Streamline Your Business Finances with a Free Accounts Payable Excel Template

Managing accounts payable is a critical aspect of a company’s financial health. A free, ready-to-use accounts payable template in Excel can help you efficiently record your payable invoices and maintain accurate financial records. In this blog post, we’ll discuss the importance of accounts payable, its role in business operations, and how a downloadable template can simplify the process.

Understanding Accounts Payable

Accounts payable represents the money owed by a business to its suppliers and is recorded as a liability on the company’s balance sheet. This financial obligation is separate from notes payable liabilities, which are debts usually established through formal legal documents. An accounts payable ledger includes a list of suppliers, invoice details, payment dates, and outstanding balances.

The Role of Accounts Payable in Business Operations

The accounts payable (AP) process encompasses three main functions:

- Reporting and paying external business expenses

- Making internal payments, such as reimbursements and petty cash distribution

- Monitoring and processing vendor payments

Additionally, the AP department is responsible for managing travel arrangements, maintenance expenses, and corporate taxes. By verifying purchases and analyzing aging reports, the AP department helps ensure the company’s cash and assets are safeguarded against fraudulent or duplicate payments.

The Accounts Payable Process

The end-to-end AP process consists of four steps:

- Receiving bills

- Checking bill details against purchase orders (PO)

- Recording invoices in the accounting system

- Reviewing and making timely bill payments

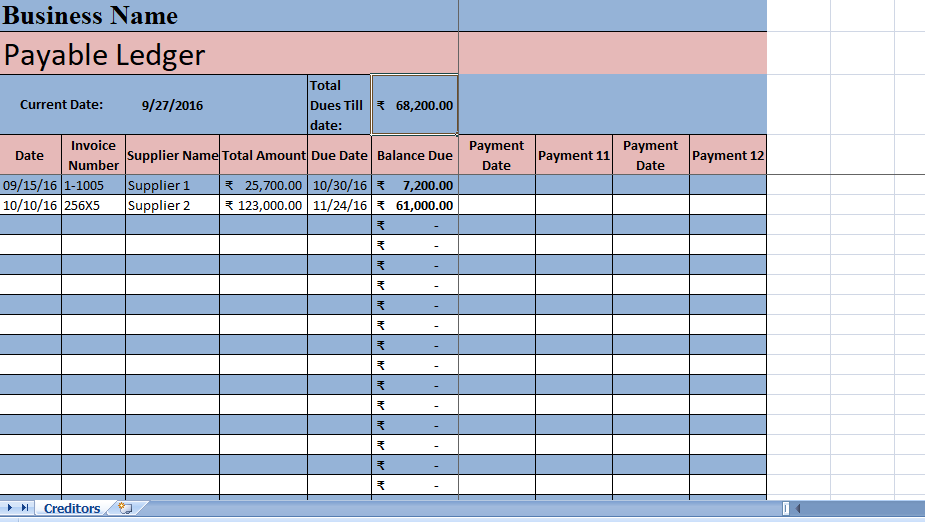

Using an Accounts Payable Excel Template

A free accounts payable template simplifies the management of payable invoices. With predefined formulas and functions, you can easily input invoices, and the template will automatically display the outstanding balance for each invoice. This user-friendly tool helps streamline the AP process and maintain accurate financial records.

Benefits of Using This Template

- Efficient record-keeping: The template allows you to easily track and manage payable invoices in one centralized location.

- Time-saving: Predefined formulas and functions automate calculations, saving you time and reducing the risk of manual errors.

- Improved financial accuracy: By using the template, you can ensure your company’s payable invoices are recorded accurately, helping maintain a healthy financial status.

- Enhanced organization: The template organizes your payable invoices in a clear and concise manner, making it easy to review and analyze your financial obligations.

Conclusion

An accounts payable Excel template is a valuable tool for businesses looking to streamline their financial management processes. By efficiently tracking and managing payable invoices, this free, easy-to-use template helps you maintain accurate financial records and safeguard your company’s assets. Download a free accounts payable template today and experience the benefits of organized, efficient financial management.