Demystifying Adjustable Rate Mortgages with Excel: A Free Calculator Template

In the diverse world of home financing, Adjustable Rate Mortgages (ARMs) have earned their place as a viable mortgage option for many homeowners. Yet, understanding the intricacies of ARMs can be a daunting task. This post presents a free, fully customizable Adjustable Rate Mortgage calculator template in Excel to simplify this process. Complete with graphs, charts, loan information, and rate adjustments, this user-friendly tool can help home buyers, real estate professionals, and financial advisors alike.

What is an Adjustable Rate Mortgage (ARM)?

An Adjustable Rate Mortgage is a type of mortgage where the interest rate can change over the loan’s lifetime. It starts with an initial fixed-rate period, followed by a variable rate period where the interest rate adjusts periodically. Unlike a Fixed Rate Mortgage, where the interest rate remains the same throughout the loan term, an ARM can lead to changes in monthly payments due to interest rate fluctuations.

Why Use an ARM Calculator?

An ARM calculator helps prospective borrowers understand how interest rate changes may affect their future monthly mortgage payments and the total interest they’ll pay over the loan term. It provides valuable insights into potential payment increases or decreases and can assist in making informed decisions about whether an ARM is the right choice.

Who Uses an ARM Calculator?

- Homebuyers and homeowners: Use it to understand the potential impact of interest rate changes on their monthly payments and total mortgage cost.

- Real estate professionals: Use it to provide clients with a clear picture of the implications of choosing an ARM.

- Financial advisors: Use it to help clients make informed financial decisions about their mortgage options.

Benefits of Using an ARM Calculator

- Future projections: An ARM calculator allows users to see how potential rate adjustments might impact their monthly payments and overall loan cost.

- Budgeting: By providing estimates of future payments, it helps borrowers to plan their budget more effectively.

- Informed decision-making: It empowers borrowers to make more informed decisions about the mortgage type that best suits their financial situation.

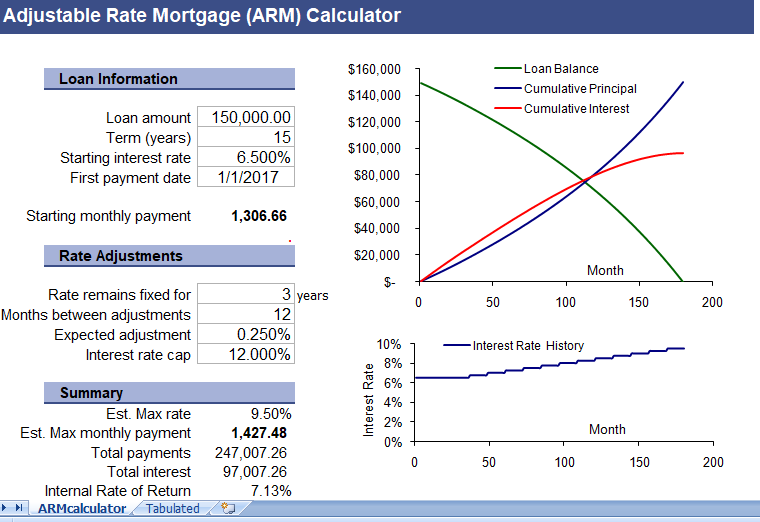

Navigating the Adjustable Rate Mortgage Calculator Template

Our free, easy-to-use Adjustable Rate Mortgage calculator in Excel is designed to make understanding ARMs simpler. Here’s how to use it:

1. Input Loan Information

In the dedicated section, enter the following loan details:

- Initial loan amount

- Loan term

- Initial interest rate

- Initial fixed-rate period

- Estimated rate adjustment

- Maximum and minimum interest rates

2. Review Rate Adjustments

The template automatically calculates the potential rate adjustments based on the input data. It shows the changes in interest rates and monthly payments over the loan term.

3. Analyze Graphs and Charts

The template provides visually appealing graphs and charts, making it easy to visualize how the interest rate and monthly payments might change over the loan term.

4. Evaluate Loan Summary

The template offers a comprehensive summary of the total interest paid, total payments made, and the estimated maximum monthly payment.

5. Scenario Analysis

You can manipulate various parameters, such as estimated rate adjustments, to see how different scenarios might impact the loan.

The Value of Our ARM Calculator Template

Our ARM calculator template simplifies the complexity of adjustable rate mortgages by providing a clear picture of potential payment scenarios. It gives users the ability to visualize and anticipate changes in their loan, promoting greater financial understanding and planning. With its straightforward design and robust features, it’s an invaluable tool for anyone considering an Adjustable Rate Mortgage.

Unlock the potential of informed decision-making in your mortgage journey with our free Excel Adjustable Rate Mortgage Calculator template. Home finance doesn’t have to be complex – with the right tools, it can be a breeze.

Customizing the Adjustable Rate Mortgage Calculator Template

Flexibility and adaptability are key strengths of our ARM Calculator template. Here’s how you can make it work even more effectively for you:

1. Adjust the Frequency of Rate Change

You can specify how often the rate change occurs – annually, semi-annually, quarterly, or monthly. Depending on the specifics of your ARM, this flexibility can provide more precise projections.

2. Add More Scenario Analysis

By duplicating the original worksheet, you can maintain multiple versions for different scenarios. This can help you compare different loan structures, rate changes, and other variables, aiding in a more comprehensive analysis.

3. Incorporate Additional Financial Parameters

Customize the template to include additional financial parameters, such as PMI (Private Mortgage Insurance), property taxes, or homeowners insurance, for a more inclusive view of your monthly payment.

Insights from the Graphs and Charts

The power of visual data cannot be overstated, and our ARM calculator exploits this power fully. Here’s what you can extract from the graphs and charts:

- Payment Timeline: This graph will give you a clear visual understanding of how your payments could change over time based on the interest rate adjustments.

- Interest Rate Fluctuation: Visualize how the interest rate could change over the loan term, providing a clearer picture of the variable rate phase.

- Payment Distribution: The pie chart displays the proportion of total payments that go towards the principal and the interest, providing a useful snapshot of your loan economics.

Making the Most of Our ARM Calculator

While our ARM calculator provides a wealth of information, remember it’s only as accurate as the data you input. Changes in the economy and mortgage market can affect interest rates, and it’s important to use realistic estimates when planning for the future.

Also, use this tool as a part of your larger financial planning process. Combine it with other financial tools, like budgeting worksheets and savings calculators, to create a comprehensive financial strategy.

The Bottom Line

Armed with our free Adjustable Rate Mortgage Calculator, understanding and planning for an ARM can be much simpler. Whether you’re a prospective homebuyer, a real estate professional, or a financial advisor, this template can help illuminate the financial path ahead, providing peace of mind and supporting smart, informed decisions. Experience the confidence that comes with financial clarity – download our free Excel ARM Calculator template today.