Depreciation is a term used to describe the reduction in the value of as asset over a number of years. Thus, A Depreciation Schedule is a table that shows the depreciation amount over the span of the asset’s life. Therefore, we have created Depreciation Calculator in excel template for accounting and tax purposes. , the depreciation expense is calculated to “write-off” the cost of purchasing high-value assets over time. Usually a company will want to write-off the asset as soon as possible in order to increase the after-tax present worth, or profitability, of an asset. However, For this and other reasons, governments often regulate the different depreciation methods that eligible companies use.

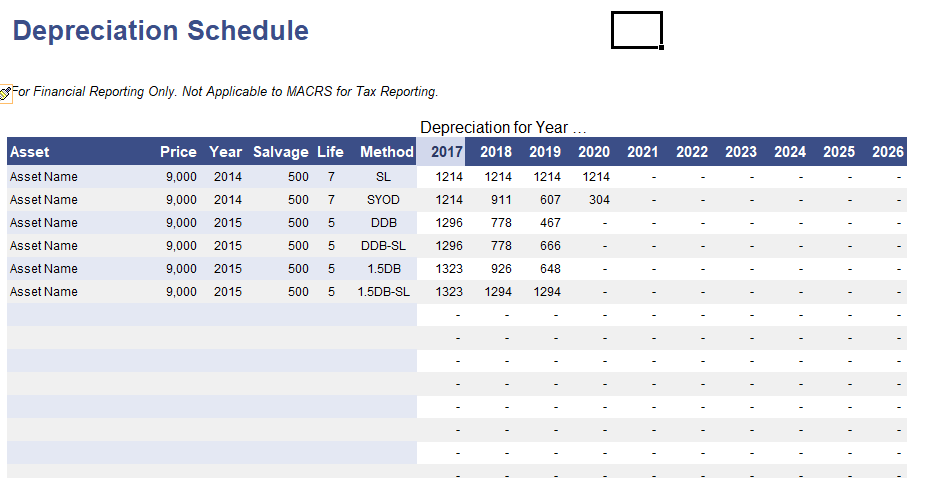

However, this Depreciation Schedule template provides a simple method for calculating total yearly depreciation for multiple assets.

Monthly Depreciation Formula in Excel

Certainly, there are a number of built-in functions for depreciation calculation in Excel. Certainly include SLN (straight line depreciation method), SYD (sum-of-year’s digits), DDB (declining balance with the default being double-declining), VDB (declining balance with switch to straight-line), DB (fixed-declining balance), AMORDEGRC, and AMORLINC.

Depreciation Methods

Certainly, there are many different depreciation calculator basis the different types of depreciation method . Some uses for financial reporting and other uses for tax reporting. The methods below are some of the more basic methods for financial reporting.

Straight line method of depreciation

Straight-line depreciation is the simplest depreciation method to calculate. The amount of depreciation each year is just the depreciation basis, Cost (C) – Salvage Value (Sn), divided by the useful life (n) in years.

Sum-of-Years’ Digits (SOYD)

The SOYD depreciation method is a fairly simple accelerate depreciation method. Although, Accelerate depreciation methods are based on the assumption that an asset is more useful when it is newer, and therefore more of the cost should be write off in earlier years than in later years.

Reducing balance method

For instance, In the declining balance method, the depreciation for year j is calculated by multiplying the book value at the end of the prior period by a fixed depreciation rate, d. This method is commonly called the Double-Declining Balance Method.

The Book Value should not be less than the Depreciation Salvage Value Formula. The Salvage Value does not include in the Book Value calculation for the declining balance method, so that necessitates the use of the MIN and MAX functions in the above formula. The Excel function, DDB(), handles all of that for you.

The VDB (variable declining balance) function is a more general depreciation formula that we use in switching to straight-line because boolean value TRUE as the last argument tells the function NOT to switch to straight-line.

Declining Balance Depreciation Formula with Switch to Straight-Line

It is common for a company to switch from the declining balance depreciation method to the straight-line method in the year that the depreciation from the straight-line depreciation method is greater. The VDB function has this feature built-in. The formula for calculating the depreciation for year

where factor = 200%, 150% or 125%

MACRS System for Tax Reporting

The U.S. MACRS System is highly regulating and adds quite a bit of complexity to the simple depreciation formulas. The Depreciation schedule in income tax helps to calculate the income tax.

Depreciation Terms

- Cost (C)

- Salvage Value (Sn)

- Depreciation Period (n) or Recovery Period

- Depreciation Basis Book Value

- Date Placed in Service

However this Sample Depreciation calculator helps to understand the value of your existing asset and also the value of any new asset in the long run.