Child Tax Credit Calculator is an excel template that help you to easily calculate your Child Tax Credit amount. Child Tax Credit is a provision in federal income tax that offsets many expenses related to raising children.

This begins at an adjusted gross income of $ 75,000 for single and head of household, $ 110,000 for married filing jointly and $ 55,000 for married filing separately.

Child Tax Credit in US

Foreign Income exclusion must be included while figuring your income forb the child tax credit. A taxpayer cannot claim Child Tax Credit if your taxable income slab is 15% or higher.

Child Tax Credit reduces your tax liability by $ 1,000 per child if all varied criteria are met.

We have created an easy Child Tax Credit Calculator excel template with predefine formulas. Just enter few amount to calculate your child tax credit.

Contents of Child Tax Credit Calculator

Child Tax Credit Calculator consists of 3 sections:

- Firstly Header Section

- Secondly Initial Information Section

- Finally Child Tax Credit Assumptions Section

1. Header Section

Generally, the header section consists of company name, logo and the heading of the sheet ” Child Tax Credit Calculator”.

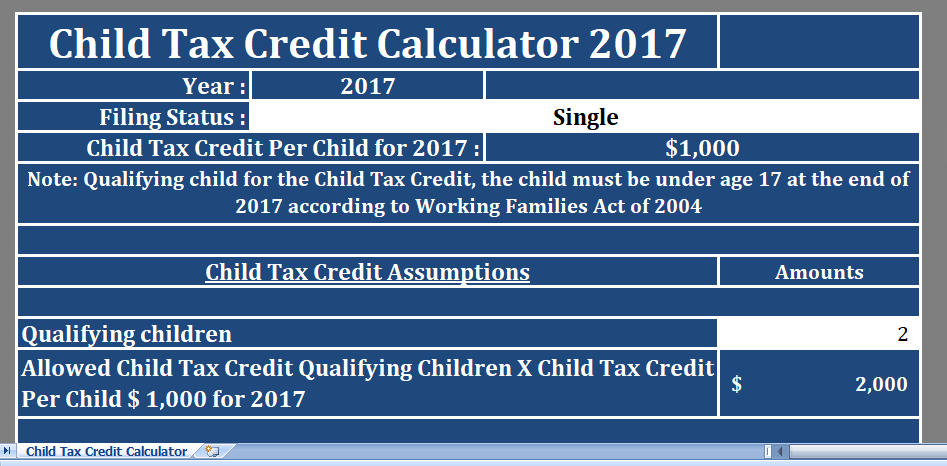

2. Initial Information Section

However, This section consists of Year of filing, Filing status, the amount of child tax credit allowed as per child by IRS.

3. Child Tax Credit Assumptions Section

Assumptions section contains following items:

Qualified Children: Enter the number of qualifying children in white cell.

Allowed Tax Credit: Allowed Child Tax Credit is number of children multiplied by the tax credit amount per child. There is a predefine formula and it will automatically calculate the amount.

Alternative Minimum Tax

It is a line 45 of Form 1040. You just need to enter the amount as displayed in your Form 1040.

1. Foreign Tax Credit: Line 46 of Form 1040. Foreign tax credit reflect on your Form 1040 must enter here.

2. Credit for child and dependent care expenses: The amount reflects in line 47 of your Form 1040 shall be enter here.

3. Credit for elderly or disabled: Enter the amount of the line 48 of Form 1040 in this cell.

4. Education Credits: Similar to the above enter the amount reflects line 49 of your Form 1040.

5. Retirement Saving Contribution Credit: Lastly, you need to enter the amount reflected in line 50 of your Form 1040.

Child Tax Credit: Child tax credit is the difference between your alternative tax amount and subtotal of points 1-5.

The amount of alternative tax is greater than subtotal of credit, then you get full credit. Or else, the amount decreases.

Somewhat, If there is no child credit amount or it is a negative amount, you may be able to take the additional child tax credit.