Supercharging Your Strategy: Download The Business Financial Plan Template In Excel

Planning is paramount to business success. A detailed, robust financial plan not only paves the way for smooth operations but also acts as a roadmap for growth, investment, and potential risks. However, creating an exceptional financial plan can often seem a complex and overwhelming task. That’s where our Business Financial Plan Template comes in.

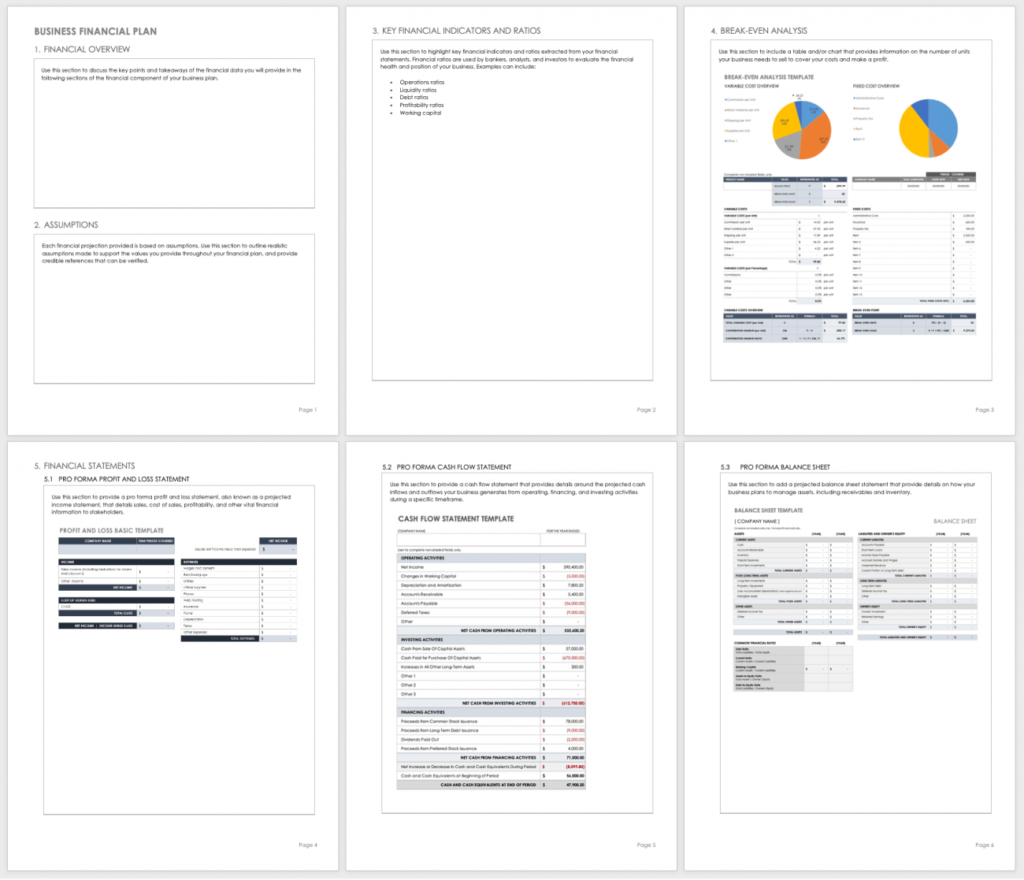

Overview of the Business Financial Plan Template

Our template is a comprehensive, easy-to-use tool designed to make financial planning as straightforward as possible. It includes multiple sections, each one tailored to capture critical aspects of your business financials. The sections are:

- Financial Overview: This is where you lay out your financial objectives and strategies.

- Financial Assumptions: Outline the assumptions made in creating the financial plan.

- Key Financial Indicators and Ratios: Highlight the important financial indicators that measure the health of your business.

- Break-even Analysis Report: A graphical presentation and tabular analysis that shows when your business is expected to start making a profit.

- Financial Statements: Detailed income statements, balance sheets, and cash flow statements.

- Pro Forma Cash Flow Statement: A projected cash flow statement that provides insight into your business’s future cash position.

- Pro Forma Balance Sheet: A projected balance sheet that helps you plan for future financial stability and potential risks.

The Benefits of Using the Business Financial Plan Template

Here are a few reasons why our Business Financial Plan Template is an excellent tool for businesses:

- Comprehensive: The template covers all the critical aspects of financial planning, ensuring you don’t overlook any crucial details.

- Ease of Use: No need for extensive financial planning experience – the template is designed to be simple, direct, and easy to use.

- Cost-Efficient: A free tool that gives you insights akin to professional financial planning without the hefty cost.

- Visual Representation: Graphical presentations and tabular analyses allow for better understanding and communication of your financial standing.

- Forecasting: Pro Forma Cash Flow and Balance Sheets give you a glimpse of future financial possibilities, allowing for more informed decision-making.

Who Can Use This Template?

Our Business Financial Plan Template is a versatile tool designed for anyone looking to create a detailed, effective financial plan. It’s perfect for:

- Startups: To attract investors, manage funds, and understand when they can expect to start making a profit.

- Established businesses: To analyze performance, strategize for growth, and communicate financial information to stakeholders.

- Consultants: To help clients create robust financial plans and provide valuable financial insights.

- Students: To learn about financial planning and apply theoretical knowledge to practical scenarios.

Conclusion

Financial planning is the backbone of any successful business strategy. It allows you to foresee challenges, strategize for growth, and communicate your business’s financial health to stakeholders. With our free Business Financial Plan Template, you have a comprehensive, easy-to-use tool at your fingertips. This template simplifies the often complex process of financial planning, allowing you to focus on what you do best: growing your business. Remember, good planning today leads to better results tomorrow. So download our template and start paving your path to business success.