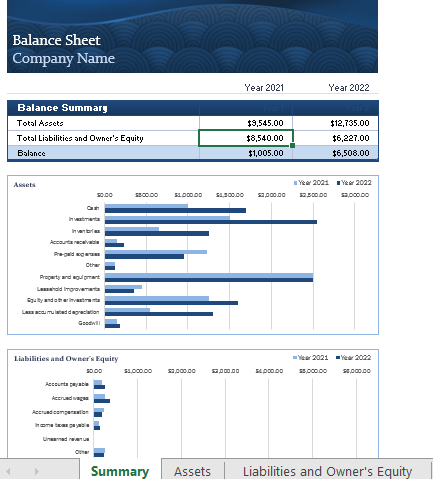

About Balance Sheet Excel Template

You can download balance sheet excel template to audit costs and balance your budget. Also, by using this balance sheet you can Compare year-to-year balances, including accumulated depreciation. Balance sheet Excel templates do the math for you, helping business owners save time and keep finances in order. Download and use this Excel balance sheet to compare and monitor company liabilities, assets, net worth, and more.

Before you download Balance sheet Excel Template, lets clear your understanding about balance sheet structure

How to prepare and analyze a balance sheet

Examine the concepts of assets, liabilities, and net worth in a way that will help you relate them to your business. Learn how to create a balance sheet for your company and how to use it to analyze your business’ liquidity and leverage.

The Purpose of Financial Statements

The purpose of financial statements is to communicate. Financial statements tell you and others the state of your business. The three most commonly prepared financial statements for a small business are a balance sheet, an income statement, and a cash flow statement.

A balance sheet (also known as a statement of financial position) is a formal document that follows a standard accounting format showing the same categories of assets and liabilities regardless of the size or nature of the business. The balance sheet you prepare will be in the same format as IBM’s or General Motors’. Accounting is considered the language of business because its concepts are time-tested and standardized. Even if you do not utilize the services of a certified public accountant, you or your bookkeeper can adopt certain generally accepted accounting principles (GAAP) to develop financial statements.

The strength of GAAP is the reliability of company data from one accounting period to another and the ability to compare the financial statements of different companies. The standardization introduced by commonly defined terms is responsible for this reliability. To help you get a grip on accounting terminology, terms are defined as they are introduced and a glossary is included for reference.

Garbage-in, garbage-out. The integrity of any financial statement is directly related to the information that goes into its construction. You may want to consider revamping your record-keeping, if necessary, before you begin compiling financial statements.

This Business Builder will explain what data is necessary for accurate financial statements, but answering the following questions might be a good place to start:

- Are the financial records for all (or most) of the company’s assets (equipment, inventory, furniture) and liabilities (personal loans, bank loans) in one place?

- Is there a record of the amounts and sources of cash expended to begin the business and acquire inventory?

- Do you know what is currently owed to the bank, creditors, or others?

- Do you know how much of what is owed is due in the next 12 months?

- Can you estimate what percentage of accounts receivable may not be received?

Why Create a Balance Sheet?

A balance sheet provides a snapshot of a business’ health at a point in time. It is a summary of what the business owns (assets) and owes (liabilities). Balance sheets are usually prepared at the close of an accounting period such as month-end, quarter-end, or year-end. New business owners should not wait until the end of 12 months or the end of an operating cycle to complete a balance sheet. Savvy business owners see a balance sheet as an important decision-making tool.

Over time, a comparison of balance sheets can give a good picture of the financial health of a business. In conjunction with other financial statements, it forms the basis for more sophisticated analysis of the business. The balance sheet is also a tool to evaluate a company’s flexibility and liquidity.

how to prepare a balance sheet

A balance sheet is a statement of a firm’s assets, liabilities and net worth. The key to understanding a balance sheet is the simple formula:

Assets = Liabilities + Net Worth

All balance sheets follow the same format: If it is in two columns, assets are on the left, liabilities are on the right, and net worth is beneath liabilities. If it is in one column, assets are listed first, followed by liabilities and net worth.

Assets

In this section, each type of asset is explained. A worksheet is provided for your use in assembling a balance sheet for your business on Page 9.

All balance sheets show the same categories of assets: current, long-term (fixed) assets, and other assets. Assets are arranged in order of how quickly they can be turned into cash. Turning assets into cash is called liquidity.

Current assets include cash, stocks and bonds, accounts receivable, inventory, prepaid expenses and anything else that can be converted into cash within one year or during the normal course of business. These are the categories you will use to group your current assets. This Business

Builder focuses on the current assets most commonly used by small businesses: cash, accounts receivable, inventory and prepaid expenses.

Cash is relatively easy to figure out. It includes cash on hand, in the bank and in petty cash.

Accounts receivable is what you are owed by customers. The easy availability of this information is important. Fast action on slow paying accounts may be the difference between success and failure for a small business. To make this number more realistic, you should deduct an amount from accounts receivable as an allowance for bad debts.

Inventory may be your largest current asset. On a balance sheet, the value of inventory is the cost to replace it. If your inventory were destroyed, lost or damaged, how much would it cost you to replace or reproduce it? Inventory includes goods ready for sale, as well as raw material and partially completed products that will be for sale when they are completed.

Prepaid expenses are listed as a current asset because they represent an item or service that has been paid for but has not been used or consumed. An example of a prepaid expense is the last month of rent of a lease that you may have prepaid as a security deposit. It will be carried as an asset until it is used. Prepaid insurance premiums are another example of a prepaid expense. Sometimes, prepaid expenses are also referred to as unexpired expenses.

On a balance sheet, current assets are totaled and this total is shown as the line item:

Total Current Assets.

Step 1: Complete the Current Asset Section of the worksheet.

Fixed Assets are also known as long-term assets. Fixed assets are the assets that produce revenues. They are distinguished from current assets by their longevity. They are not for resale. Many small businesses may not own a large amount of fixed assets. This is because most small businesses are started with a minimum of capital. Of course, fixed assets will vary considerably and depend on the business type (such as service or manufacturing), size and market.

Fixed assets include furniture and fixtures, motor vehicles, buildings, land, building improvements (or leasehold improvements, if you rent), production machinery, equipment and any other items with an expected business life that can be measured in years.

All fixed assets (except land) are shown on the balance sheet at original (or historic) cost less any depreciation. Subtracting depreciation is a conservative accounting practice to reduce the possibility of overvaluation. Depreciation subtracts a specified amount from the original purchase price for the wear and tear on the asset. It is important to remember that original cost may be more than the asset’s invoice price. It can include shipping, installation, and any associated expenses necessary for readying the asset for service.

This Business Builder assumes that you are familiar with depreciation, have already selected a depreciation method and are comfortable with its application. If you are not familiar with depreciation, you can still prepare a balance sheet. It will provide you with similar benefits, but it will not be in conformance with GAAP.

This section concentrates on the categories of fixed assets common to most small businesses: furniture and fixtures, motor vehicles, and machinery and equipment.

- Furniture and fixtures is a line item that includes office furniture, display shelves, counters, work tables, storage bins and other similar items. On the balance sheet, these items are listed at cost (plus related expenses) minus depreciation.

- Motor vehicles is a line item to list the original value (less depreciation) of any motor vehicle, such as a delivery truck, that is owned by your business.

- Machinery and equipment are vital to many businesses. If you are a manufacturing firm, this could be your largest fixed asset. Like the other fixed assets on the balance sheet, machinery and equipment will be valued at the original cost minus depreciation.

- Other assets is a fourth category of fixed assets. Other assets are generally intangible assets such as patents, royalty arrangements and copyrights.

Step 2: Complete the Fixed Assets Section and the Other Assets Section of the worksheet and compute the total assets of your business.

Liabilities

In this section, two types of liabilities will be explained. You will continue to use the worksheet at the end of this section. Liabilities are claims of creditors against the assets of the business. They are debts owed by the business.

There are two types of liabilities: current liabilities and long-term liabilities. Liabilities are arranged on the balance sheet in order of how soon they must be repaid. For example, accounts payable will appear first as they are generally paid within 30 days. Notes payable are generally due within 90 days and are the second liability to appear on the balance sheet.

Current liabilities are accounts payable, notes payable to banks (or others), accrued expenses (such as wages and salaries), taxes payable, the current due within one year portion of long-term debt and any other obligations to creditors due within one year from the date of the balance sheet. The current liabilities of most small

businesses include accounts payable, notes payable to banks and accrued payroll taxes.

- Accounts payable is the amount you may owe any suppliers or other creditors for services or goods that you have received but not yet paid for.

- Notes payable refers to any money due on a loan during the next 12 months.

- Accrued payroll taxes would be any compensation to employees who have worked, but have not been paid, at the time the balance sheet is created.

Long-term liabilities are any debts that must be repaid by your business more than one year from the date of the balance sheet. This may include startup financing from relatives, banks, finance companies or others.

Step 3: Complete the Liabilities Section of the worksheet. Compute Total Liabilities.

Net Worth

The formula that defines the balance sheet is:

Assets = Liabilities + Net Worth

The formula can be transposed to yield a definition of net worth:

Net Worth = Assets – Liabilities

Net worth is what is left over after liabilities have been subtracted from the assets of the business. In a sole proprietorship, it is also known as owner’s equity. This equity is the investment by the owner plus any profits or minus any losses that have accumulated in the business.

Step 4: Complete the Net Worth Section of the worksheet. When this is done, you should have a completed balance sheet for your business.

In the next section, four simple formulas will be introduced to enhance the information contained on the balance sheet.

The information in the preceding section will help you develop a balance sheet of your own.