In this article, we will elaborate the UAE VAT Invoice Format for Rent a Car Business. It is ready-to-use invoice template with predefine formulas and VAT computations for the Car Rental business.

In Car Rental business, vehicles with same or different model which are rented to different persons or companies for different durations.

Thus a rental car Invoice have all these fields along with basic calculations. In addition to this after the launch of UAE, the invoice should also be VAT compliance.

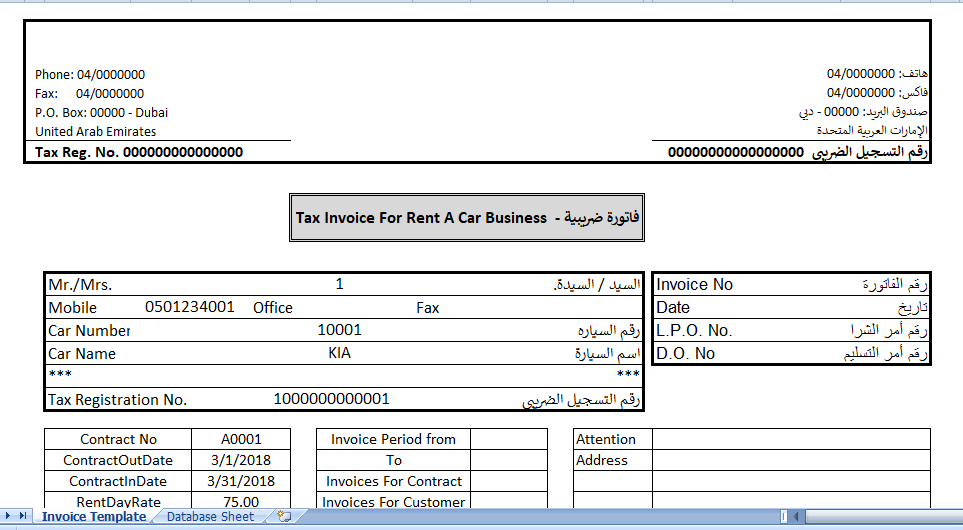

UAE VAT Invoice For Rent A Car Business

Subsequently, we have created UAE VAT invoice Format For Rent A Car Business in Excel with predefined formulas. The headings in this are in both English and Arabic so that it is easy for the customer to understand the invoice.

Just enter the require details and it will automatically fetch the names of the car, plate numbers, customer information etc.

Contents of UAE VAT Invoice Format

So, This template consists of two sheets:

- Database sheet

- Invoice Template

1. Database Sheet

This sheet consists of data the invoice template will fetch with the help of VLOOKUP programming.

2. Invoice Template

Invoice template consists of five sections:

- Supplier Details

- Customer and Car Details

- Billing Calculations

- Bank Details

- Signatures

1. Supplier Details

This section consists supplier details like company name, address, phone numbers, your TRN number in both English and Arabic language.

2. Customer and Car Details

The second section consists of customer and the Car details. It consists of following details:

Customer Name

Mobile Number

Office No.

Fax

Car No.

Car Name

Tax Registration Number of Customer

In addition to above, it also consists of contract details like contract number, Contracts Out Date, Contract In Date. per day rent, Address etc. On right-hand side, it consists of invoice no, date, LPO number, Do number.

3. Billing Calculations

Subsequently, Billing calculations consist of Description, Days, Count, Value, Tax, Amount etc. Below the billing calculation, Amount in words and Total calculations are given.

4. Bank Details

Moreover, If the payments are to be made through the bank, then your customer must have your bank details. If you wish you can leave it blank or else add your bank details in this section.

5. Signature Section

Lastly, the signature section is given where the receiver can put his name and signature.