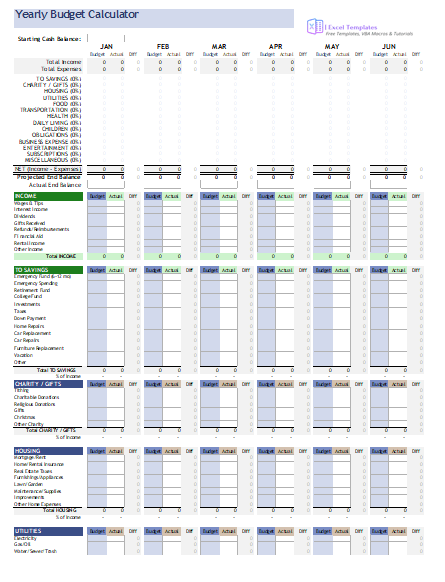

The Yearly Budget Calculator Excel Template or Budget Estimator Excel Template is a simple Excel spreadsheet with embedded basic excel formulas. Small Business owners, accountants and Financial planning analysis team can download Budget Calculator excel template for budget forecasting and prepare cashflow forecast or rolling forecast. Further, you can edit or add expense type, just make sure to use row operations (copying/cutting/inserting/deleting entire rows). Also, you must double-check formulas if you make any major changes or if you change the order of the categories.

So, before you download this template, you must refresh your understanding of Budget Management.

We’ll talk about,

- Financial Budget

- Master Budget

1. What is a Financial Budget?

A financial budget in budgeting means forecasting the income and expenses of the business for a long-term and short-term basis. Accuracy of the projections of cash flow help the business achieve to its targets in a right way.

Financial budget includes a detailed balance sheet budget, cash flow forecasting, the sources of incomes and expenses of the business, etc. The evaluation of incomes and expenses can be done on a monthly, quarterly, half-yearly or annual basis, depending companies policies and processes. A financial budget is a very powerful tool to achieve the long-term goals of any business. Importantly, it also keeps the shareholders and other members of the organization updated about the functioning of the business.

2. What is a Master Budget?

The master budget is the summation of all Functional/ department level budgets produced by a company’s, and it also includes financial statements budget. Financial statement budget means cash flow forecast, balance Projected Balance sheet, Project Profit and Loss, and financing plan. Further, The master budget is presented in either a monthly or quarterly format, and covers a company’s entire fiscal year.

It is an explanatory statement which explains the company’s strategic business plan. It explains, how companies objectives will be met in future, how the master budget will assist in accomplishing specific goals. Further, what management actions have to be taken to achieve the budget. In fact, There may also be a discussion of the headcount changes that are required to achieve the budget.

A master budget is the centralize planning tool that helps management team to direct the activities of a company. It also, judge the performance of its all business functions. It is customary for the senior management team to review a number of iterations of the master budget and incorporate modifications until it arrives at a budget that allocates funds to achieve the desired results. Hopefully, a company uses participative budgeting to arrive at this final budget, but it may also be imposed on the organization by senior management, with little input from other employees.