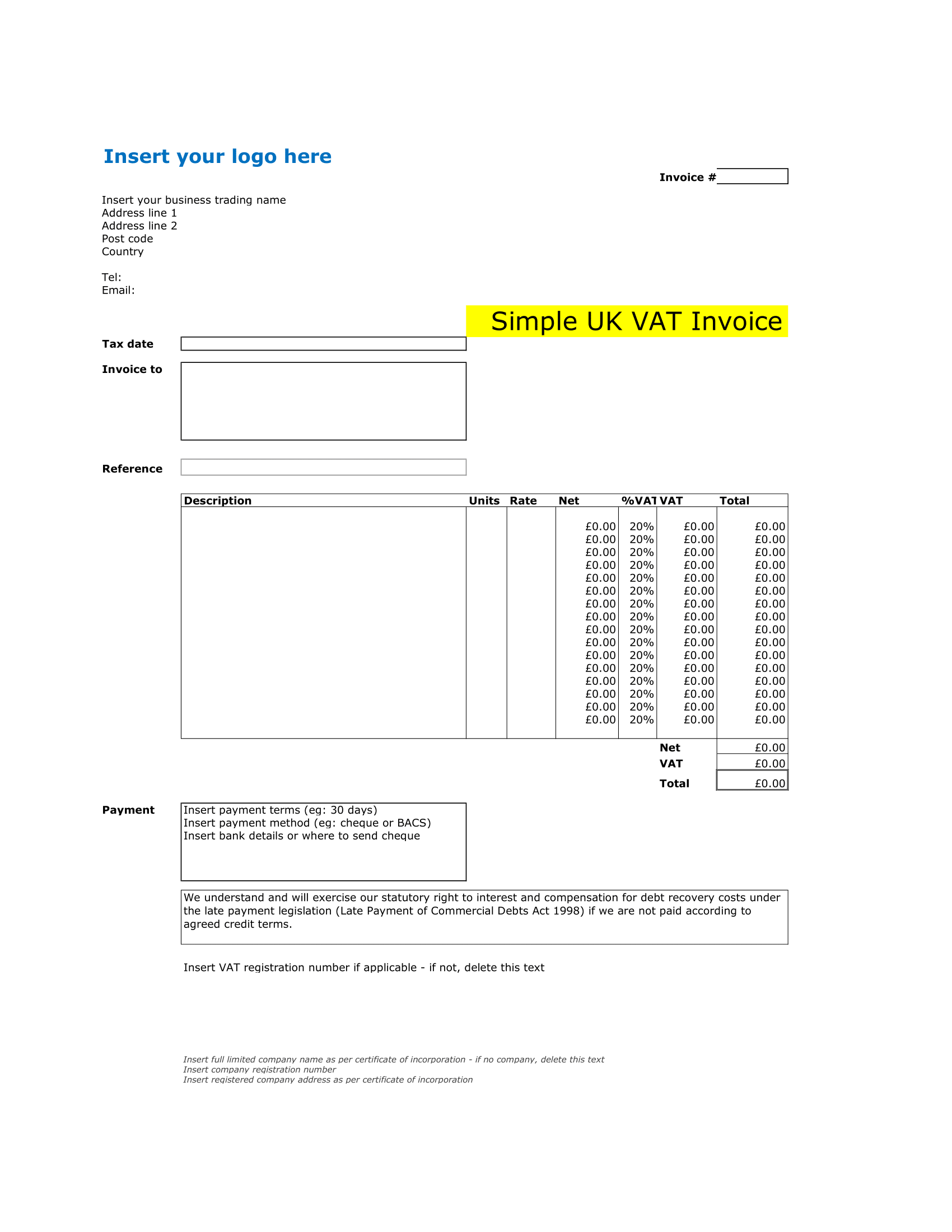

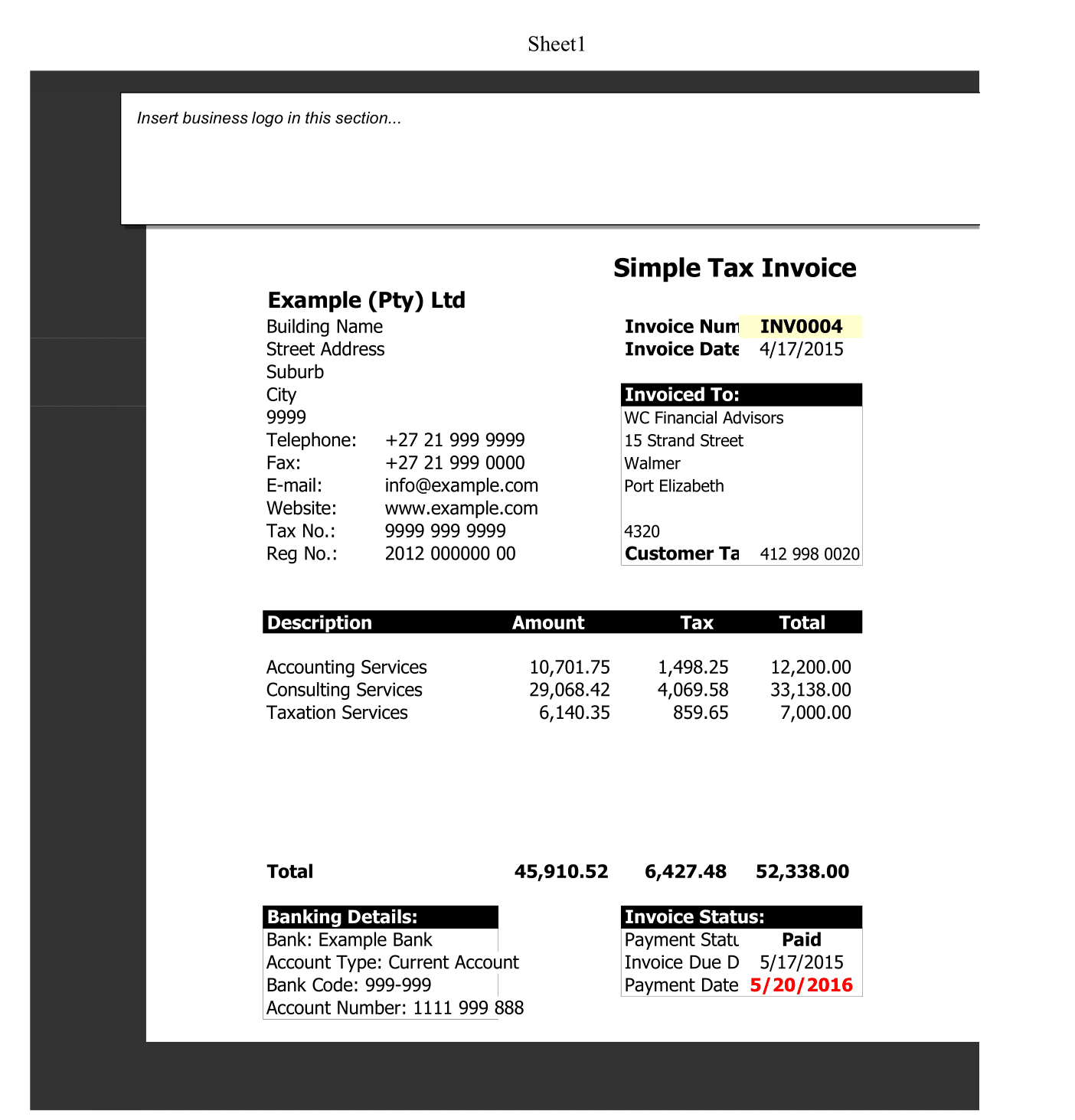

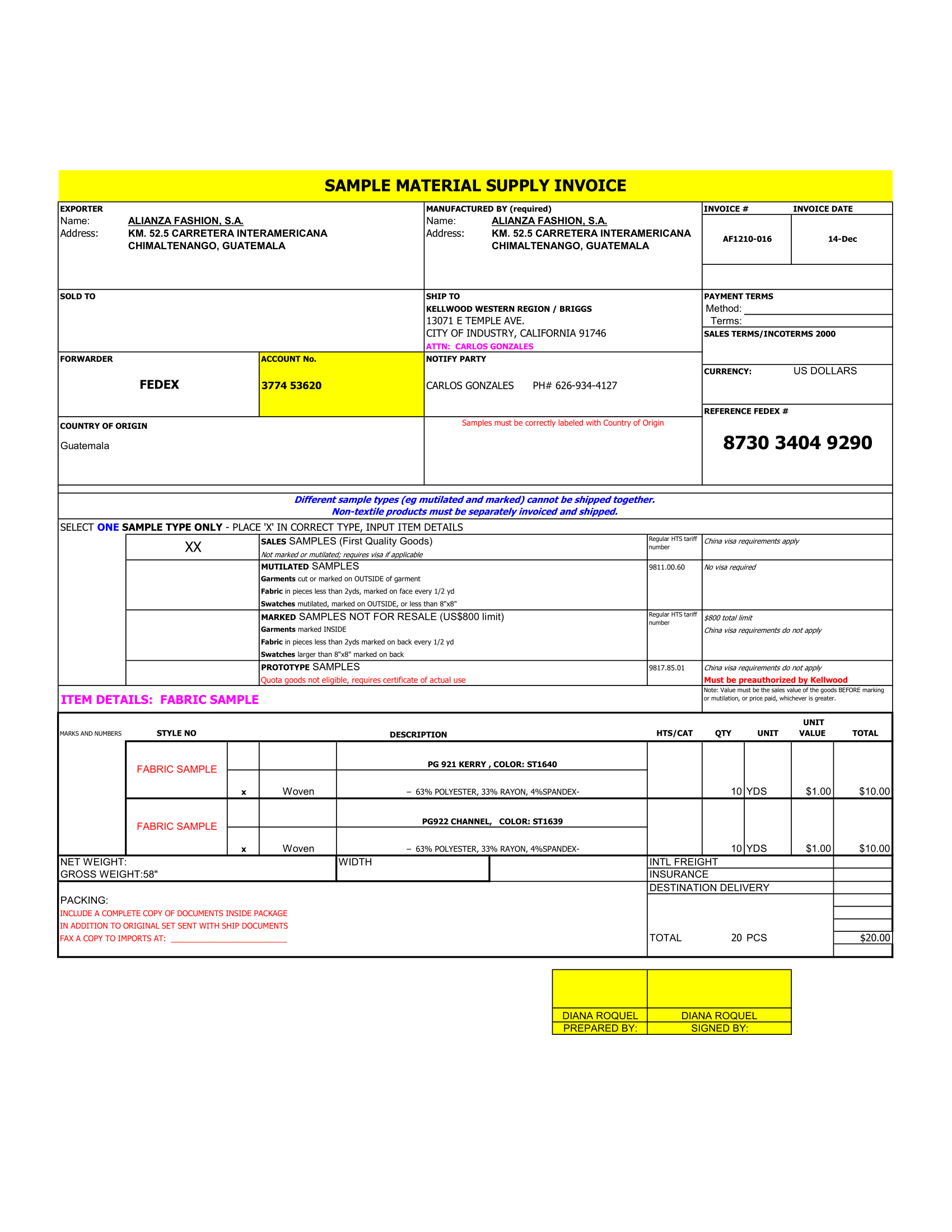

This template is a simple personal budget template that should give you better understanding on making monthly budget without complicated thought. There are only two sheets in this template. The first sheet is budget sheet where you can type your income and expenses category and fill your budget. Try not to be precise as a financial people. Just type all the expenses that you can remember and categorize it in words that you understand or based on thought.

In the second sheet, there are two tables, income table and expenses table. Type your daily income and expenses based on the dates. Make sure that you type your income and expenses within one month period. You can see sum of those amount in the first worksheet. And there is a budget vs income/expenses column in first worksheet, so you can see you are over or under budget. Save this excel template with name of the month, for example January-2011. And duplicate this file into 12 excel workbooks, so you can have your own monthly personal budget.