Schedule of Cost of Goods Manufactured (CoGM) Report template is an Excel spreadsheet to calculate cost of production of products within particular time period. This report is a part of accounting system to calculate all direct and indirect expenses within a factory where its result will be used as reference to define Cost of Goods Sold (CoGS) for finished products in particular company.

Calculate Cost of Goods Manufactured

You may not need this if you are just buying and selling products without any changes since you can set Cost of Goods Manufactured Schedule similar with your purchasing price. Moreover, Factories or manufacturers, usually those who have brands, are companies that should calculate it carefully. Because, they need to produce competitive products that will compete in open market. So It’s their manufacturing cost which are already high, and quality are similar with others, how can they compete? Especially if they also need to promote them massively that require big cost gap between CoGM and CoGS.

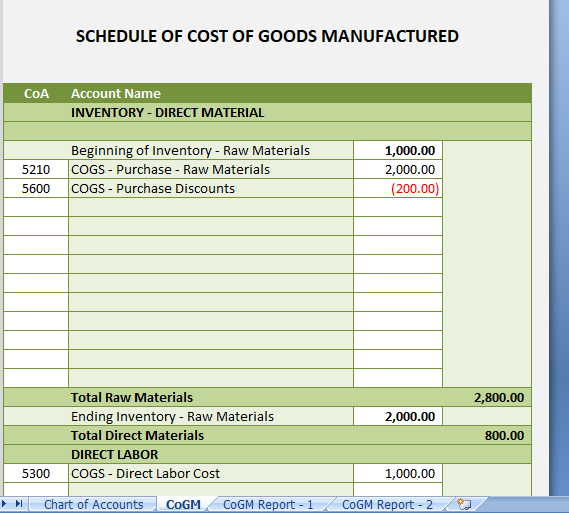

Schedule of Cost of Goods Manufactured

Thus, To understand how this spreadsheet works, you need to understand all components in this manufacturing cost. Those components are :

- Direct or raw material. For example, if your company produces bread, cookies, etc, then flours and sugar are raw materials.

- Direct Labor. Employees who work to produce those foods are classified as direct labors.

- Factory Overhead. Cost other than direct material and labor.

- Indirect material. Putting cups and plastic bags in this category.

- Indirect Labor. Supervisor who supervise employees who can produce those bread and cookies belong to this classification.

- Other. Machines depreciation, water and electricity bills are other expenses.

Different company can create different report or category on those factory overhead. But, basic concept is similar. Thus, You can see those three big parts in this spreadsheet. How to calculate it is as follows. Cost of goods manufactured formula

Direct Material

– Beginning of raw material inventory : Value of raw materials in the beginning of accounting period

– Purchase of raw material inventory : Purchase made during accounting period

– Ending raw material inventory : Value of raw materials at the end of accounting period

Beginning + Purchase – Ending = Materials in Process or it is commonly called Work in Progress Inventory

Direct Labor

– Salary and wages of all employees who work in production

Factory Overhead

– It covers anything that related with production directly.

Therefore, Sum of those will yield manufacturing cost. To find CoGM, you need to find value of materials in production. So, It should be current Work in Progress material + manufacturing cost. Thus, To calculate Work in Progress inventory, use similar calculation with Raw Material inventory above.

As you can see in screenshot above, CoGM at the bottom, or the final calculation, is a main component to calculate CoGS. Then, you can calculate the price you want to sell in the market. It will require additional expenses information, profit and break even target to sell at salable price. And do not forget to put your competitor price as part of your consideration.