Debt is usually money, borrowed by one person from another. Debt is used by many organizations and individuals to make a large buy that they could not yield under normal conditions. A debt arrangement gives the person approval to lend money under the conditions to be paid back, usually with interest. Thus, It is very important to use a debt payoff tracker to monitor your multiple debts

The most common forms of debt are loans, including mortgages, personal loans, and credit card debt. The conditions of the loan are, the lender is required to repay the balance of the loan by a certain date, typically in the future. It also specifies the amount of interest that is required to pay annually, as a percentage of the loan amount. Interest is used to ensure that the lender is compensated to take on the risk of the loan. For example, to repay the loan quickly to limit total interest expense.

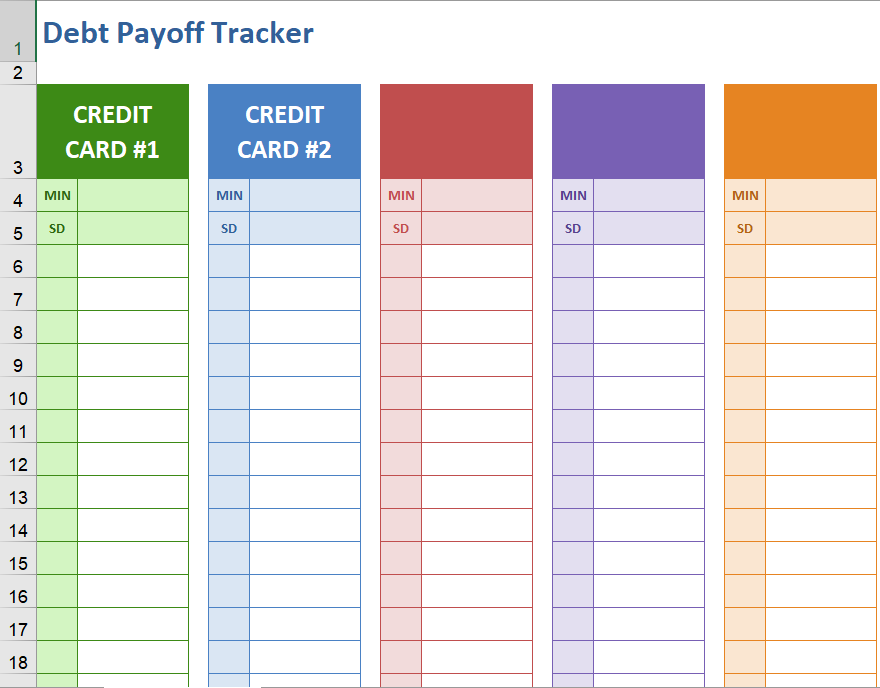

In the Debt pay off tracker excel sheet you get a ready-made spreadsheet with the right formulas to do all of the calculating for you. All you need to do is download the template and feed a few numbers—the spreadsheet will do all the math. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt.

How to track through Debt Payoff Tracker in Excel

Track several debts with a single spreadsheet. Edit the Heading, Lable for each column and then register the minimum payment (MIN) and start debt (SD) records. The columns are automatically updated in the spreadsheet. For instance, you can simply check off or colour in the chart as you achieve your goals.

Record the dates as you achieve each goal in the columns on the left.

These spreadsheets and editable and used as PDFs. Print a debt payoff tracker for every debt. So, you don’t need to do any math. As you start a debt amount, the trackers will fill automatically the recorded goal.