A cash flow statement is a very critical tool for analyzing the current liquidity of any business venture. Cash Flow Projection are even more important as they help to understand not only your current liquidity, but also your probable cash flow position in months and years to come.

Cash Flow Forecast

Some people believe that cash flow projections and profits are same thing. But this is very far from the truth. Unless you deal only in cash and have no assets (like a freelancer, maybe), cash flow and profit and loss statement will have multiple divergences.

Cash Flow Projection Template

This is because all revenue segments and expenses are considered while calculating the profits of the business might not necessarily be paid or received in cash. Profit and loss also considers non-cash items like depreciation and amortization. Profit and loss projections have different purpose than cash flow projections, and serve a different finance functionality.

Projected Cash Flow Statement

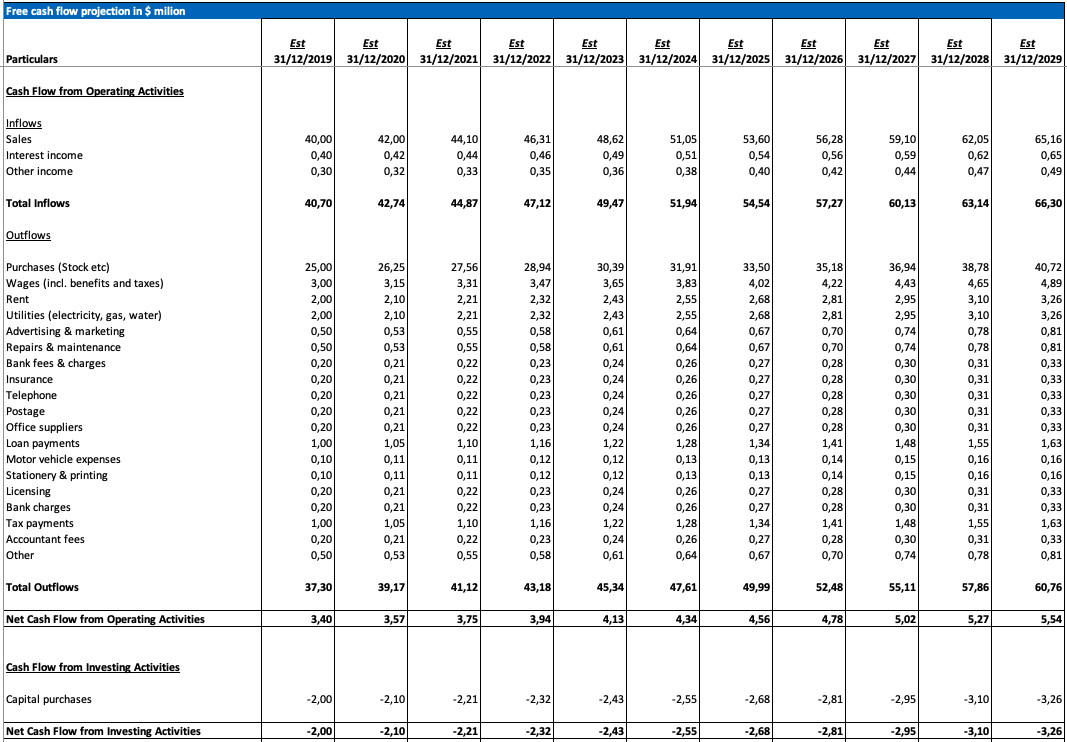

You will find our Cash Flow Projection Template, and two case studies that will help you to project the cash flows of your business over the future years.

But before we explain the Cash Flow Projection Example, let’s define what a Cash Flow Statement is.

A cash flow statement is a summary of transactions representing inflows and outflows of cash over a specific period of time. A cash flow statement also breaks the flow of cash into operating, financing, and investing activities for a more granular view.

Positive cash flow indicates a sound position for your company and demonstrates your ability to pay a robust return to its stakeholders.

The two main elements of cash flow statement are inflows and outflows:

1- Inflows: Inflows represent the amount of cash received from the:

- Sale of goods or provision of services,

- Amount received from debtors or account receivables,

- Amount of money being invested by investors,

- Amount of loans received from banks, financial institutions, and other lenders,

- Interest or any other income received, and

- Amount of cash received from the sale of fixed assets

2- Outflows: Cash outflows represent the amount of money spent on:

- Recurring and non-recurring expenses of the business,

- The cost of goods sold,

- The payment of interest on loans,

- The dividend payment,

- The number of loans repaid,

- The cash payment to creditors, accounts payables, or suppliers of material, and

- The amount paid for purchases of fixed assets.

Cash Flow Projection

Cash flow projection is a statement showcasing expected amount of money to be received into, or paid out of, the business over a period of time. It is usually prepared on a monthly basis, but that can be reduced to a shorter period of say a week, and also can be extended to include 5 to 10 years.

Why is Cash Flow Projection Important?

Sometimes, a business looks profitable when looking at the profit and loss statement, but is actually facing financial problems in the form of cash shortages. Here, cash flow statement will help you determine the company’s exact cash position, and detect any loopholes.

How to Calculate Projected Cash Flows

Projected cash flows are an extension of preparing cash flow statements. There are two methods for preparation cash flow statement, the direct and the indirect. Each of methods considers changes in cash and cash equivalents from three activities: operating activities, investing activities, and financing activities.