EBIT Per FTE Calculator is ready-to-use excel template to calculate the earnings before investment and taxes per full-time employee. Simply enter the required amounts from your income statement and you can get EBIT Per FTE in just two steps.

Before we proceed let us understand What is EBIT, EBIT and EBITDA and What is EBIT Per FTE?

EBIT accounting stands for Earnings Before Investment and Taxes. It is profitability measurement use to calculate operating profits for company. EBIT and EBITDA are different. EBITDA includes Depreciation and Amortization.

What is EBIT

EBIT Per FTE is earnings before interest and tax earned by a single full-time employee.

However, EBIT per FTE is an HR metric is used to measure the efficiency and productive use of human capital. Higher revenues, lower operating expenses, and increased productivity increases the EBIT Per FTE.

Formula To Calculate EBIT Per FTE

The formula to calculate EBIT per employee is total amount of EBIT divided by the Total Number of full-time employees.

EBIT Per FTE Calculator Excel Template

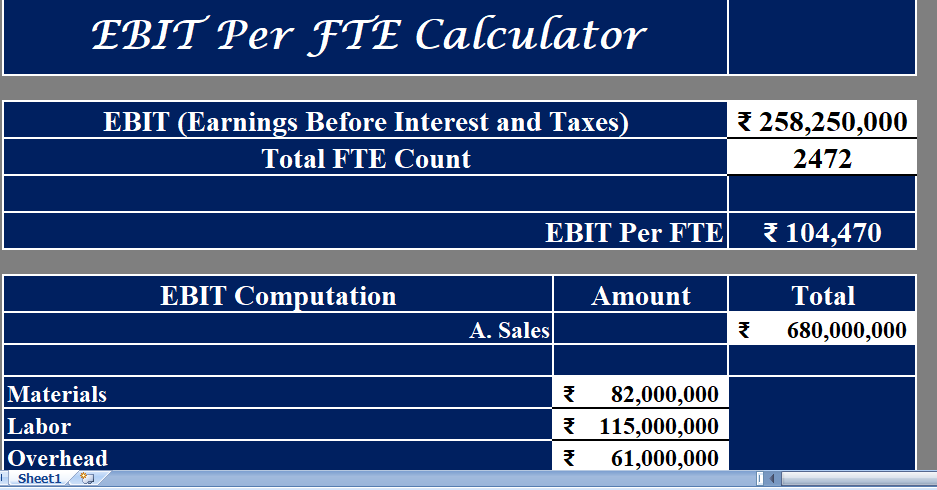

Moreover, To simplify the process and help you easily calculate EBIT Per FTE, we have create a simple and easy EBIT Per FTE Calculator Excel Template.

This template is helpful to HR professionals, HR assistants to get insights into earnings over a specific period of time.

With the help of this you can calculate EBIT Per FTE in two ways:

- By Directly providing EBIT and FTE Count.

- By Calculating EBIT manually and FTE Count.

How To Use EBIT Per FTE Excel Template?

This template contains 2 sections:

- EBIT Computation

- Detailed EBIT Computation

1. EBIT PER FTE Computation

Enter the figure of EBIT (Earnings Before Interest and Taxes) and FTE count. Applying the above formulas, it will automatically calculate EBIT per FTE for you profit before interest and tax.

2. EBIT Per FTE (Detailed)

In this section, by taking data from income statement cash flow etc. you need to enter following details:

Sales

COGS

Operating Expenses

Interest Income

Non-Operating Income

Once you enter above details, it will calculate the earnings before interest for you and then you need to provide FTE count. As soon as you enter FTE count, your EBIT Per FTE will be calculated.