How fast can I get out of debt? How much can I save in interest payments? That is what our Debt Reduction Calculator can help you figure out. Getting out of debt is not easy, but with a good plan and firm determination, it is entirely possible. The debt snowball calculator is a simple spreadsheet available for Microsoft Excel® and Google Sheets that helps you come up with a plan. It uses the debt roll-up approach, also known as the debt snowball, to create a payment schedule that shows how you can most effectively pay off your debts.

Debt reduction spreadsheet

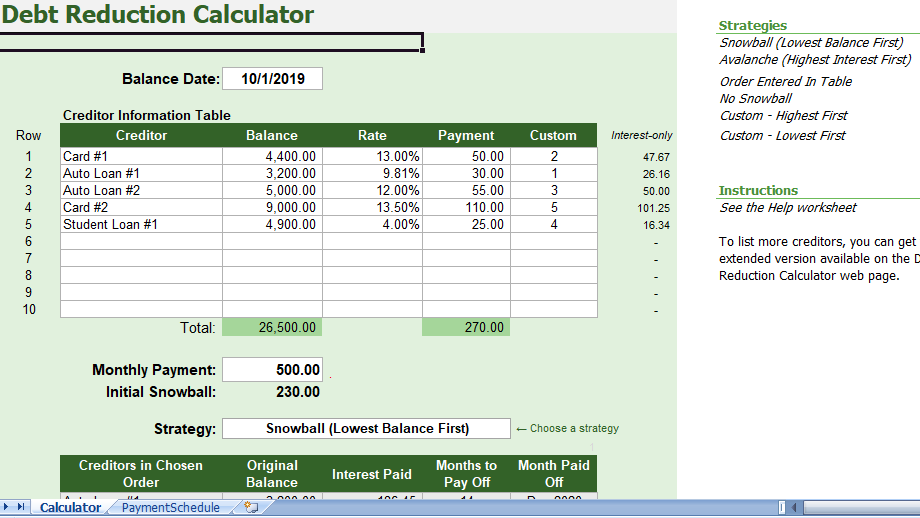

Learn how you can save $100’s or even $1,000’s of dollars. One of the most powerful things about this spreadsheet is the ability to choose different debt reduction strategies, including the popular debt snowball (paying the lowest balance first) or the debt avalanche (paying the highest-interest first). Just choose the strategy from a dropdown box after you enter your creditor information into the worksheet.

The first step in a debt snowball plan is to make a budget, then stick to it. The more you can squeeze out of your budget to increase your debt snowball, the faster you’ll reach your goals.

Debt reduction calculator spreadsheet

You should consider others financial goals and risk factors besides just paying off debt as fast as possible. But, after you’ve decided what you can contribute to debt payoff each month, enter that amount into the calculator as your total Monthly Payment to see how long it will take with different strategies. Continue reading below for more information about the various debt reduction strategies.

Using the Rapid Debt Snowball Calculator

Follow these simple steps to use the debt snowball worksheet:

- Enter abbreviated names for your credit card or lending institution, the current balances, and the interest rate information for all of your current debts (including home equity lines of credit or second mortgages).

- Enter the minimum payment you will make each month for each debt. You may need to verify your minimum payment with your lending institution. For some debts, like credit cards, the minimum payment may change over time. This spreadsheet assumes a fixed minimum payment for each debt, so you may want to update the calculator every few months.

- Enter the total monthly payment that you can pay each month towards your debts, based on your home budget. The difference between the total minimum payments and your total monthly payment is your initial snowball. This initial snowball, or “extra payment,” is applied to one debt target at a time, depending on the order defined by your chosen strategy.

- Look at the results table to see the debts in your chosen order along with the total interest paid and the months to pay off each debt. Experiment with choosing different payoff strategies or use the Custom column to choose the order to target your debts.

How Does the Snowball Effect Work?

The snowball effect is the idea that a snowball grows as it rolls down a hill. When applied to debt reduction, the snowball effect refers to how your extra payment grows as you pay off each debt.

As defined above, the snowball is the difference between your total minimum payments and your total monthly debt payment. The total monthly debt payment remains the same from month to month. The snowball is the extra payment that you will make on your current debt target.

After you pay off your first debt, you no longer need to make the minimum payment on that debt. So, that payment amount gets rolled into your snowball. Your new larger snowball becomes the extra payment that you apply to the next debt in the sequence.

There are times when your snowball is larger than the remaining balance on your current debt target. In that case, the spreadsheet automatically divides your snowball between the current and next target.

Use our other Debt management Calculators:

- Snowball Calculator

- Debt Payoff Tracker

- Credit Repair Calculator

- Credit card payment calculator

- Balance Transfer Calculator