Debt to Income Ratio Calculator

While waiting for an approval from my bank for new house loan mortgage application, I have been informed that bank has checked my loan history and status and they said that my debt to income ratio is slightly above their ratio number. But, since I am already being their customer for more than 10 years with good payment track record. It looks like that my loan mortgage will be approved.

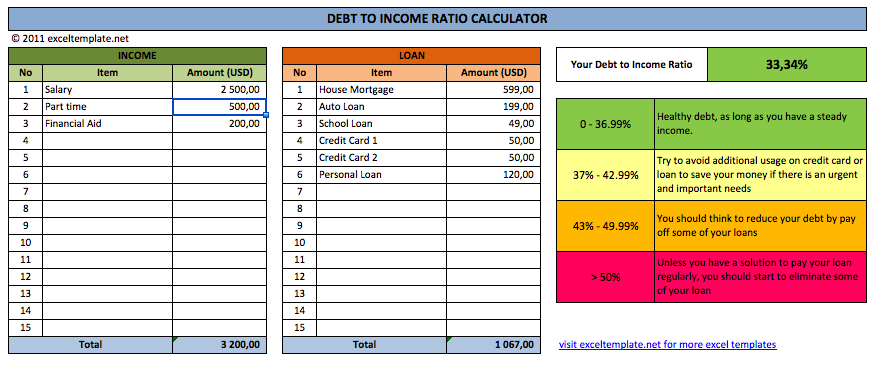

Calculate Debt to Income Ratio

If you are a financial people, you will understand this term. Debt-to-income ratio is a personal finance measure that compares amount of money that you earn to the amount of money that you owe to your creditors. This number is arisen when you plan to finance their new house, new car, or others. Any financial institutions or banks usually calculate this to determine your mortgage affordability.

Debt Ratio Calculator

Calculating your debt-to-income ratio is easy, open up an excel spreadsheet. Then put sum up all of your bank or financial institution debts in one column. Then put and sum up all of your income in other column, and divide sum of your debt to the sum of your income. That’s it. If you are still confuse to run it using the excel. You can download this simple debt-to-income ratio calculator to help you find out your ratio. Replace item name in the template with your income and loan item.

There are many factors that may affect the ratio, because it will depend on other expenses. For example, family with children will have different expenses compare to single people. Your living neighborhood also will affect your monthly expenses. So, be wise with the expenses, and read many references in internet if you have problem on managing your monthly expenses.

DTI

This tool will be more suitable if you plan to apply for a loan mortgage. Also you want to calculate whether your ratio is below your bank requirement where maximum ratio of 36% or 37% is the most common parameter use by banks to give you loan.