All business entity has to issue a UAE VAT Debit Note, whenever the goods delivered are less are or tax collected is less against the original issued invoice.

A Debit Note is a document issue by a vendor when actual supply or taxes collect are less against the original VAT invoice.

Liability of tax is mainly paid to the government increased when a Debit note is issued.

Usually, VAT Collected on Sales + VAT on Debit Notes = VAT payable to the government.

So, We have created an easy to use excel template of UAE VAT Debit note with predefine formulas. You can issue the Debit note with little efforts.

This template can be useful for accountants, accounting freelancers, accounts assistants.

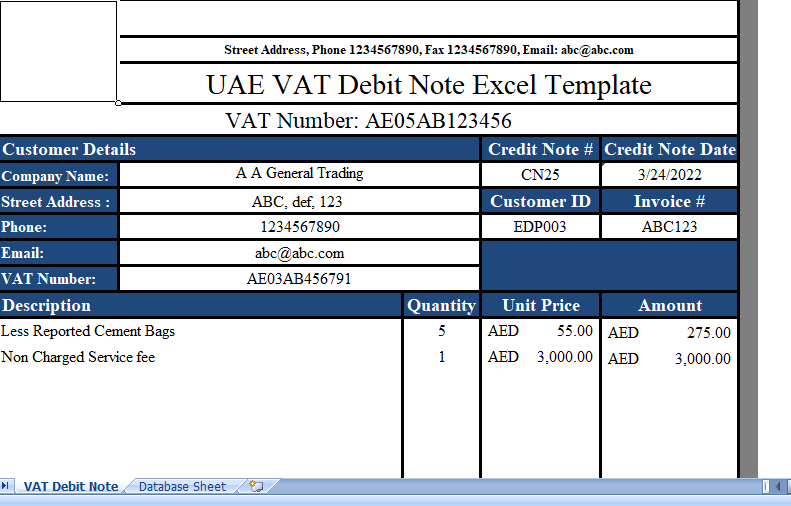

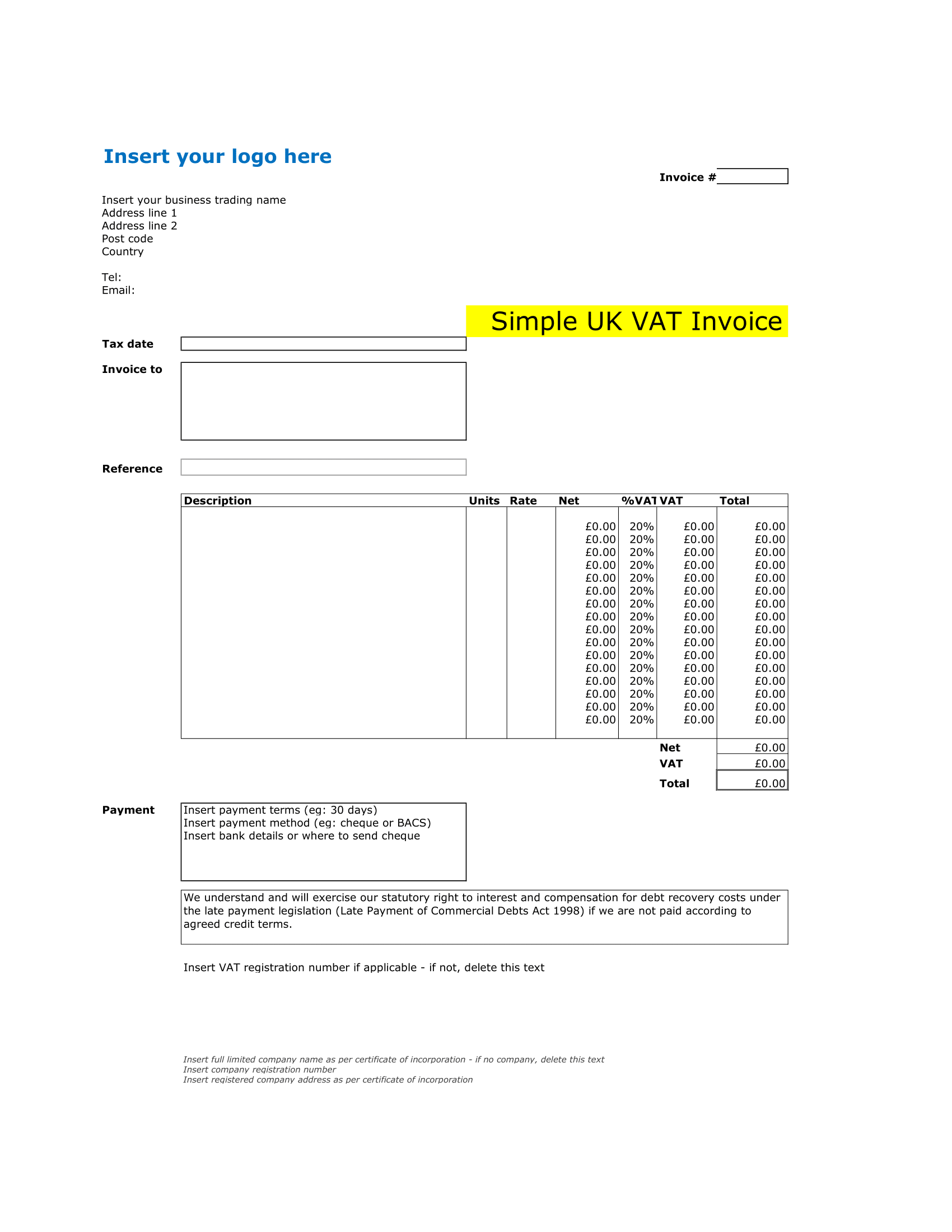

Just download and change the company details in the header section like the company name, logo, address and VAT number.

Select customer from the drop-down list. Hence, enter the details to debit against the specific invoice number.

Contents of UAE VAT Debit Note Template

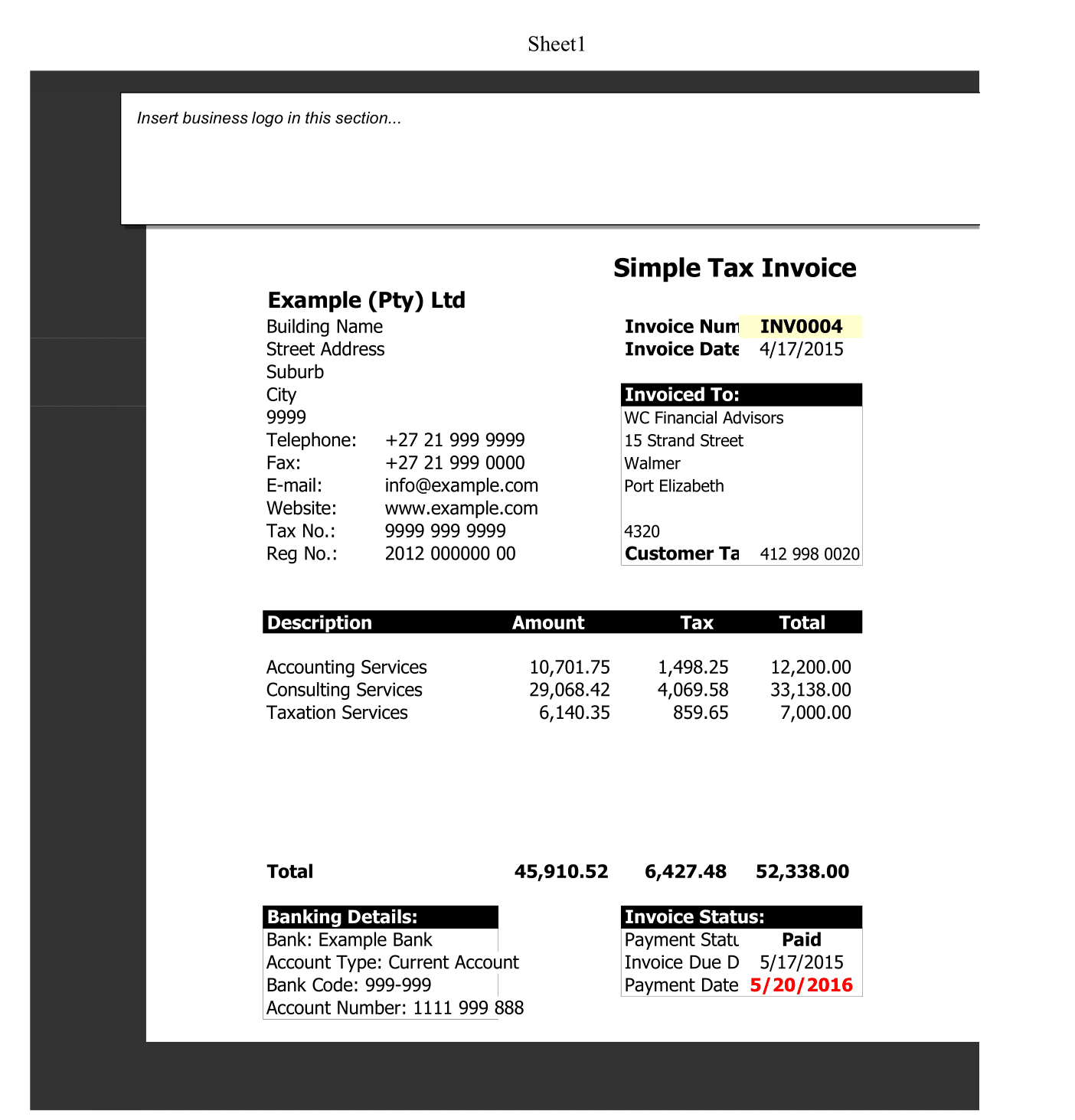

This template contains 2 worksheets.

- UAE VAT Debit Note

- Database Sheet

Database sheet contains the details like customer id, customer name, customer address, customer phone, Customer VAT number and customer email address.

This Database sheet is link using VLOOKUP function to Debit Note Template.

A drop-down list is created using data validation function and you can select the customer name from it.

When you select the customer name it will automatically select all the relevant customers.

These details include customer’s VAT number, address, phone number will update automatically.

The Debit Note Template has 4 sections:

- Header Section

- Customer Details Section

- Product Details Sections

- Other Details Section

1. Header

As usual, the Header section contains the company logo, Company name, and heading of the template ” UAE VAT Debit Note”.

2. Customer Details

The second section is Customer details section. It is linked with data validation and VLOOKUP function to the database sheet.

You need to update the database sheet once with your customer details according to the need.

You need to enter Debit Note number, Debit note date, and Invoice Number against which the Debit note is issue on the right-hand side of Customer Details Section.

3. Product Details

Product details consist of details of goods like Description, Quantity, Unit Price and Amount. Simple mathematical computations are applicable.

Quantity X Unit Price = Amount.

Moreover, The Subtotal is given at the end of Product details section. SUM Function use here is for making totals.

4. Other Details

Other details section consists of following 7 subheadings:

- Amount in words

- Terms & Conditions

- Business Greeting

- VAT Calculation

- Invoice amount

- Company Seal/Stamp

- Authorized Signatory Section

However, The cell of the VAT amount is pre-formulate. Thus, it will automatically calculate 5 % VAT amount on the total amount of the bill.