Streamline Your Finances with the Free Business Budget Excel Template

Managing finances is a crucial aspect of running a successful business. Proper budgeting ensures that you allocate resources wisely, control costs, and ultimately maximize profits. To help make this process easier and more effective, finance professionals have designed a free, easy-to-use Business Budget Excel Template. With inbuilt formulas and a user-friendly interface, this template is perfect for business owners, finance managers, and entrepreneurs. In this blog post, we’ll explore how to use this powerful tool and who can benefit from it.

What is a Business Budget?

A business budget is a financial plan that outlines a company’s expected revenues, expenses, and net income for a specific period. It serves as a roadmap for resource allocation and decision-making, helping businesses maintain financial stability and achieve their financial goals.

Key Features Business Budget Excel Template

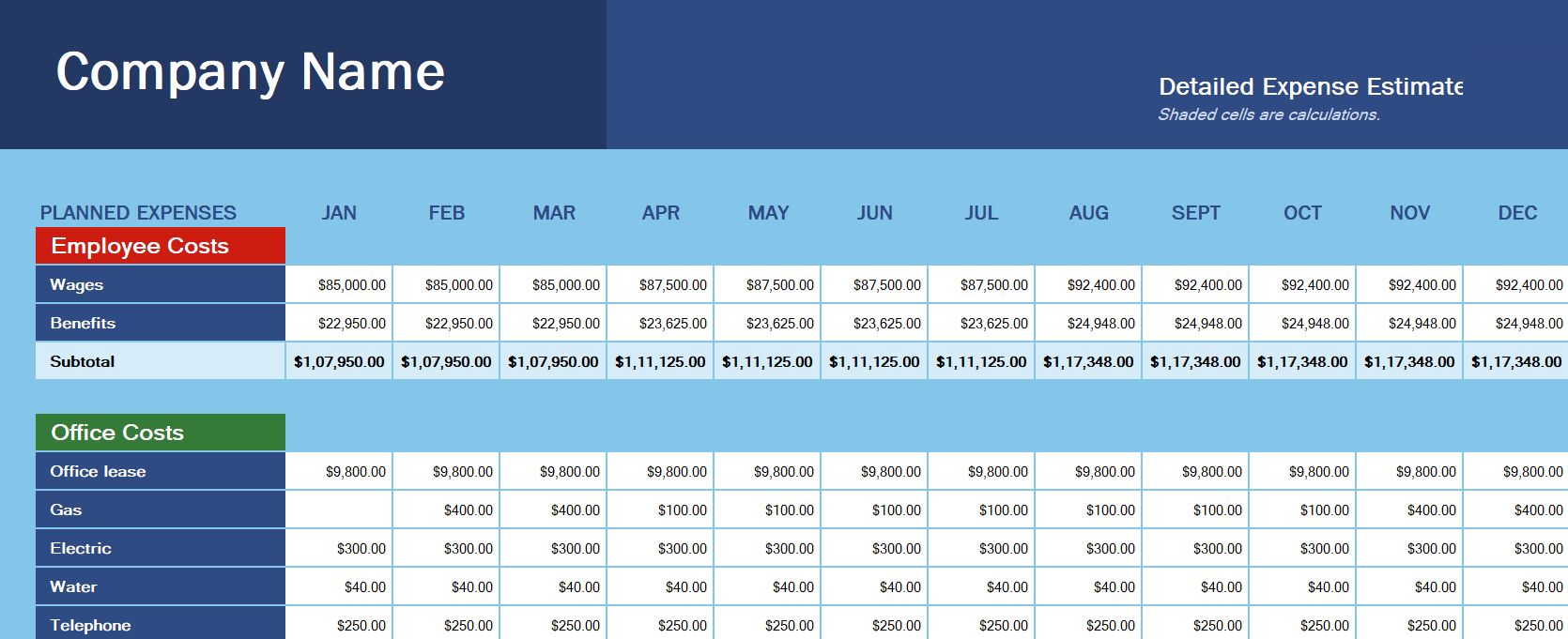

Designed by finance professionals, the Business Budget Excel Template is a versatile and user-friendly tool that simplifies the budgeting process. Key features of this template include:

- Free and easy to use: The template is available at no cost, making it accessible to businesses of all sizes. Its intuitive layout makes it simple for anyone to navigate and input data.

- Inbuilt formulas: The template comes with pre-programmed formulas, which automatically calculate essential figures such as total revenues, total expenses, and net income. This eliminates the need for manual calculations and reduces the likelihood of errors.

- Customizable: The template can be easily tailored to suit the specific needs of your business. You can add, modify, or delete categories as necessary.

Who Can Use the Business Budget Excel Template?

The Business Budget Excel Template is suitable for a wide range of users, including:

- Small business owners: This template is an excellent resource for small business owners looking to gain better control over their finances. It provides a clear overview of the company’s financial health and helps identify areas for improvement.

- Finance managers: Finance managers in larger organizations can use this template to streamline the budgeting process and monitor financial performance.

- Entrepreneurs: Start-ups and entrepreneurs can utilize the template to plan their budgets and allocate resources effectively. It can also be used to present financial projections to potential investors.

- Freelancers and consultants: Independent professionals can use the template to manage their personal business finances and track income and expenses.

How to Use the Business Budget Excel Template

Using the Business Budget Excel Template is straightforward. Follow these steps to get started:

- Download the template: Access the free template and save it to your computer or preferred device.

- Customize categories: Tailor the template to your business by adding, modifying, or deleting categories as necessary.

- Input data: Enter your projected revenues and expenses for each category in the appropriate cells. The inbuilt formulas will automatically calculate your totals and net income.

- Analyze results: Review the figures to gain insights into your company’s financial health. Identify areas for improvement and adjust your budget as needed.

- Update regularly: To keep your budget relevant and accurate, update the template with actual figures periodically. This will help you monitor your financial performance and make informed decisions.

The Business Budget Excel Template is an invaluable resource for businesses of all sizes, designed to simplify the budgeting process and provide a clear overview of a company’s financial health. With its user-friendly interface, inbuilt formulas, and customizable features, this free tool is a must-have for anyone looking to take control of their business finances. Download the template today and start maximizing your profits!