A family budget is a record that outlines a plan for a family’s finances, funds, resources and serves as a guide for how much to spend on various items. You can prepare a family budget for a month, annually, or any other segment of time. However, there are plenty of guides and apps available to help you develop and execute your budget, most important is that tool will work for you.

Similarly, A family budget is a statement that shows how family income is spent on various items of expenses, money management on necessaries, comforts, luxuries, and other things. It shows the allocation of the family income over the various items of expenditure.

Although, there are plenty of consultants and applications available to help you develop your budget. However, We do not recommend you to do that, as it will involve unnecessary cash outflow. So, it is better to use our free excel template to manage your expenditure budget or family budget.

Further, If you earn well but are unable to save. Have no idea where all your earnings are spent. If any of these things apply to you, it’s time to write down a household budget on a spreadsheet.

How to Create a Family Budget in EXCEL

Before you create a family budget, you need to put down on paper where all your money currently goes. There’re many apps and software that can help with that. In fact, your bank already has information features that will show you exactly which categories consume your money each month.

Once you have a detailed awareness of where your money is going. Sit down with the rest of the family and decide how much money you want to assign to each category. For instance, If you see that you’re spending $1000 a month on entertainment, decide you want to reduce that to $500 and put $500 a month toward saving or paying off debt.

Budgeting Steps Includes-

Register your income.

The first step here is to record your income—any money you plan to get during that month.

Money

Start budgeting with Every Dollar today.

Write down each normal payment for you and your spouse—and don’t forget to add extra money coming your way through a side hustle.

If you’ve got an irregular income, calculate the lowest estimate of the budget that you normally make in this spot. Similarly, You can adjust it later in the month.

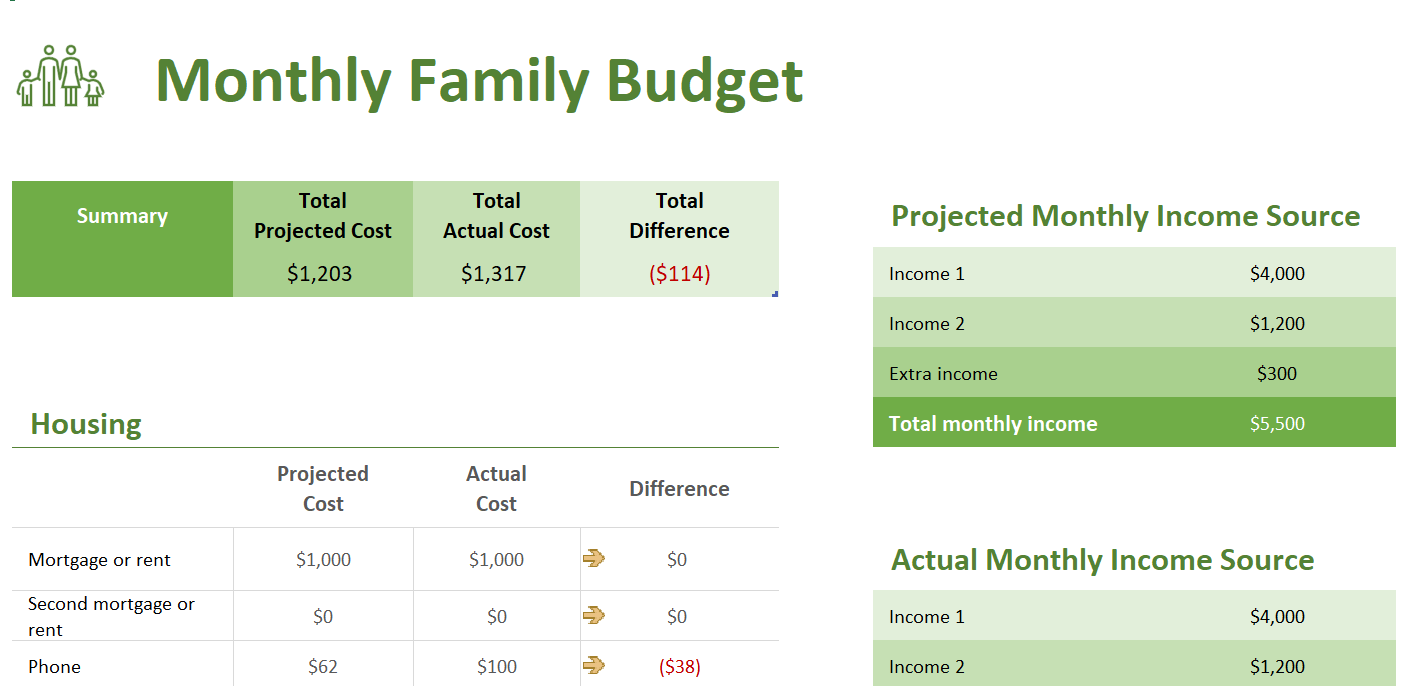

It template estimates the Total Projected Monthly Income and Actual Monthly Income Source.

Update your expenses.

Now you have to plan for the money coming in, and the money going out. It’s time to list your expenses. Firstly, open up your online bank account or look at your bank statement to help you evaluate your expenses.

Start by covering your Four Walls like- food, utilities, shelter, and transportation. These are called fixed expenses because they stay the same every month example mortgage or rent and Others change up, like groceries.

Next, list all other monthly expenses about insurance, debt, savings, entertainment, and any personal spending. Start with your fixed expenses. After that use your online bank account or those bank statements to estimate planned amounts.

Subtract your income from your expenses.

Subtract your income from your expenses, and it should equal zero. That doesn’t mean your monthly income is at zero. It means overall of your income has a job. And this method is called a zero-based budget.

Similarly, if you have money left over after you’ve subtracted all your expenses, be sure to put it in the budget too. Because you are putting that “extra” toward your current money goal, like saving or paying off debt.

For instance, What if you end up with a negative number? it’s okay or you just need to cut expenses until your income minus your expenses equal zero.

And last thing is to Total the Amount- Subtract the Projected Cost From the Actual Cost to find the difference.

Goals of Family Budgeting

- To Analyze your Financial Situation

- Calculate Daily Expenses

- Plan for the Future

- Track Spending

- Remove Debts Paying Pressure