This spreadsheet is design for someone who want a simple way to track the value of their investment accounts over time. Every investment site or financial institution seems to have its own way of reporting results. To know most of all is simply the return on investment over time. This is why I am using my own spreadsheet for the past few years to track my 401k and other accounts.

Investment Tracker

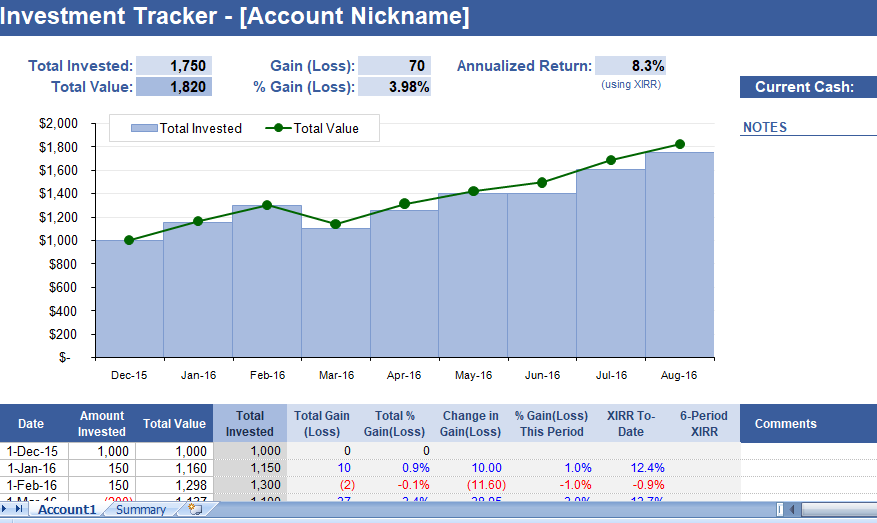

This template is design to provide a simple way to track an investment account. It boils everything down to tracking only what are investing and the current value of that investment.

Portfolio Tracker

The spreadsheet does not define every term and every calculation in detail manner. It is up to the individual to make sure they understand what is calculating.

Investment Tracker Spreadsheet

I use a spreadsheet as an ADDITIONAL way to track my accounts. It is not the best way or that it should be used in place of reports generated by the advisor or financial institution. Below are a few reasons why I use this spreadsheet to track investments.

Reason 1 – Consistent Way to Compare Different Types of Investments

This is a consistent way to look at return on investment makes it possible to compare real estate investments to stock brokerage accounts.

Reason 2 – Learn how things work in this

I like to try to understand how investments work, and that is why I like using this spreadsheet. I like to see and try to understand the formulas so that I can better understand what is reporting

Reason 3 – Fees, Dividends, Interest Earned, Re-investments, Cost-Basis, Realized vs. Unrealized gains

All issues are important, but they can also be distracting when I am only comparing my out-of-pocket investment to the total value of the investment.

Handling Investment Income

Investment income that remains within your account as cash will generally be included automatically in the total value of your account. However, how you handle investment income that you withdraw or that you have automatically deposited into another account? You may want to track the investment income separately and do your own calculation for return on investment.