About Balance Sheet Report Template

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It’s made up of two main sections: assets and liabilities. The assets section lists all of the company’s resources, including cash, accounts receivable, inventory, and fixed assets. The liabilities section lists all of the company’s obligations, including accounts payable, loans, and taxes.

Benefits of using Editable Balance Sheet Template in Excel

One of the key benefits of using a balance sheet template is that it allows you to easily track and analyze your company’s financial performance over time. With a well-designed template, you can quickly and easily see how your company’s assets and liabilities have changed over time and identify any trends or patterns that may be cause for concern.

This templates come with pre-formatted with all of the necessary sections and calculations already in place, making it easy to input your own data and create a professional-looking balance sheet.

Features of this editable excel template

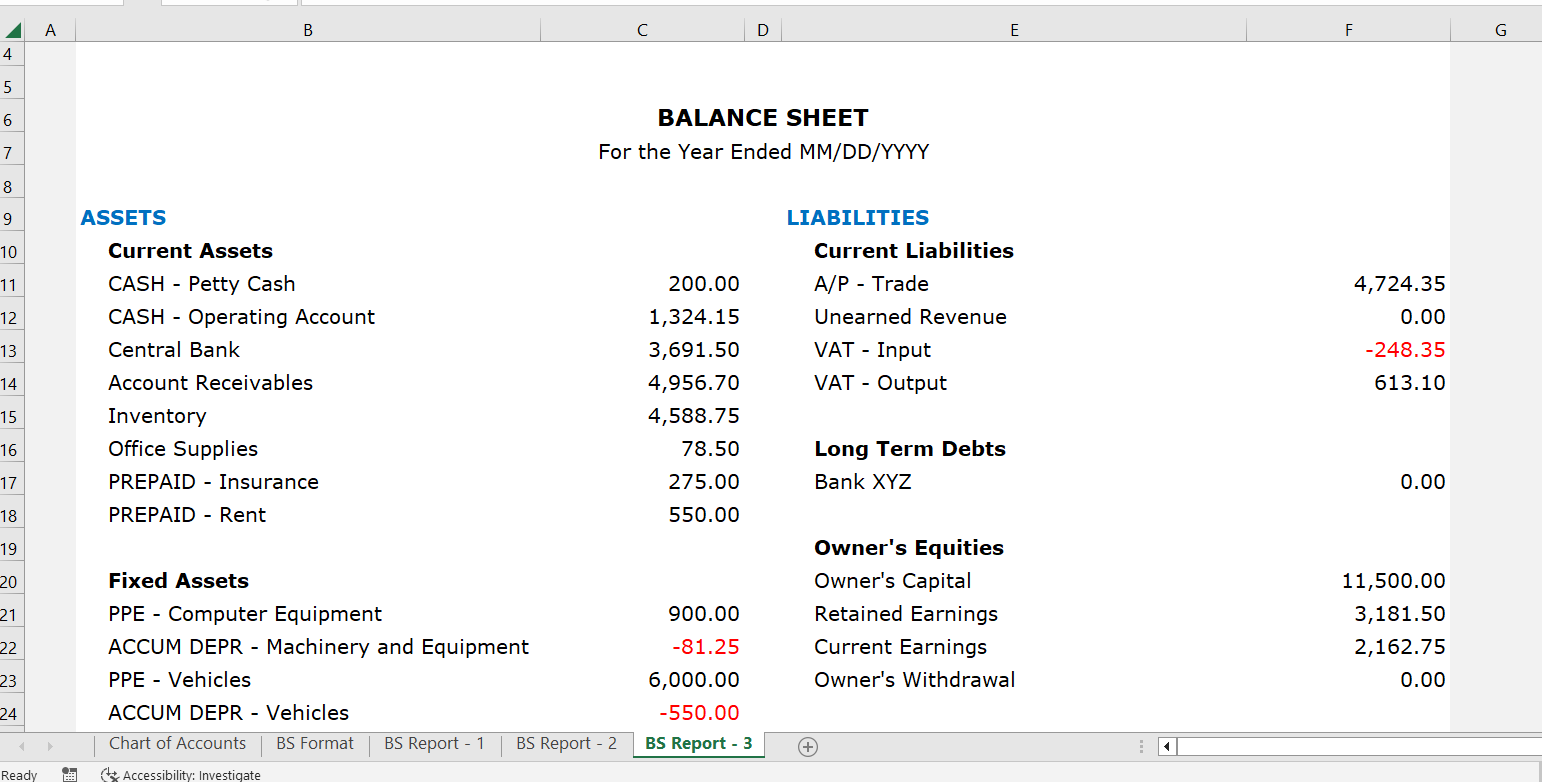

It includes all of the necessary sections and calculations for your business. For example, you’ll want to make sure that the template includes sections for both current and non-current assets and liabilities, as well as a section for equity. Additionally, you’ll want to make sure that the template includes calculations for key financial ratios, such as the current ratio and the debt-to-equity ratio.

The template includes a chart of accounts, which is a list of all the accounts in the accounting system. The accounts are typically organized into categories such as assets, liabilities, and equity. Each account should have a unique account number for identification and classification purposes.

The template also include a brief description of each item on the balance sheet. This also include information about the nature of the asset or liability, as well as the amount and any relevant details.

What are the component of a Balance sheet:

- Assets: Assets are resources owned by the company that have monetary value and are expected to provide future economic benefits. Examples of assets include cash, investments, property, equipment, and inventory.

- Liabilities: Liabilities are obligations or debts that the company owes to others. Examples of liabilities include loans, accounts payable, taxes, and salaries.

- Equity: Equity represents the residual interest in the assets of the company after liabilities have been deducted. Examples of equity include common stock, retained earnings, and capital surplus.

By understanding the items on a balance sheet and how they are organized in the chart of accounts, businesses can better manage their financial information and make informed decisions about their operations and growth. An editable balance sheet template can provide a helpful framework for tracking and organizing this information

Assets

Economic resources owned by the company, which in future is expected to provide more benefits to the company. Examples for those assets are :

- Current assets are economical assets in the time being and near future. Some examples are account receivables, cash, receivables, inventories, prepaid expenses, equipment etc.

- Long-term assets are assets where economical benefits can be taken in the long term, such as buildings, lands, stocks, bonds, etc.

- Fixed assets are assets from production or supply of goods/services of a company, such as property, buildings, factories, production equipment, office equipment, operational vehicles, computers and so on.

- Intangible assets are the types of assets without physical form, such as trademarks, goodwill (good company name), and patents.

Liabilities

This element is opposite of assets where it usually corresponds with debts. Moreover, There are two common classifications for this category :

- Short-term liabilities are debts where any companies must pay in less than one year, such as trade payable, notes payable, dividends, notes payable.

- Long-term liabilities are debts where any companies must pay within specified period of more than one year, such as bank debt, bonds, and mortgages, pension liabilities, and long-term notes payable.

Capital

Capital corresponds with net asset, usually beginning asset, that also come from company’s owners to build company and its operations after expenses.

General balance sheet report will show assets and liabilities/capital as two main parts where their values must be equal. All three are related to following basic accounting principles:

Assets = Liabilities (Payable) + Capital

If values are not equal, then report is incorrect. It is not difficult to create this type of report for accounting people. But, for non accounting people, it should give them some headache since there are plenty of financial criteria needs to be put in correct values and categories again.