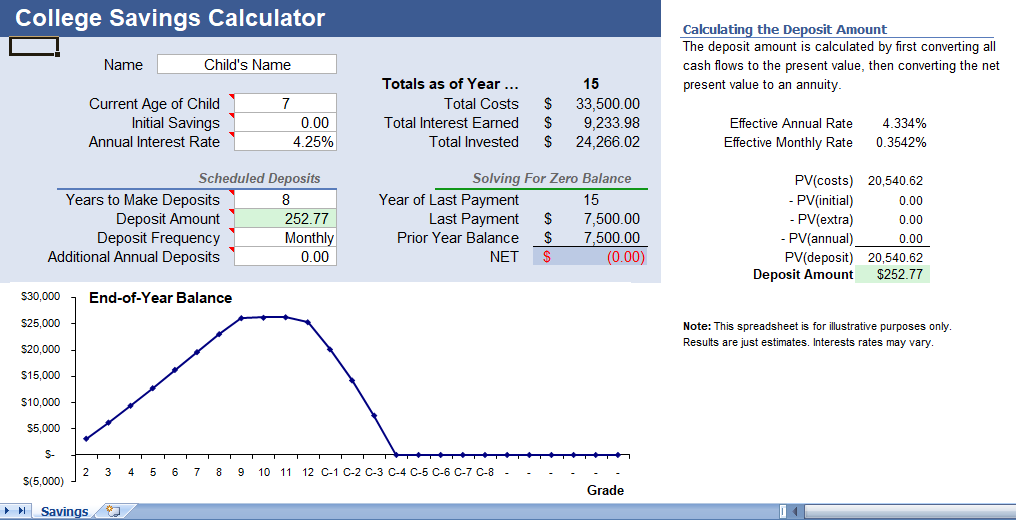

How much you need to save to help your child get a college education? That is the question my College Savings Calculator can help you answer. College can be expensive, so a parent should be wise to set up a college savings plan. The calculator can help you figure out how much to save each year, and you can include costs for and High School as well as college.

If your college plan includes a study abroad, mission, or some other major cost, you can include that, too. I’ve been meaning to make something like this for my own use for quite a while, and now I know why I didn’t. Anyway, I hope you find the calculator useful at least.

College Saving Calculator excel

Create a college savings plan.

- Includes costs of grades K-12, High School, College, and other major events.

- Add extra deposits within the yearly savings schedule list.

- Make a copy of the worksheet for individual child.

- Automatically solve the monthly deposit amount or choose a different deposit frequency.

Using the College Savings Calculator

Year vs. Age vs. School Year

The investment year is assume to start at the beginning of the school year. Annual deposits can be done at the end of the year and school costs are withdrawn at the beginning of the year.

The Age and School Year columns are for convenience in identifying when the child will be in grade level. The calculator makes the assumption that the child enters kindergarten at the age 5. If you want to, you can edit the list of grades in the formula for the School Year column to customize the grades associated with your child’s age.

College, School, and Other Costs

This calculator lets you create a general educational savings plan so that you can include costs for more than just college. High-School can be pretty expensive and if your child attends a private school that can really eat at your budget as well.

All the costs for the year are assume to withdraw at the beginning of the school year. That is probably not how it will really happen, but unless you are somehow getting a crazy amazing interest rate, the exact timing of the withdrawals won’t make much difference. The calculator will err on the conservative side, because if you left your funds in the account longer, you’d make more interest than the calculator predicted.

If you’re college savings plan is anything like mine, you’ll probably find that interest earned is very small compared to the amount you will have invested, unless you are funding the account at a level to put your kid through Harvard.

Solving for the Monthly Deposit Amount

The college savings plan calculator is set up by default to calculate the monthly deposit amount base on what you are entering as the Initial Savings, Annual Deposits, Costs, and any Extra Annual Deposits within the schedule.

NET Value: If this value is Zero then you will just break-even, or in other words, you will have saved just enough to cover all the costs. If you want to solve for an input other than the deposit amount, you can manually enter the deposit amount and then use Goal Seek or Solver to set NET to zero while changing one of the other inputs (like Initial Savings, Annual Deposit, or the Interest Rate).

Years to Make Deposits: The calculation to solve for the deposit amount will only work if the years to make deposits is less than or equal to the year before the last payment.