UK VAT Invoice With Discount is a ready-to-use excel template which helps you to issue a VAT compliance invoice with discount for taxable goods and services.

Usually, retailers offer discounts to the customers. Moreover, semi-retailers also give discounts to customers for cash payments. Therefore, the supplier needs to show such discounts on the invoice.

According to rules, the rate of discount if applicable must be shown in the invoice.

The supplier cannot provide a discount on final invoice amount which is VAT inclusive. You need to calculate VAT on Taxable amount. Furthermore, the VAT is charge on discount prices.

UK VAT Invoice With Discount Excel Template

We have create a UK VAT Invoice with Discount excel template with predefine formulas and formatting as per the guidelines. Just Issue a VAT compliant invoice to your customers in just a few minutes.

Contents

This template has 2 sheets, one is UK VAT Invoice With Discount Template and the other is Customer Database sheet.

Customer Database Sheet

You can manually type customer name and other details when your business type is retail.

It consists of list of your customers. These customers are the one whom we issue the invoices for the goods supply or services render regularly.

This database sheet is further use to create a dropdown list in invoice template. Insert your customer details once when you are making the first sale and it gets add to the dropdown list.

This enables the user to save time by just selecting the name for the supplier and sheet automatically fetches the customer details on the invoice.

UK VAT Invoice With Discount Template

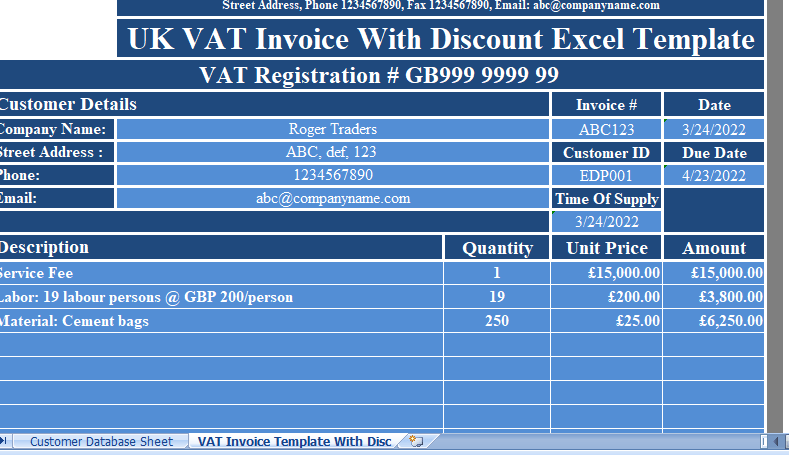

The UK VAT Invoice With Discount consists of the Performa of invoice as per the government guidelines. It consists of the 4 sections.

Header Section

The header section consists of company’s logo, name, VAT Registration Number and the heading of the invoice. Insert the logo, name and VAT registration number along with your address.

Customer Details

The customer details section consists of client’s details as below:

Company Name

Street Address

Phone

Email

Invoice

Date

Customer ID

Due Date

Time Of Supply

The customer details section is format with data validation to create the dropdown list. Once you select the name of customer from the dropdown list the sheet automatically fetches relevant details with the help of the VLOOKUP function.

Product Details

The product details section consists of following columns:

Description: Insert description of goods or services for client.

Quantity: Quantity of the product.

Unit Price: Price per product.

Amount: This column shows total amount of supply per item using Quantity multiply by Unit Price. The final total of this column is the taxable amount.

Other Details

Other details section consists of the following:

Amount in words: No need to insert anything in this. It will automatically convert amount in words using Spell Number GBP.

Terms & Conditions: So, Insert your invoice terms and conditions.

Discount: Also, Insert the discount percentage and it calculates the discount amount on the subtotal amount.

VAT computation: Select type of VAT from the dropdown list.

Taxable Amount X VAT % = VAT Amount

VAT Amount + Taxable Amount = Final Invoice Amount

Company seal: A blank space is given for company seal. After printing invoice you can stamp here.

Signature: A blank space is given for authorized signatory. After printing the invoice the authorized personnel can sign the invoice here.

Moreover, That’s it and your UK VAT Invoice With Discount is ready to print. So, It is helpful to small and medium scale businesses to issue VAT compliance invoices with a discount to their clients.