Budget calendar daily

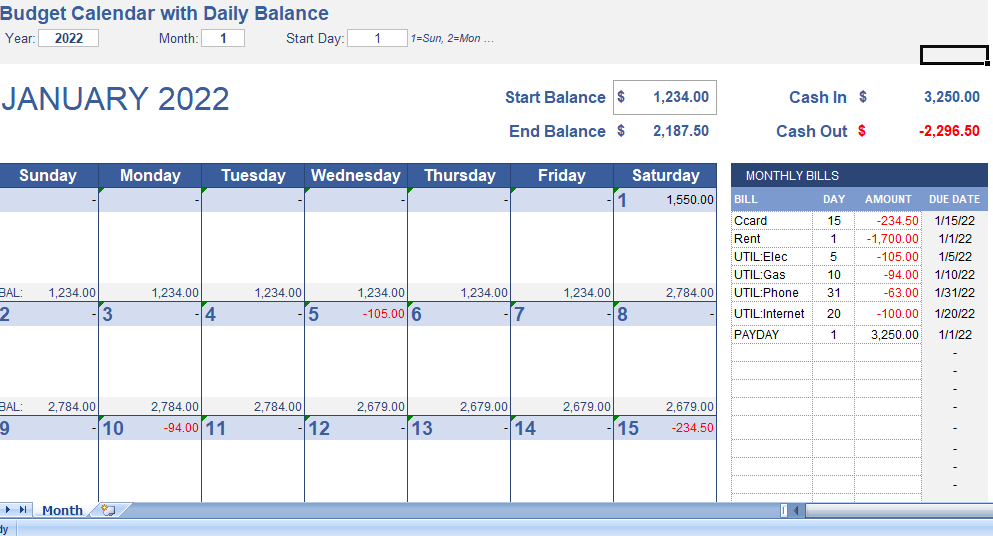

Thus, A budget calendar daily is a calendar that keeps track of payment amounts and dates. Also, It’s a helpful way to estimate how much money will flow in and out in a given month. You can also use the traditional or digital calendar.

Your budget calendar must include:

-

Income. If you earn regular paychecks, or at least know when to expect the next one, add your paydays to the calendar.

-

Bills. Make note of all monthly expenses — like rent or cell phone and credit card bills — plus infrequent costs, such as semi annual car insurance payments and yearly subscription charges or bills.

-

Savings contributions. Scheduling transfers to any account can help you save up for an emergency fund, wedding or other savings goal.

You can certainly log into smaller and irregular transactions, too. However, it might be difficult to pencil in every cup of coffee or anticipate how much you’ll spend at the grocery store for monthly budget calendar.

How to Use the Budget Calendar

I created this template from my Monthly Calendar Template, so it’s best to think of this as simply a calendar that sums up numbers you enter.

Start by updating the year and the month on the top of the worksheet. You can also make duplicate copies of calendar worksheet to use for different months.

Each day of calendar is made up of two columns. Use these column on the left for the description, and the column on the right for the expense amount. Also monthly planner with budget pages.

DESCRIPTION

This new version shows the daily balance and also lets you schedule monthly bills by entering day of the month that the bill is due and the amount. Make copies of worksheet to set up a spreadsheet that will work for an entire year.