The Annuity Calculator is based on the time-value-of-money or “finance theory” definition of annuity. As a result, an annuity is a fixed payments over a certain period of time. However This annuity calculator was not designed to analyze an Insurance Annuity which can mean something entirely different from the finance theory definition.

Download This Template for Free

Because of the general definition of annuity, an Annuity Calculator may calculate the future value of a savings investment plan. Certainly I’ve already created a few savings calculators, so instead, I created the following Annuity Calculator to answer general questions related to taking a withdrawal or annuity payment from a fixed-rate savings account.

Deferred Annuity Formula

Moreover Each of these questions is very easy to solve for using built-in Excel formulas, which I will explain in detail below. So you can just dive into the Annuity Calculator right now.

Subsequently, to figure out whether the initial payout is sufficient, you may want to use the Inflation Calculator to compare what you think you could live on based on today’s prices to what you may need the first year of your retirement.

Annuity calculator spreadsheet

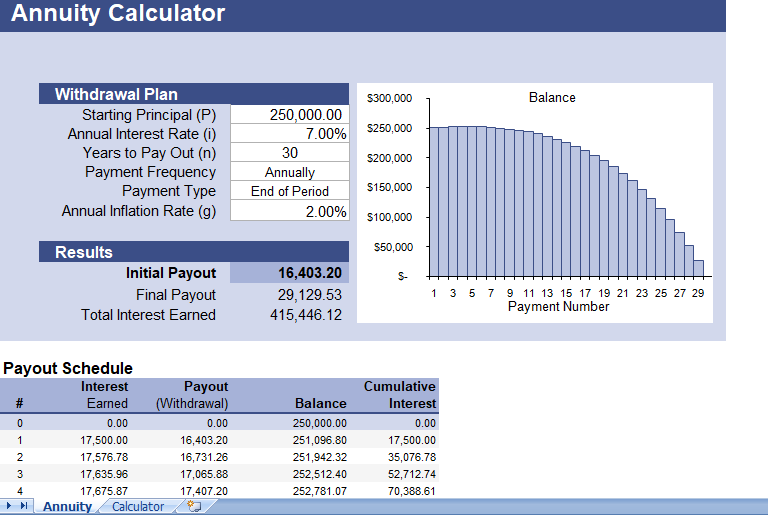

Above all this Annuity Calculator spreadsheet contains two worksheets.

Moreover the first worksheet shows a yearly cash flow table and a graph of the balance. It solves for the annuity payment amount.

However, in the second worksheet shown in the screenshot on the left, you can solve for the annuity payment, the initial principal, or the number of years to pay out.

So, Both worksheets allow you to specify an annual inflation rate which will cause the withdrawal or annuity payment to increase over time.

Ordinary Annuity Formulas

In short as a financial term use for time-value of money calculations, an annuity is the name for the uniform series cash flow. So, It is represented as a payment of amount A starting at t=1 and remaining constant through t=n, as shown in the cash flow diagram

Annuity Calculator Formulas

In short the formulas for solving for the annuity payment, annuity payout period, and initial savings are listed below. However you can consult the following table for the definitions of the variables used in the equations.

| annuity factor formula or its Variables | |

|---|---|

| P | Initial Principal |

| A | Annuity Amount |

| Eo | Exponential Gradient Amount |

| n | Number of annual Annuity Payments |

| i | Annual Interest Rate (effective rate) |

| g | Annual Inflation Rate |

| type | 0 = Ordinary Annuity (Payments at end of period) 1 = Annuity Due (Payments at beginning of period) |

Adjusting the Annuity Payment for Inflation or annuity due formula

The Annuity Calculator is design for use as a retirement annuity calculator or pension annuity calculator, whereas withdrawals can be done. Certainly A very basic fixed-annuity calculator assumes the withdrawals are constant for n years. However, the reality is that the withdrawal amount will most likely need to increase each year due to inflation.

Likewise don’t get the inflation adjustment of the withdrawal amount mixed up with the terms variable annuity or adjustable annuity. Mostly these terms usually apply to the interest rate and are typically used to describe Insurance Annuities.

Moreover without going through the derivation, suffice it to say that to use the PV, FV, PMT, and NPER formulas above for an inflation adjusted annuity payment, or more accurately an exponential gradient series, you substitute the variable Eo for A and z-1 for the annual interest rate where

z = (1+i)/(1+g)

Example: Solving for the Initial Value, Eo

Mostly for the inflation-adjusted calculations in the Annuity Calculator, the annual payment that is calculated using the PMT function is the value Eo (see the cash flow diagram in Figure 2 for clarification). If type=1 (Payments at Beginning of Period), Eo represents the first annual payment. However, if type=0, the first annual payment is Eo*(1+g).