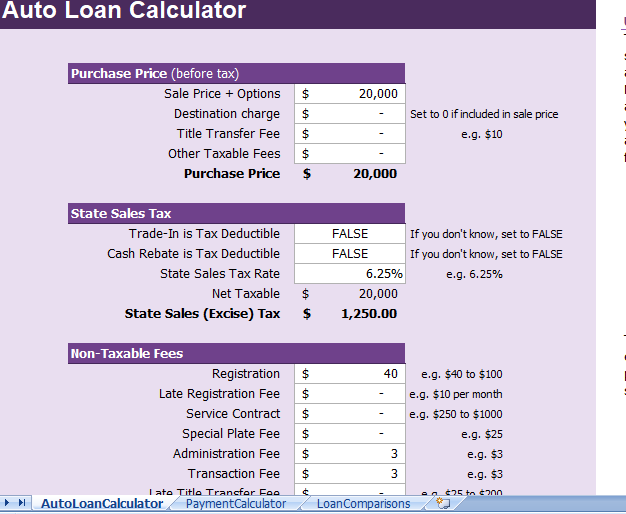

Use free Auto Loan Calculator to estimate the overall cost of purchasing a car, including the sales price, sales tax, and many charges and fees that creep up on you when you finally decide to make the purchase. The worksheet calculates total Loan Amount, taking into account your down payment, trade-in, or cash rebate. You can then use the Auto Loan Payment Calculator to create an amortization schedule and analyze different types of loans by changing the loan amount, interest rate, term of the loan, and the payment frequency.

Using the Auto Loan Calculator

Information about how to use the loan calculators are contained within the spreadsheet, mostly as cell comments. Basically, you just have to enter values in the white-background cells, and see what happens to the other numbers. In the Payment Calculator, you can also enter values in the yellow cells. The spreadsheet is unlocked, to give you complete freedom to modify it as needed for personal use. However, make sure you know how the equations and formulas work before you try to branch out on your own.

Buying vs. Leasing Calculators

Our auto loan calculator spreadsheet does not contain a calculator for comparing leasing vs. buying.

Cash Back vs. Low-Interest Financing

Sometimes, the auto manufacturer offers incentives in the form of a cash rebate or lower interest rate, but usually not both same time. The auto loan calculators is a spreadsheet that let you specify a cash rebate and the annual interest rate. You can save two different versions of the spreadsheet in order to make comparisons.

Car loan payment calculator

Our Auto Loan Calculator gives you complete flexibility how you make additional payments. In case you want to pay off your loan early and avoid paying much interest.

IMPORTANT: Many auto loans are actually “Simple Interest Loans” that accrue interest daily. Our Auto Loan Calculator is great for running quick calculations, but if the loan is actually a simple interest loan, then you may get more accurate numbers by using our Simple Interest Loan Calculator.

Auto calculator

This Microsoft Excel workbook contains three different worksheets .

1. Use the Auto Loan Calculator worksheet to calculate the amount you need to finance, based on the sales price of the car, destination charge, fees, sales tax, down payment, cash rebate, and trade-in value of an older auto.

2. Use the Payment Calculator worksheet to create an amortization table based on auto loan amount, annual interest rate, term of the loan, and payment frequency. However making extra payments can help you pay off your car loan early and reduce the amount of total interest paid.

3. The third worksheet takes the inputs from the loan payment calculator and creates graphs showing you different interest rates. Number of payments, or the amount of down payment and how it affect the monthly payment and total amount of interest.