A cash flow forecast or cash flow projection is like a budget, but rather than computing revenues and expenses, it measures cash coming in and going out based on past business performance. It’s common for a business to experience a cash shortage, even when the business is good. It happens when customers are allowed to pay after the product or service is delivered. Therefore in cases like these, a business owner must design how they will cover costs before getting the payment.

Small business owners just want their accounting records done so they can focus on that. But tracking and predicting cash flow—even though the time and effort required—is essential for starting, operating, and expanding a business.

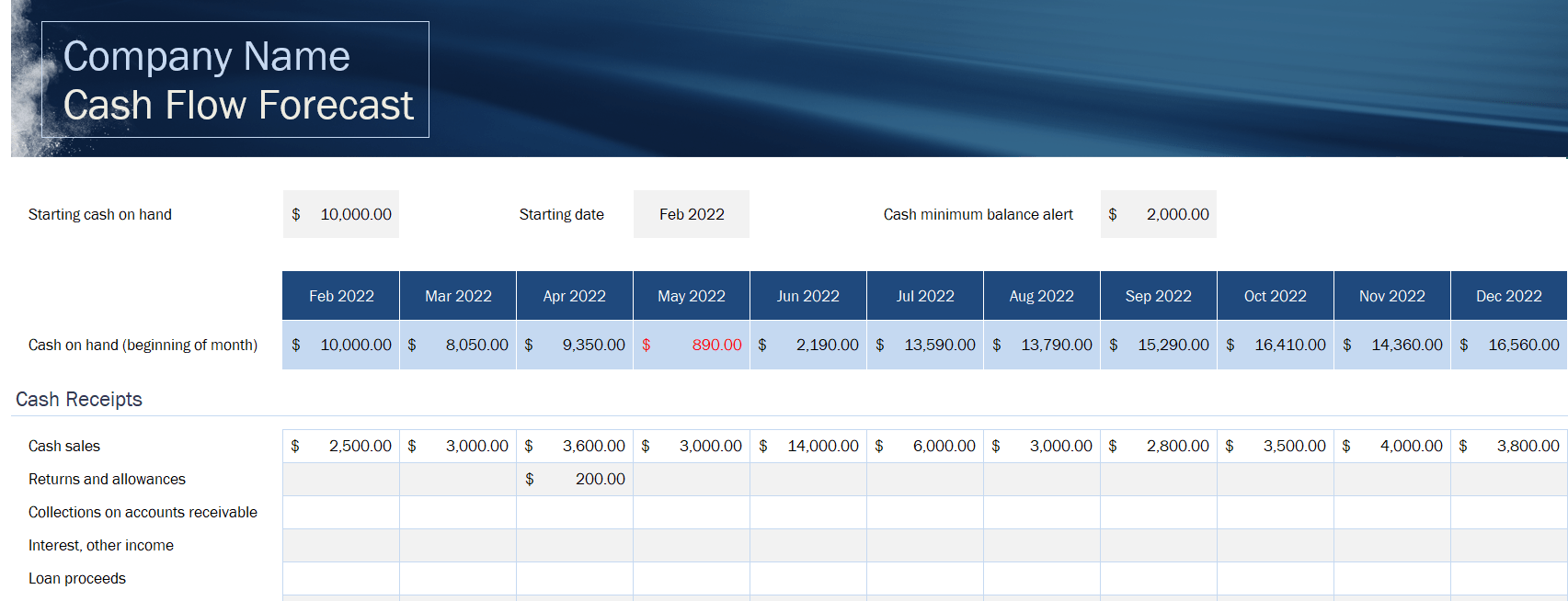

How to Prepare a Cash Flow Forecast in Excel

This cash flow Forecast is for the small business owner looking for a sample of how to format a statement of cash flows. The categories can be personalized to suit your business’s needs. For instance, if you don’t want to separate the cash receipts or the cash paid for then you can just delete the columns containing those labels and reorder the cash flow item as needed.

The spreadsheet contains sheets for year-to-year and month-to-month cash flow reviews.

The best way to forecast cash flow for your business depends on your business goals, your management, investor’s requirements.

For example, a company seeking to gain clarity over quarter-end contract positions will need a forecasting process than a company that needs to manage debt payments every week. The process we recommend for building a cash forecasting model, as well as what kinds of data you’ll need to enter in order.

Also, use this cash flow analysis to prepare an estimate or plan for future cash flows. It is important because cash flow is about – making sure you have money on hand when you need it to pay expenses.

Different Types Of Cash Flow

Operating Cash Flow

The money your business produces and spends regularly, day-to-day operating activities—like sales of your products or services and your usual business expenses—is your operating cash flow (OCF). This shows how your business activities are performing from an expense versus revenue perspective, so you can evaluate performance and other types of financial activities that cover the overall picture.

Formula For OCF – Operating Cash Flow = Net Revenue + Non-Cash Expenses + Changes in Working Capital

Categories of Operating Cash flow:

- Costs received from COGS

- day-to-day supplies

- Employees’ salaries and other cash payments

- Bills

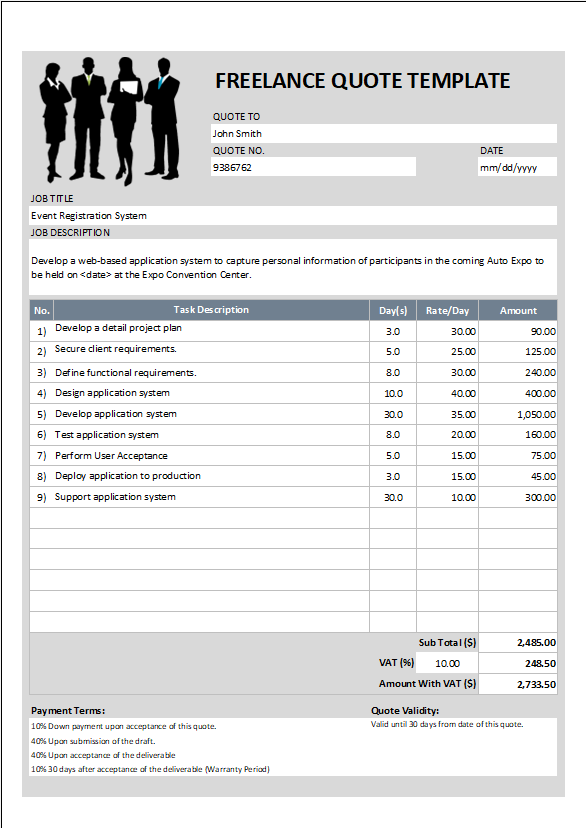

- Contractor

- Lenders

- Interest paid on Debt

- Interest received on loans

Financial Activities Cash Flow : The money circulating between a company and its owners, investors, and lenders are called the financing cash flow. This type of cash flow shows how well the business is organized—and its achievement and strength from an investment perspective—by showing the record of money going out to owners and investors as compared to money coming back in.

FACF is important because, even if a business isn’t yet strong from operating activities, it may have a good cash flow from financing activities.

Formula to calculate Cash Flow From Financial Activities

- Cash gained from equity or debt, known as CED

- Dividend payments or CD

- Repurchase of debts and equity, or RP

FACF = CED – (CD + RP)

Investing Cash Flow

The money spent on and created from market securities, long-term assets such as property, and other financial tools over the reporting period is called investing cash flow. Some organizations—for example, manufacturing, that tend to buy real estate—will have much larger investing activities cash flows, while other types of small businesses have small cash flow.

Investing Cash Flow Common Examples

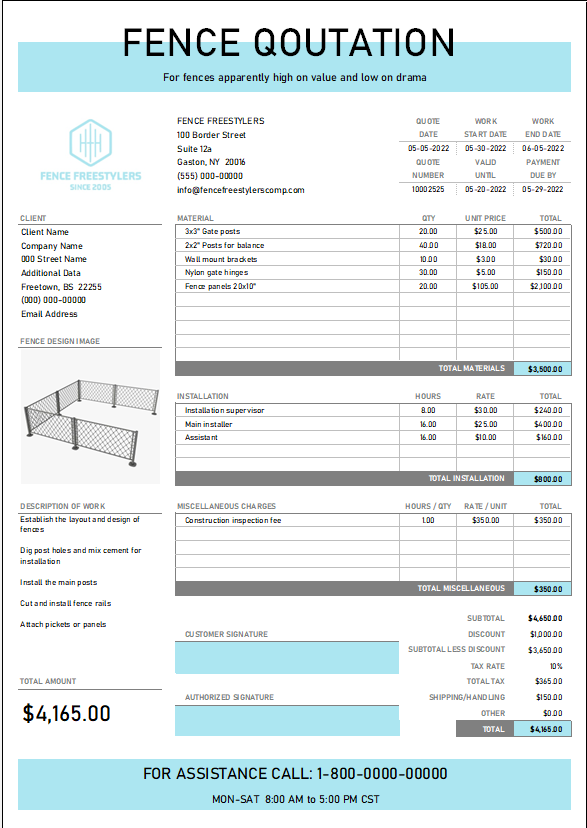

- Purchase or sale of fixed assets

- Sale of investment

- Acquisition or sale

- Lenders

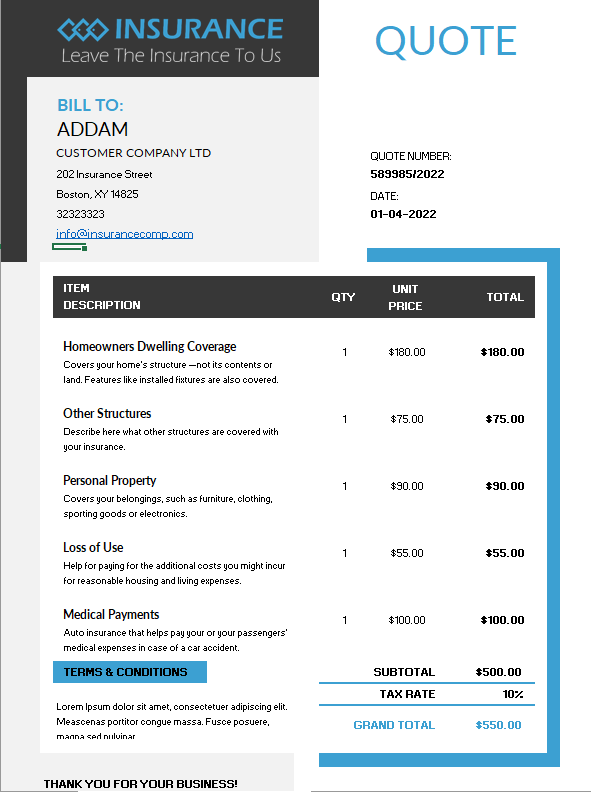

- Insurance

- Fixed assets

To calculate ICF, add the costs received from the sale of assets and any record collected on loans, and subtract the costs spent to buy assets and any debts.

BENEFITS OF CASH FLOW FORECAST

- To Spend in Focus Target

- Development in Business

- Forecast Cash Shortages

- Improve Management

- Gain Investors

- Emphasizes Potential Problems

- To get Debts Faster