Checkbook in Register Template is a ready-to-use template in Excel to track and reconcile your personal or business bank accounts.

Checkbook Register

A Checkbook register is very useful document for keeping track of your Bank balances for personal and business accounts. In simple terms, it records all deposits and withdrawals of checking account and use for performing bank reconciliation.

The Checkbook Register is a crucial document to remain on top of the financials. It helps you to look where the money is coming from and how much is left with you.

Purpose of Maintaining A Checkbook Register

Moreover, it happens that bank officials commit some mistakes. So, If you maintain Checkbook Register, you can identify those errors and get them corrected.

Additionally, you can also prevent bouncing of checks due to the unavailability of balance. Thus, avoiding unnecessary fees charged in your account.

Checkbook Register Template

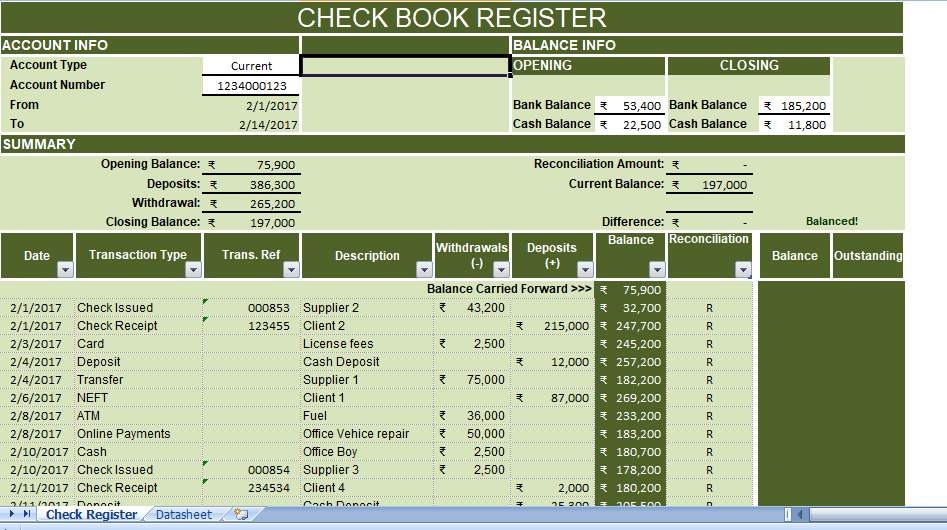

We have created an easy to use Checkbook Register Excel Template with predefined formulas. Just insert your bank transaction daily and easily reconcile at the end of the month.

This template can be helpful to individuals, accounting professionals, and students. You can use this template to keep track of all your income and expenditures.

Content of Checkbook Register Template

This template consists of 2 worksheets: Datasheet and Register

The Datasheet consists of lists and type of transactions. This list is use for creating the dropdown menu in the Checkbook Register Template.

Checkbook Register

At the top, there is the heading of the sheet. Insert the following Account Information:

Type: Type of account Checking, Current, Savings, Personal, etc.

Number: Number of the respective accounts.

From: Start date. The Formula given here is =A15, the first line of date column of data input section.

To: End date. The Formula given here is =MAX(A15: A41), the last date of entry of date column.

Insert opening and closing balances in the balance info section of the right side.

Opening: Opening balance of Bank and Cash as per records.

Closing: Closing balance of Bank and Cash as per records.

In addition to the above, it consists of the summary section also. Although It displays all balances automatically as it contains predefined formulas. Hence, you don’t need to input any data.

Opening Balance: This will reflect the opening balance from the Balance section.

Deposits: Total of Deposits column in Data input section.

Withdrawal: Total of Withdrawals column in data input section.

Closing Balance: This will reflect closing balance from the Balance section. If the closing balance will not match the closing balance of data input section it will show a remark “Incorrect balance” next to this column.

Reconciliation Amount: This will reflect opening balance from the Balance section. To easily reconcile the entries you need to put “R” next to entries. If the reconciliation of any entry pending, this section will display in the outstanding column.

Current Balance: This cell will display the ending Balance of account as per the data enter by the user.

Difference: This cell displays the difference if there is any. If there is a difference then it displays a message “Check Statement” next to the amount. Otherwise, it will display “Balanced” next to the cell.