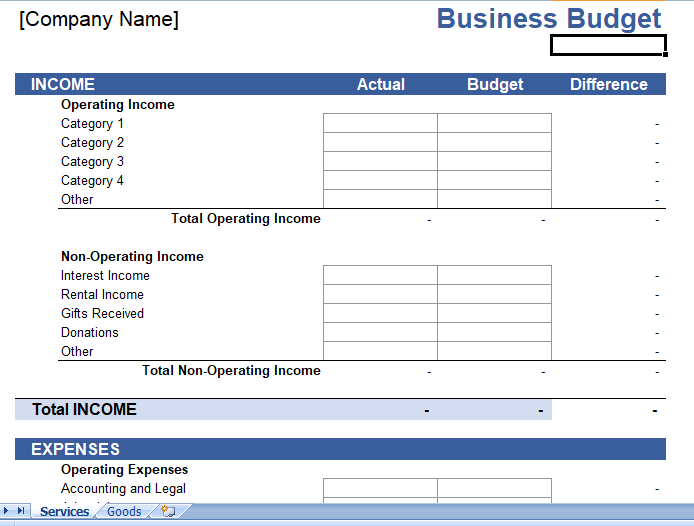

Compare Your Budget Variance Analysis

You can download this free excel template for your business and compare your budget with actuals. Excel template Budget Variance Analysis helps you to assess your business strategy and manage your expenses with respect to revenue.

Benefits of using Budget Variance Analysis Excel template

- Helps you to assess your financial position your business

- Monitor your expenses

- Take necessary action and scale up sales as per budget

- Track your overhead expenses

Budget Comparison helps you to take action to grow your business, Increase additional inventory and assets, and avoid bankruptcy.

It’s possible to modify a personal budget spreadsheet to apply to a business, but if you are using our Income Statement Template, you’ll want to use the business budget spreadsheet so that you can create a budget that is parallel to your income statement.

Features of Budget Variance Analysis

You can compare business budget as per your requirement monthly, yearly, quarterly and annually.

What is the Importance of a Business Budget?

A business budget gives you a clear picture of your expenses and income. It helps you make crucial decisions like enhancing marketing, lowering costs, employing people, buying equipment, and improving efficiencies in other ways. It also specifies your company’s financial and operational objectives. Thus, it may be consider an action plan that aids in resource allocation, performance evaluation, and plan formulation. Therefore, let’s delve deeper into understanding the importance of a business budget and types of budgets.

What are the requirements of a Business Budget?

The basic method of creating a budget entails creating a monthly list of your company’s fixed and variable costs and then deciding how to allocate funds to meet goals.

Specialized budgets are frequently used by businesses to evaluate specific areas of operation. For example, a cash flow budget forecasts your company’s cash inflows and outflows over a set period. Its primary function is to forecast your company’s capacity to take in more money than it pays out.

The majority of businesses have fixed costs that are unrelated to revenue, such as:

- The cost of constructing a building or office, as well as the cost of a mortgage

- Payments on a loan (if using debt financing)

- Insurance

- Leasing a vehicle (or loan payments if the vehicle is purchased)

- the necessary equipment (machinery, tools, computers, etc.)

- Paystubs (if employees are on salary)

- Charges for utilities such as landline phones and internet

Depending on the level of company activity, variable costs rise or fall. Here are several examples:

- Wages and commissions paid to contractors (for salespeople)

- Utilities that rise in price as activity rises, such as electricity, gas, or water

- Supplies of raw materials

- Costs of shipping and delivery

- Advertisement (can be fixed or variable)

- Equipment maintenance and repair