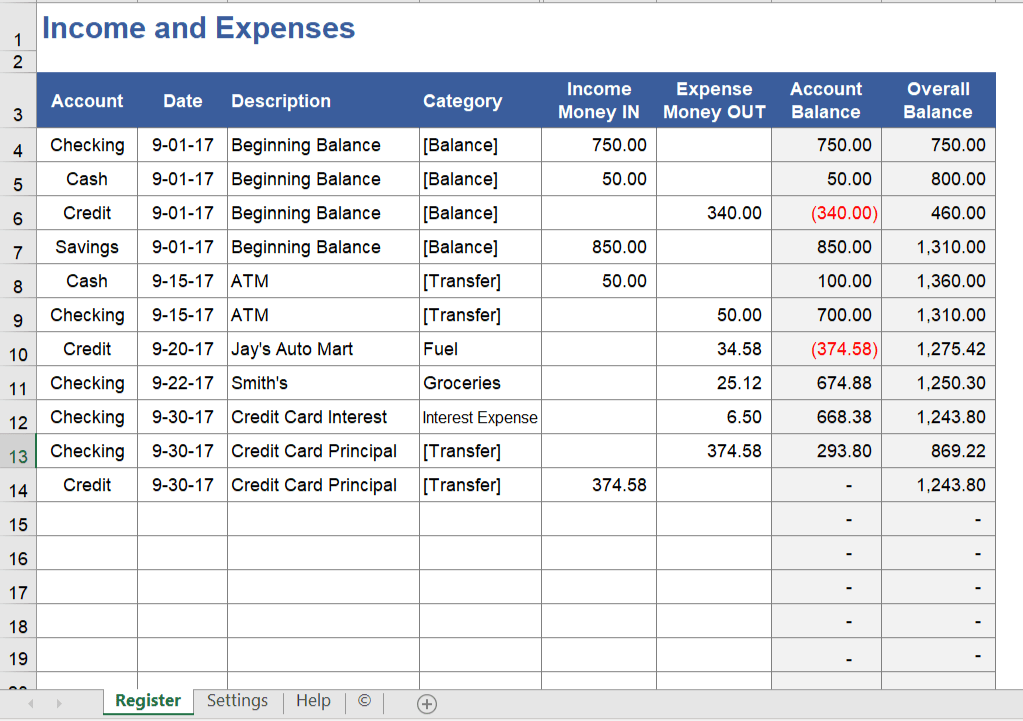

Best Income and Expenses Management Excel Template

Tracking your expenses and income is one of the important steps in handling your money. This spreadsheet is designed for personal finance and printable benefits and it is also modified as an editable worksheet.

Although we have other finance and budget templates for every budget category, if you are looking for a very easy way to keep track of your expenses that stay steady with your income, this spreadsheet helps you get started.

How to Use this Income & Expense Excel Template?

We tried to make the template as easy to use as possible. You can edit all categories in the Settings spreadsheet.

This spreadsheet doesn’t calculate the sum of income and expenses by category for you. However, if you know how to use Excel you could use a pivot table to analyze your income and expenses.

Step 1: Clear the trial data, but don’t clear the formulas in the column.

The data is there to give an example of how you can enter beginning categories, transfer money, and enter some expense transactions. It is not essential to use the sheet for all your accounts in one register. In conclusion, duplicate the worksheet and use one spreadsheet for each of your accounts if you wanted.

Step 2: Enter starting balances for the accounts you want to record.

This isn’t required, but if you wanted to keep records of each account balance select this. The hidden column that you can unhide will show your current Account Balance.

Step 3: Edit the Accounts and Categories.

Check categories shown in the drop-down lists for each column, these are just for convenience.

Step 4: Reform the Income and Expense Worksheet daily.

If you are using the template on your phone, you can edit it. If you are using the printed sheet, you can take it with you in your wallet and edit it whatever you make a purchase. For example, make notes about your spending, and then edit your worksheet at home.

Step 5: Use Pivot Table to examine Income and Expenses

This template shows an example of the type of report you can generate easily using a Pivot Table in Excel.

What are Income and Expenses?

Income-

If you have a stable income, it’s good for you! This step is easy.

Let’s see about unstable income. The first step in dealing with improper income is to create a monthly cash flow plan.

Cash Flow Projection decide how much you need each month, cash flow statement – is a document that is used to track the amount of income you reasonably expect to bring in and what is going out.

These expenses should be listed in sequence of priority. Once you categorize each of your expenses, it makes it helpful to decide what has to be paid, or whatnot.

Expenses-

Constant Expenses: These are expenses in your monthly budget that never changes. For instance, your all bill payments will always be $300 a month. Your loan always is $600 a month. There is no other option to reduce them.

Necessary expenses are also usually the priority expenses on your cash flow statement. These expenses are paid on monthly basis without changing the amount.

Examples are:-

- Car/Rent Payment

- Life Insurance

- Cable/Internet

- Variable Expenses: These expenses vary monthly Variable costs are not predictable. For example, one month you might spend $100 on clothes, the next month you might spend $500.

- Examples are:-

- Food/Groceries

- Cloths

- Household Items