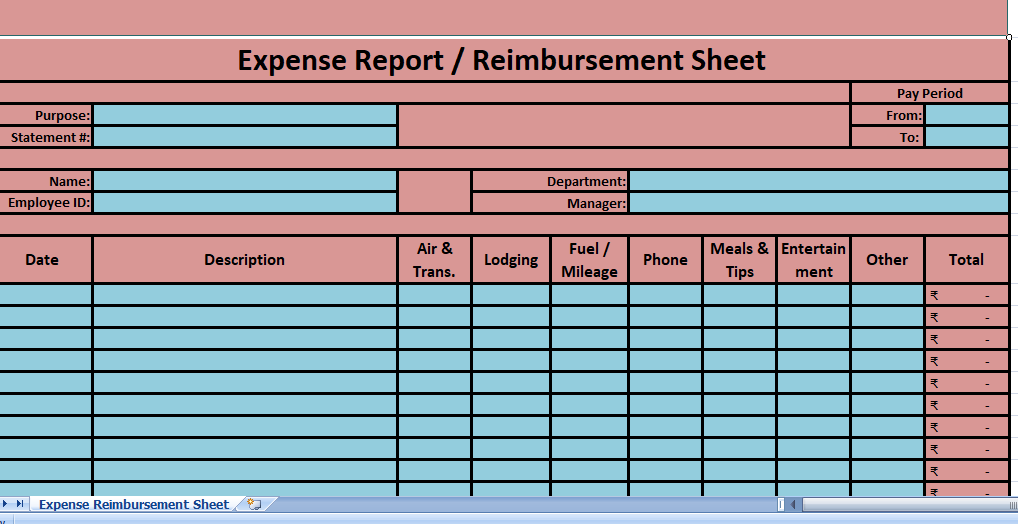

The Expense Report Template is a ready-to-use template in Excel to keep track of personal and business expenses. This template is useful for reimbursement purposes for business trips and also helpful to analyze expenses about a specific department or a project.

Thus, the analytical study of the expenses can be useful for companies to cut down costs on unnecessary expenses and increase profits.

Concur Expense Reporting

It is basically a reimbursement form that a company uses to track its business spending. Moreover It helps to keep track of business expenses for an employee’s business trip, a particular department, or any project of a company. Above all It provides a quick track of expenses and its relevant documentation.

An employee prepares the this for the actual spending made by him/her for the business. The employee submits this for the approval. An employee must attach the receipts of expenses incurred along with the report.

Furthermore, the authorized personnel examines the expense report for the accuracy and validity. After approval, the employer pays to the employee if the claim are in line with guidelines and reimbursement policies.

Elements of an Expense Report

Components of expense report might vary from business to business. Here are some common elements of report:

- Purpose of expenses such as meeting clients, survey of the market, procurement of goods, purchase of machinery, etc.

- Secondly Employee details along with Employee ID, department, and reporting authority.

- Thirdly Period for Expense Report.

- Subsequently Date of the actual occurrence of expenses.

- Description of expenses.

- Amount of expenses.

- Expense under Heads.

- Details of advances if any.

Business Expense Report

Generally, businesses allow their employees to spend the money to enhance their business. The employer reimburses the expenses to respective employees.

So, Being a business owner, it is necessary to ensure that the expenses are made as per the company policy. For proper recording of expenses, an employee prepares expense report. Usually, companies keep it mandatory for the employees to attach the receipts of expenses.

Uses of Expense Report

- Reimbursement of expenses paid by an employee on behalf of company.

- Reporting and recording the business expenses.

- Tax purposes. Business expenses reduces the tax liability.

- Business use the report for the analytical purposes.

- It helps the management to curb unnecessary overheads.

- Expense reports help to save fraudulent use.

Expense Report Template

We have created a simple template that helps you to quickly put the details of specific expenses incurred obtain approvals from department heads as required.