Depreciation Calculator is an excel template to calculate Straight-Line as well as Diminishing Balance Depreciation on Tangible/Fixed Assets.

The template displays the depreciation rate for the straight-line method based on scrap value. Moreover, it displays the year on year amount of depreciation for as per Diminishing Balance method.

Straight Line Depreciation means:

Subsequently “Straight Line method depreciates an asset uniformly over the period of usability. The Straight-line method of depreciation applies even cost throughout the life of any fixed asset.”

Diminishing Balance Depreciation means:

Similarly “The declining balance method reduces an asset’s value by the amount it is depreciated in the previous years. It calculates the new depreciation base on that lower value. Hence, it is named as diminishing balance method.”

Depreciation Calculator Excel Template

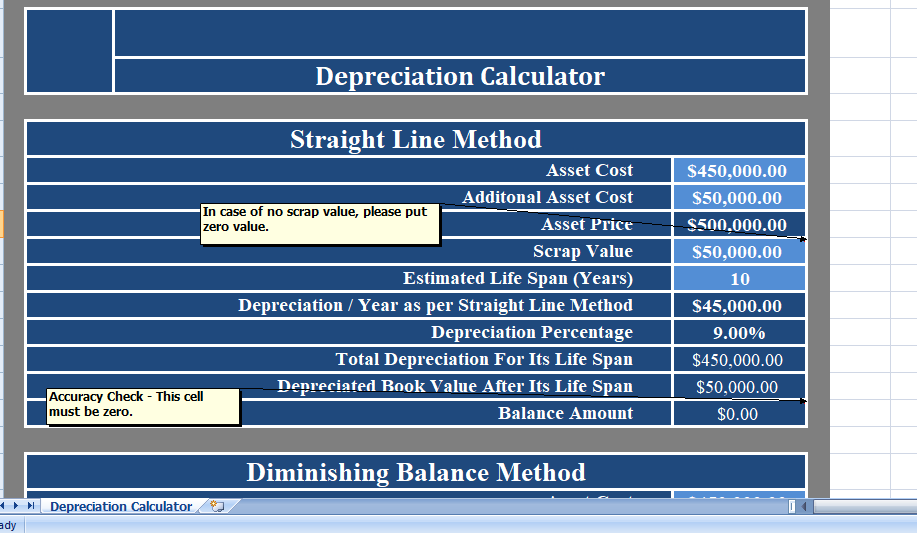

We have created a simple and easy Depreciation Calculator with predefined formulas. Just enter a few values and it will automatically calculate depreciation for both the methods.

Contents of Depreciation Calculator Excel Template

Above all this template consists of 2 method: Straight-Line Depreciation Calculation and Diminishing Balance Depreciation Calculation.

Straight-Line Depreciation formula

In addition, the template calculates the straight-line depreciation. It’s calculation is based on Asset value, scrap value and life of an asset.

Here, asset value is the asset price in addition to the additional costs link with an asset. These costs include fixtures, transportation, insurance.

Insert the Asset Cost and Additional Asset Cost in given cells and it will automatically calculate the total Asset Price for you.

Enter the Scrap Value and the Life Span for the asset and 0 if an asset is completely written off. When asset scrap value is 0 template will calculate the depreciation on complete asset value.

Entering the above-mentioned details will give you the following results:

Depreciation

Depreciation in Percentage

Total Depreciation for the life span of asset

Book Value after life span of the asset

The balance amount is for accuracy check. It should always be 0. It is Scrap Value minus Book Value at the end of the life span.

Diminishing Balance Depreciation formula

Similar to the above section, enter Asset Cost and Additional Asset Cost to obtain total Asset Price.

Enter the Scrap Value and Life Span of asset. In Diminishing Method, the scrap value will never be 0.

The template calculates the Rate of Depreciation applying the following formula:

1 – (Scrap Value/Asset Value) ^ (1/Life Span)

In the end, the template displays the depreciation schedule for the diminishing balance method. However it uses the rate of depreciation on closing asset value of the asset.

Book Value of Each Year X Depreciation Rate

It calculates the depreciation until the scrap value amount.