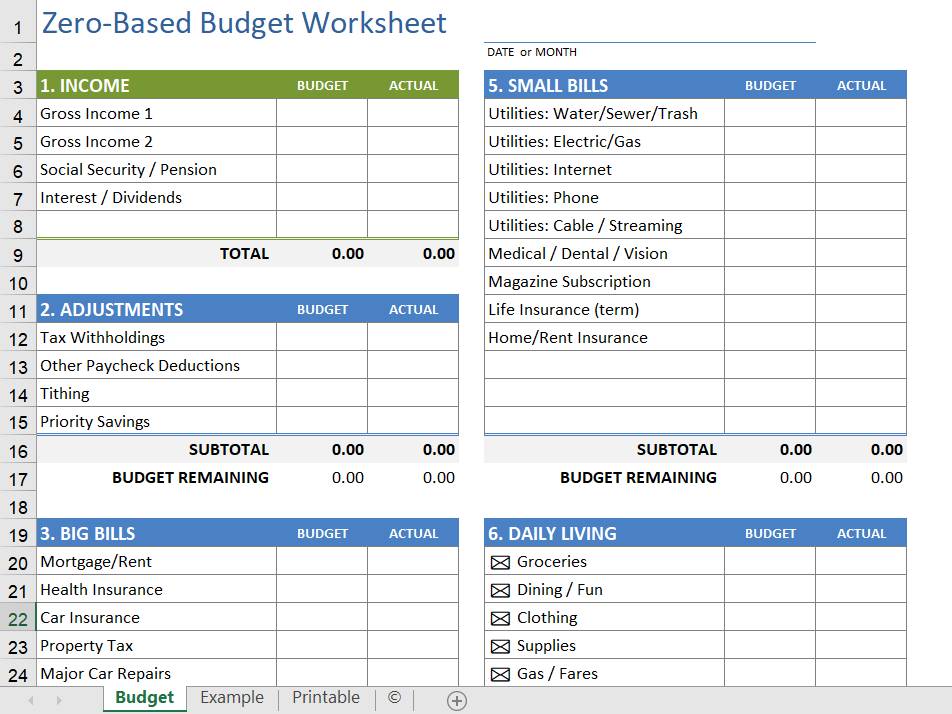

Before you download this excel template, you should know about zero-based budgeting.

What Is a Zero-Based Budget?

Zero-based budgeting is a method that allows you to distribute all of your money to expenses, savings, and debt payments. The goal is that your monthly income minus expenses equals zero by the end of the month. You can change expense categories and amounts every month. If you have a good budget in all categories at the end of the month, add the remaining amount to next month’s budget categories.

It’s the same notion as the envelope system, which involves distributing money for different expense categories into envelopes.

For instance, it is a saving and spending plan where you allot the whole money of your income to some specific plans. So, at the end of the spreadsheet, the budget is fully balanced or you should have ZERO budget left over.

Some of your income will be going into savings, expenses, some might even be invested. The main point is to assign what you want to do with it and how to do savings.

How to Make a Zero-Based Budget?

1. Figure out your monthly income

Start with creating a monthly budget, list all sources of income for the month. If you get paid weekly, or monthly you can create a budget for 4 weeks. If your income varies, create a budget on how much money is left after all expenses minimum and for that month will be.

2. Make Changes until your final budget is Zero

If the final budget is negative, you can try to increase your income, or cut it down in one or more of your heavy expense categories.

This is why this spreadsheet is useful. You can simply change utilities in any part of the spreadsheet and try to get the “Remaining” at the bottom of the Savings category to equal ZERO.

The key principle to balancing your budget is to Highlight what you don’t need on daily basis.

3. List your Expenses

All the categories in this template have a very useful structure. These are created to help you apply the Budget system in principle like the ‘Debt Snowball’ and ‘Savings Snowball’ or the ‘Saving Funds’.

Some categories are:-

Bills– Life is full of unexpected things or unexpected big bills. So, plan for them. Things like hospital bills, home repairs, and other heavy expenses can be out of your budget sometimes so, that you have the money when you need it. For a monthly budget, divide the total yearly cost of a large bill by 12. And divide in Excel using a formula such as =1500/12

Sinking Funds- After listing your monthly expenses, add your sinking funds. A sinking fund is savings that set aside the money toward an expense that doesn’t occur monthly. Create sinking funds for any infrequent expenses.

Debts- Debt refers to the total money owed by one person and due to another person. The most popular kinds of debts are loans with or without mortgages. If you have a lot of different debts, you may need to sum up them into different categories such as “credit cards” and “students loans. Include the minimum monthly payments in this section. So, you can list your mortgage as a big bill or a debt is up to you.

Savings– Refers to the net total of funds for an individual after all expenses. So, you can put some savings in investment and emergency funds.

4. Daily Expenses

If you are using a budget system where you record categories carry over from month to month, then as you complete your monthly zero-based budget, check the balances in each record, to see whether you can minimize a category in the month to make room for a bigger debt or savings.

Example- Within the name of your category, it may be helpful to list your typical monthly budget for that category, such as “Groceries ($30)” or “Shopping” ($400)”. If you have $30 leftover in Groceries at the end of September, you can reduce your budget by $30 when you plan for October. Unless the reason you came in under budget is that you just delayed spending.

5. Actual Amount

To examine your spending in this template. At the end of the month, enter your actual income and spending in the right-hand columns of the spreadsheet.

This template doesn’t track the stabilities in your savings or checking accounts. But, to make a new budget for every month, you have to track these account balances so that you can know what changes you can make in your plan for next month.